UKAR – the biggest mortgage lender you’ve never heard of

U.K. Asset Resolution (UKAR) was established in late 2010 as a holding company for Bradford & Bingley (B&B) and the part of Northern Rock that was to remain in public ownership (NRAM). Unlike other rescued institutions – RBS and Lloyds – whose progress we are kept well abreast of in the media, UKAR has flown under the radar somewhat. To give an idea of scale of the rescue; despite neither entity issuing a mortgage since 2008, UKAR is still the 7th largest mortgage lender in the UK today with a balance sheet of £74bn. About a third of assets on UKARs balance sheet are the legacy securitised RMBS deals of the two firms; B&B’s Aire Valley and the Granite complex from Northern Rock. A further 26% and 22% of assets are unencumbered mortgages and covered bonds respectively.

So, how well have they been using our tax money? And, are we likely to receive a return on our cash?

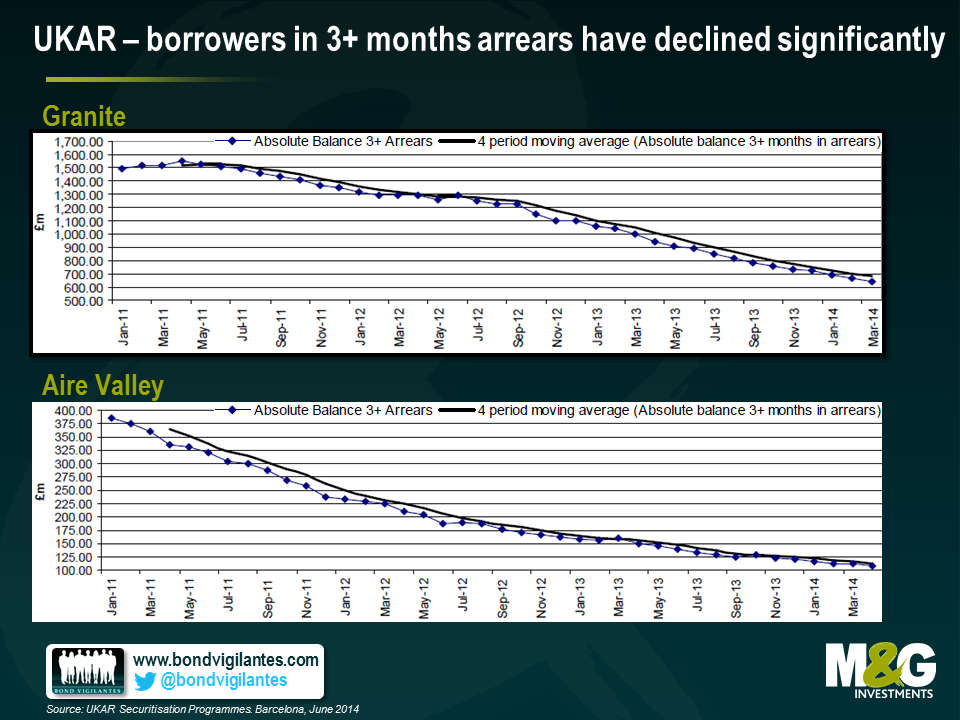

We met with management last week and they laid out their broad strategy going forward. They told us they are very focused on trying to help those able to refinance their mortgages elsewhere at a better rate. They also detailed how processes for collections and dealing with arrears have improved. This trend can be observed below, as the number of borrowers in the two securitised deals who haven’t made a mortgage payment for over 3 months has decreased significantly.

More specifically, UKAR has a three pronged strategy for dealing with each of the three groups of assets (RMBS, unencumbered mortgages and covered bonds):

- RMBS deals – has a strategy of tendering for notes that represent expensive financing

- Unencumbered mortgages – sell off loan portfolios to third parties who wish to securitise them

- Covered bonds – shortening the maturities through liability management exercises

Along with lowering arrears, UKAR has been successful in achieving these objectives whilst turning a decent profit. Clearly this profit is where we as tax payers (or the government) extracts value. Unlike the cases of RBS and Lloyds in which the government took an equity position, here they fully nationalised the institutions and extended a loan. Last tax year UKAR paid back £5.1bn of debt and £1.1bn in interest, fees and taxes to the government.

One further, slightly more technical point to note is the RMBS structures have hit a non-asset trigger. The trigger specifies that the notes issued out of UKAR have to be paid back sequentially – in order of seniority – until the whole deal is paid off. At this point there will be a slice of equity that will become available to the Treasury, roughly £8bn in total.

So, yes, I do think that they are doing a good job of looking after the tax payers’ investment. I also think commercial liability management exercises and portfolio whole loan sales will continue to maximise value. And of course, helping to keep people in their houses is a pretty good deal as well.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox