Greece, the currency vigilantes and the Expulso solution

It has been a while since we have discussed the economics of the single currency, but once again the issue of its suitability for all its members is at the forefront of economic concerns, as Greece faces some difficult decisions.

The financial crisis has taught us a number of lessons: fiscal policy works, monetary policy works, better regulation is beneficial for the financial sector, confidence is key, and importantly exchange rates matter.

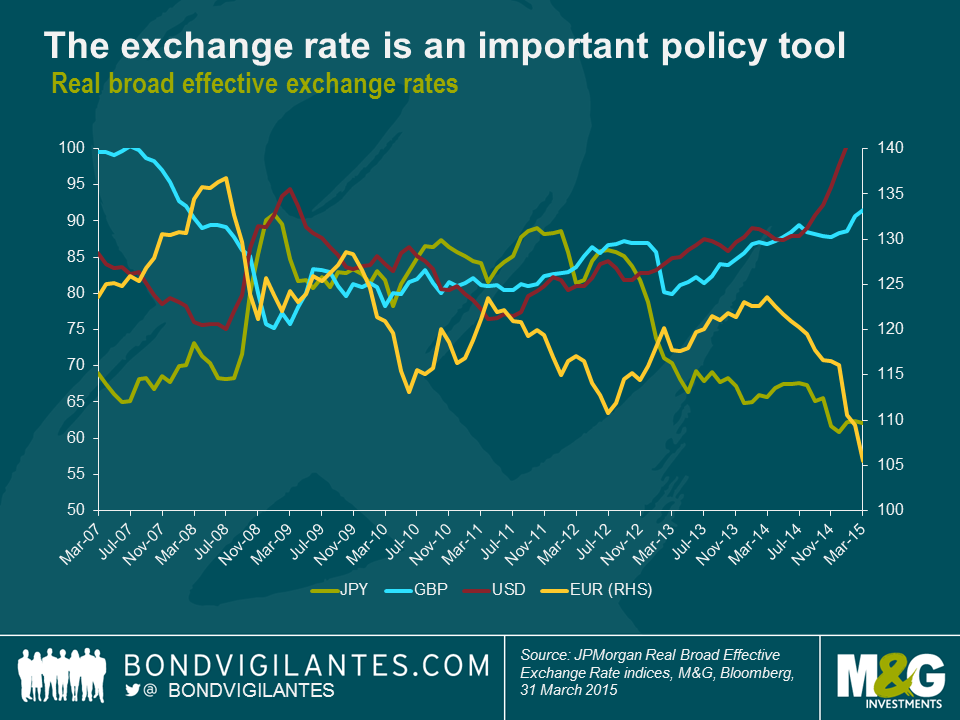

Throughout the crisis, one of the economic mechanisms that aided the economies in most stress was the exchange rate. This can be seen with the collapse in sterling in 2007 on a trade weighted basis, the weakening of the dollar from 2009 until 2011, the yen in 2013 onwards, and the euro of late, see chart below. At the heart of these fx moves lie the currency vigilantes, as we discussed here in 2010.

These external foreign exchange rate moves are a textbook play in terms of making labour cheaper and therefore helping economic recovery. However, as we know, in the Eurozone this mechanism does not exist, due to the creation of monetary union. I think exchange rates have become relatively more important in determining national economic outcomes and this is particularly relevant now to Greece.

The three main macro-economic levers are monetary policy, fiscal policy, and the exchange rate. Fiscal policy is still in the hands of politicians and therefore can be used to provide a strong impetus when required to differentiate national outcomes (although less so in Europe). Monetary policy has basically approached the zero bound in the main G7 economies, which means short rates have become hugely correlated. Without room to differentiate economic outcomes by cutting rates, national economic flexibility has been reduced, which means the exchange rate has to play a more important role than has historically been the case.

This is working between the main economic blocks. However, as the need for this most famous “invisible hand” has become greater, it has not been available within the Eurozone. This means that Greece has to somehow adjust with no fiscal room, no monetary room, and no exchange rate flexibility.

It would take at least a generation for Greece to solve its problems via structural reforms given the constraints it sits with. The short term solution is therefore for Greece to be bailed out via fiscal transfers directly, or in a quasi manner by allowing a Greek default. These are obviously hard to achieve given the political dilemmas many countries would face in providing this relief.

Greece has faced difficulties before, however we now have further pressure to find a solution as the economic policy options outlined above become more focused on the exchange rate conundrum, and the political environment in Greece points to a government more willing to take radical measures in the face of a great depression. The ability of Greece to provide for its citizens is damaged like the famous Venus de Milo statue. It could well be that politicians recognise the invisible hand of the exchange rate is still an important tool, and a free floating Drachma, the “Expulso” solution (see 2011 blog), though painful, might be the best shot at providing an economic solution given the extent of Greece’s problems.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox