Five reasons EM debt is attractive

The consensus view on the outlook for Emerging Market (EM) bonds is bearish. Many point to risks posed by a Fed rate hike, falling commodity prices, possible Grexit and a slowing China as reasons to reduce investment allocations to the asset class. However, there is a solid investment case for EM debt at this point in time for those willing to have a closer look.

Firstly, geopolitical events appear to have stabilised in several regions across the globe. For example, there are encouraging early signs from the Ukrainian sovereign and corporate restructuring process, with successful negotiations between creditors and the government to extend the repayment terms of the state owned bank Ukreximbank. In Brazil, Petrobras has at last released its financial results, delayed by several months over its bribery scandal, which eliminates the risk of acceleration and technical default on its bonds. And in Tunisia and Kenya, where terrorist attacks have recently taken place, bonds have recovered to their previous levels after a brief period of underperformance. We would argue that these reduced tail risks are yet to be factored into investors risk assessment for these countries.

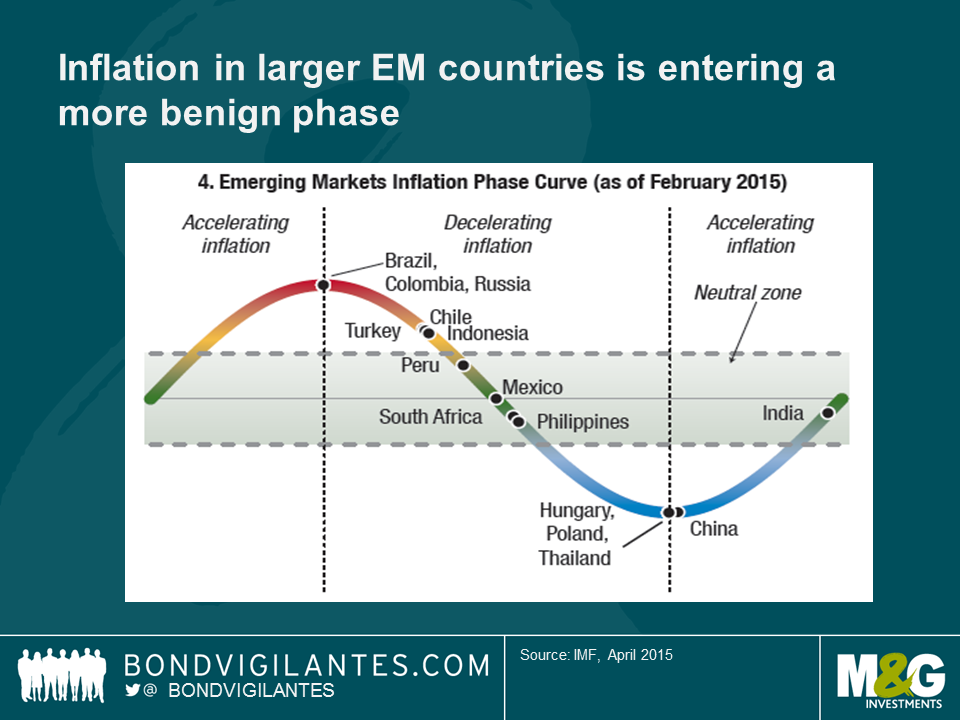

Secondly, inflation in some of the larger emerging market countries is now at a more benign phase. This will give the central banks some additional monetary policy flexibility, and they won’t be required to hike interest rates before the Fed starts doing so.

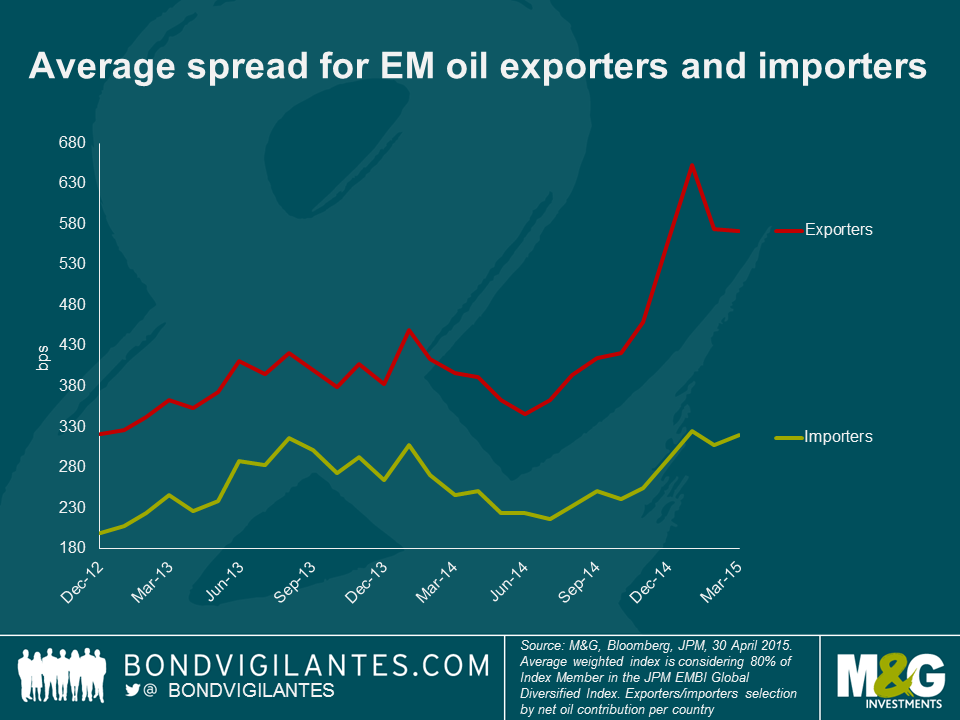

Thirdly, recent oil price developments also suggest more cheer in some emerging markets. Countries such as Venezuela, Ecuador and Iraq, heavily reliant on oil for export and fiscal earnings, would have faced a particularly negative macro environment, had oil prices continued declining into the USD40 range. With the oil price recovery, a Venezuelan default largely priced in for 2015 earlier in the year has now been pushed into 2016, removing another immediate tail-risk. Oil exporters such as Nigeria who have not yet allowed their currencies to depreciate have lost a considerable amount of foreign exchange reserves in defending their currency – but as oil prices have rebounded towards the USD50-60 range, earlier underperformance has been reversed. Additionally, the still generally low oil price is also a welcome tonic to the US consumer, helping emerging markets with close ties to the US economy such as Central America and the Caribbean, Mexico, and some Asian exporters.

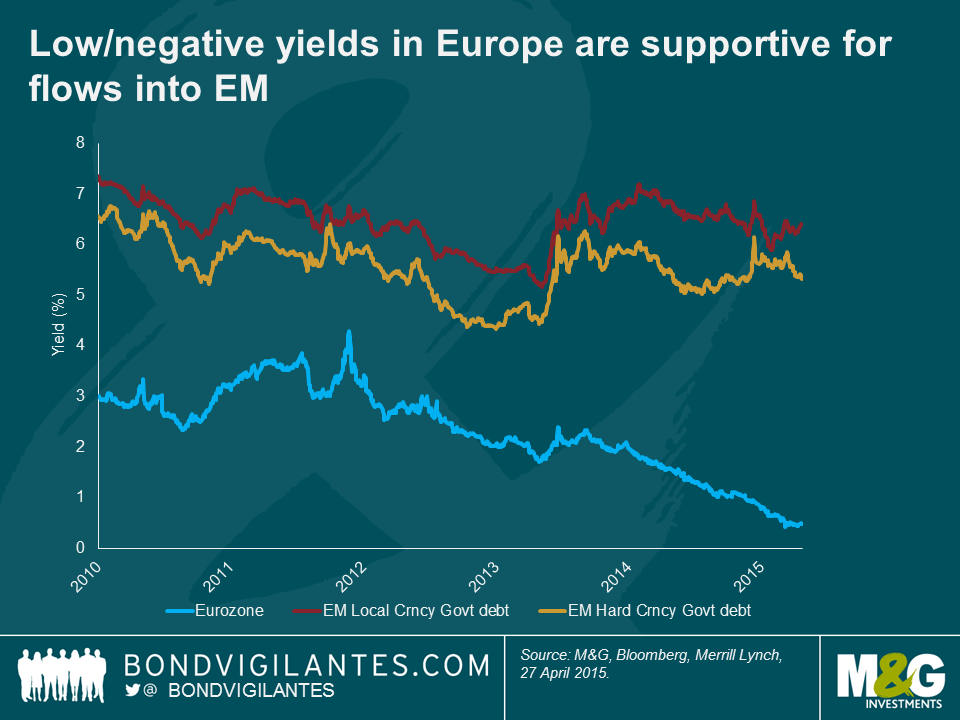

Fourthly, EM bond yields are still attractive on a relative basis and investors still have the opportunity to acquire assets with yields over 7%. The relative value opportunity is especially the case given the very low level of developed market government bond yields. Additionally, EM issuers are exploiting the lower yields on offer in Europe and have started funding in EUR, as opposed to USD. Of course, some sovereign and corporate credits with large balance sheet mismatches are vulnerable in this environment, but there are also winners in the space, such as exporting corporates. Other winners include sovereigns that are already advanced in their current account rebalancing, such as India, Chile, Pakistan, Poland and Hungary.

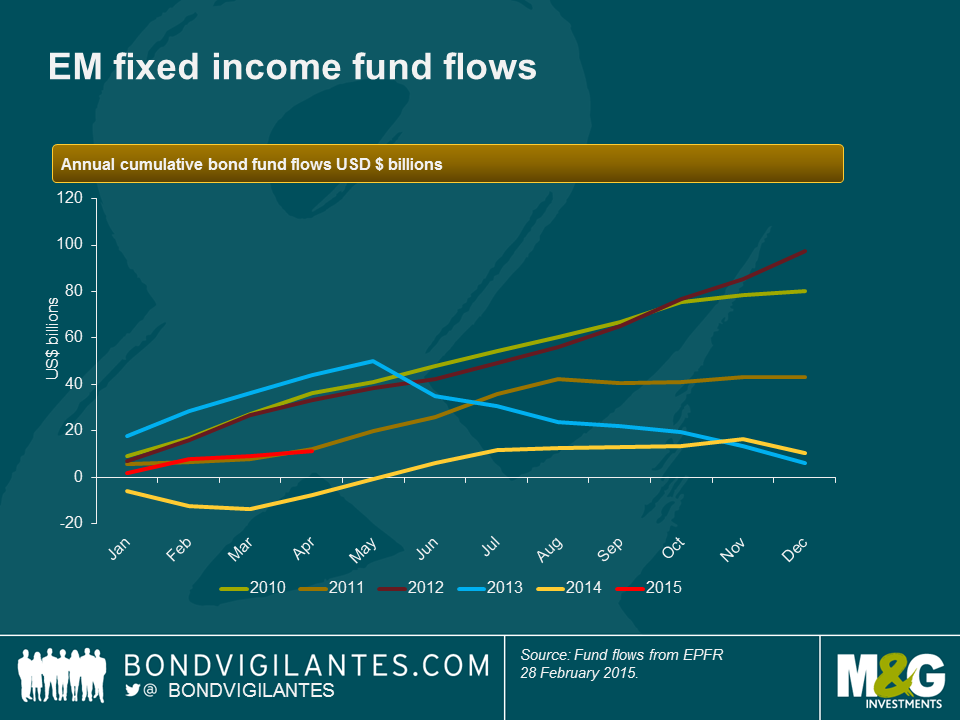

Finally, flows into emerging market debt markets have slowed materially since 2013, thereby reducing the risk of Taper Tantrum-esque outflows should the Fed begin to hike rates. Arguably, some of the “hot-money” has already retreated from the asset class potentially reducing any future volatility.

I expect that EM debt will continue to look attractive in a world of ultra-low interest rates and loose monetary policy. The receding of geopolitical risks, low inflation, stabilisation in the oil price, strong relative value dynamics and reduced risk of outflows are solid tailwinds for the asset class in the remainder of 2015.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox