Race to the Bottom: Eurozone Inflation Rates

In principle, the European Central Bank (ECB) is well in line with its price stability objective, which it defines as a “year-on-year increase in the Harmonised Index of Consumer Prices (HICP) for the euro area of below 2%”. Nonetheless, July inflation numbers released last week bring the currency union as a whole dangerously close to deflationary territory. The aggregate HICP annual rate of change for the Eurozone fell to 0.4%, its lowest inflation print since October 2009.

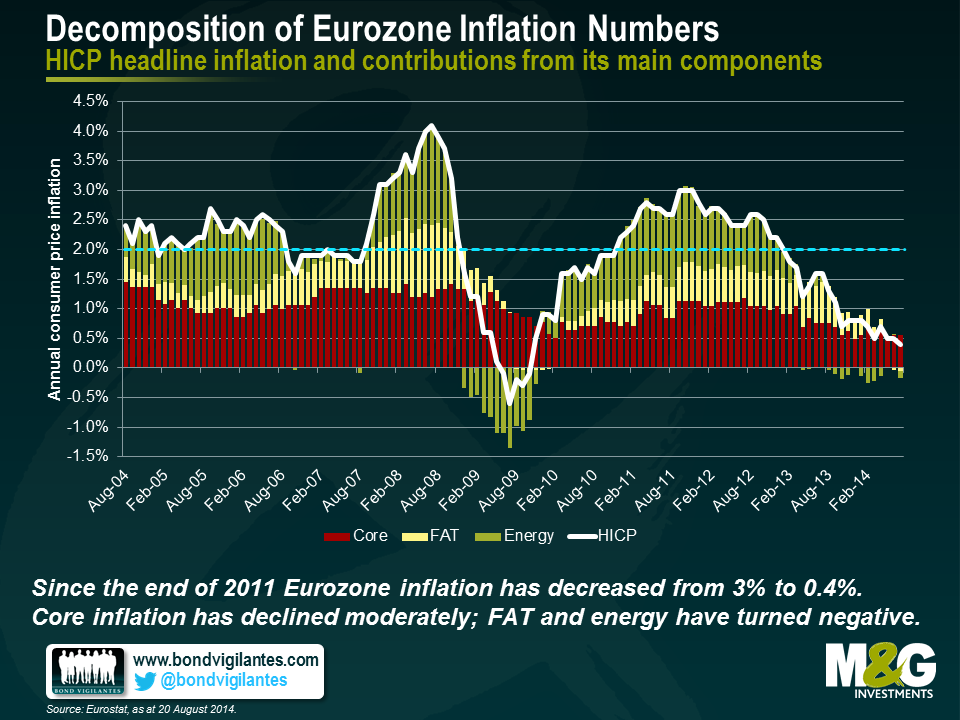

But what has been driving this development? To answer this question we broke down HICP headline inflation numbers into three components: (i) food, alcohol and tobacco (FAT); (ii) energy; and (iii) core inflation, i.e., the remainder when stripping out (i) and (ii) from the headline figure. In the chart below we plotted the contributions of each of these three components to the headline number, calculated by multiplying the annualised monthly changes of the component indices by their respective weights within the overall HICP.

Only a relatively small part of the substantial drop in HICP headline inflation from 3.0% in the end of 2011 to currently 0.4% can be attributed to core inflation. Admittedly, core inflation contribution has fallen from 1.1% to 0.6% in this time period but compared to the other two components it has been much more stable. This result intuitively makes sense as core inflation comprises very different items, such as clothing, healthcare and communications. The inherent diversification subdues core rate volatility as fluctuations in individual item levels are likely to balance out each other to a certain degree. The fall in Eurozone inflation has mainly been caused by FAT and energy. Whereas FAT and energy boosted headline inflation by 0.7% and 1.3%, respectively, in November 2011, by now both components have essentially become a drag, chipping off 0.1% each from the July 2014 aggregate figure. Declining inflation rates in the Eurozone can at least partially be explained by a strengthening of the Euro vs. USD (c. USD 1.27 per EUR in the beginning of 2012 to a peak level of c. USD 1.39 in early May 2014), having a deflationary effect on import prices. In recent months, when the exchange rate trend started to reverse, the oil price dropped sharply (c. USD 114 per barrel Brent in mid June 2014 to currently c. USD 102), which helped to put downward pressure on energy prices. It will be interesting to see how geopolitical developments in the Ukraine and the Middle East are going to affect energy inflation contributions in the months to come.

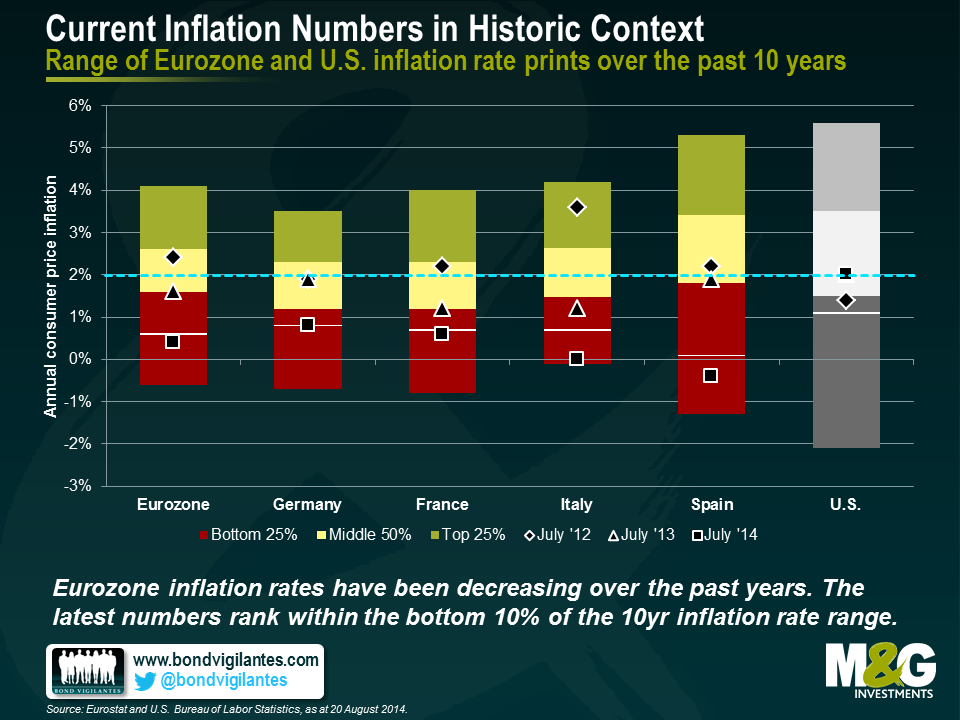

Now let’s turn towards inflation rates of individual countries. The two biggest Eurozone economies, Germany and France, showed July inflation rates clearly below 1% (0.8% and 0.6%, respectively). The periphery experienced either no inflation at all (Italy with 0%) or even deflation (Spain with -0.4%, Portugal with -0.7%, Greece with -0.8%). Undoubtedly, these numbers are low. But how do they compare with historical inflation rates? We took a look at the past ten years of inflation rate data (HICP annual rates of change, published monthly) for the Eurozone in total, its four main economies and, for comparison, the United States. For each entity, we ranked the numbers from smallest to largest and divided the range of inflation rates into three bands, containing the bottom 25%, middle 50% and top 25% of data points, respectively (see chart below). The white lines mark the border below which the bottom 10% of inflation rate prints are located for each data series. In addition, we highlighted the most recent inflation numbers as well as the figures from one and two years ago.

We can draw a number of conclusions from this chart. For instance, inflation rate spans for Germany with 4.2% (-0.7% to 3.5%) and Italy with 4.3% (-0.1% to 4.2%) are significantly smaller than for Spain with 6.6% (-1.3% to 5.3%) and the U.S. with 7.7% (-2.1% to 5.6%). Most importantly, the chart puts the drop in European inflation rates over the past years into some statistical context. July 2012 inflation prints still rank within the middle 50%, or even in the top 25% in the case of Italy. Except for Germany, inflation rates exceeded the ECB’s upper limit of 2% back then. However, the most recent data points from July 2014 can all be found in the bottom 10% of the 10-year inflation rate ranges. German inflation is exactly at and the French figure slightly below their respective bottom 10% thresholds. Italy’s and Spain’s inflation rates have fallen deep into their bottom 10% ranges. Italy’s current 0% inflation figure marks in fact the country’s second lowest monthly reading within the past 10 years. In contrast, U.S. consumer price inflation is not on a downward trajectory but numbers have been bouncing back and forth between 1% and slightly above 2.0% over the past two years. The July 2012 print of 1.4%, for example, ranks in the bottom 25%, whereas inflation rates both for July 2013 and July 2014 sit with 2% within the middle 50%.

What does this mean for fixed income investors? For a start, the divergence of European and U.S. inflation rates, in combination with substantial differences in real GDP growth (Eurozone with -0.4% in 2013 and 0% in Q2 2014 vs. U.S. with 2.2% and 4.0%, respectively) and labour market strength (Eurozone with 11.9% unemployment rate in 2013 and 11.6% in Q2 2014 vs. U.S. with 7.4% and 6.2%, respectively), reinforces the argument of an on-going decoupling between the two economic areas. The progressive fall of Eurozone inflation rates well below the 2% level gives the ECB some room for manoeuvre. European interest rates are likely to stay at essentially zero for the time being, and we should not be surprised if more accommodative monetary policies, such as asset purchases, were implemented by the ECB going forward in an attempt to stimulate economic recovery.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox