Greece is not Argentina: don’t expect exports to drive growth if Greece leaves the euro

I have heard it said, semi-seriously, that the biggest risk for the Eurozone isn’t that Greece leaves the single currency and its economy collapses, but that it leaves and thrives. In this scenario Greece starts again, debt free, able to adapt fiscal easing rather than austerity, and with a devalued “new drachma” encouraging an influx of tourists and a manufacturing and agricultural export boom. When the other indebted and austere European nations see the benefits of leaving the euro, they do so, leaving their debts behind and causing the complete breakup of the European Union as we know it (and the second Great Financial Crisis in a decade?). One parallel that’s drawn regularly is that of the 2002 Argentinian devaluation, and subsequent economic recovery. We wrote about the similarities between the two economies a couple of years ago, here.

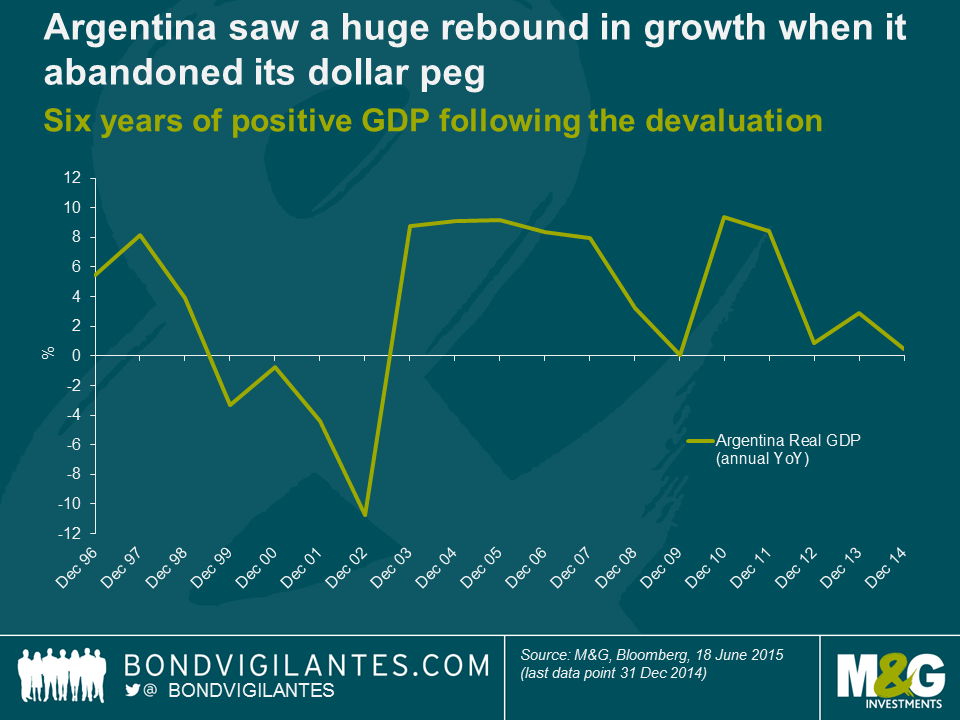

From four years of negative annual rates of GDP growth (at worse over -10% per year), Argentina bounced back to see positive GDP growth of high single digits per year for five years when it left its currency straightjacket. Could we expect Greece to experience the same sort of economic rebound if it left the eurozone that Argentina experienced after abandoning its peso-dollar parity peg in January 2002?

Argentina Real GDP (annual yoy)

There are many economic similarities between the Argentinian and Greek crises; the overvalued currency pegs; unsustainable government debt burdens and IMF involvement; poor tax collection; dubious statistical accuracy and high unemployment. Following the hyperinflation of the 1980s, the Argentinian peso was pegged to the US dollar. Inflation fell dramatically, and this stability and stronger currency led to a boost to domestic living standards and a big rise in imported goods; but there was also capital flight as many realised the peg might not hold forever. The current account deficit soared. In 1999 as the economy slowed from a period of growth, Argentinian unemployment hit 15% and the public debt started to rise alarmingly. External debt hit 50% of GDP, and the IMF told the government that it needed to implement austerity in order to access funds. Market interest rates almost doubled to 16% and Argentina’s credit rating was cut to weak junk (there was subsequently a debt restructuring). Eventually the IMF refused to release new funds as the government hadn’t kept to its budget deficit targets. By the end of 2001 bond yields were 42% above US Treasuries and bank accounts were all but frozen (the “corralito”) to stop bank runs. Amid political chaos and riots (rising inequality had been another feature of the economy) – and the lack of circulating dollars – there emerged alternative IOU currencies issues by municipalities (Claudia Calich here has some “patacons” issued by Buenos Aires, we tweeted pictures on @bondvigilantes if you want to see one). In January 2002 the dollar-peso peg was abandoned, and the peso devalued and floated freely. Dollar bank accounts and investments were forcibly converted into pesos. From 1:1 the exchange rate moved to 4:1. Inflation returned, imported goods became scarce, businesses went bust and the unemployment rate hit 25%, with another 19% under-employed. (Wikipedia has an excellent timeline of Argentinian crisis period for much more detail).

But 2003 saw a turnaround; and it’s this recovery that gives some hope that Greece might follow the same path if it leaves the euro. Tourism was indeed a contributor to economic growth as the weak currency made it a cheap destination. In 1997 tourism and travel had a total contribution of 7.5% of GDP, and by 2006 it had risen to 12.5%. Greece has a much larger tourism industry already, accounting for around 18% of GDP. I’ve heard this high level of the Greek tourism industry described as a handicap – perhaps it already is operating at full capacity (airports and transport, restaurants and hotels) and after default there would be little initial appetite to provide capital to ramp up capacity. But it doesn’t seem fanciful to expect a devaluation to produce growth through tourism in Greece, even though it’s unlikely to be a near doubling as was the case in Argentina.

But Argentina’s big win was one of fortunate timing – and Greece won’t have this luck on its side. World growth was very strong in the period post the Fed’s emergency rate cuts after the 9-11 terror attacks. Global GDP growth was 3.1% pa in the period 1992 to 2001, but for the next ten years it averaged 3.9%. China joined the World Trade Organisation (WTO) in 2001 and there was an explosion of global trade – supplier nations to China did especially well – to Argentina’s benefit. Until the ending of the dollar peg Argentina had been extremely uncompetitive, especially once its neighbour Brazil devalued in 1999 (Asian currencies had also devalued – O’Connell points out that only Argentina and Hong Kong had maintained their pegged currencies and suggests that over the 1990s Argentina’s Real Effective Exchange Rate had appreciated by 40%). The rapid rise in global trade, and a return to competitiveness post devaluation helped lead to a 120% rise in Argentina’s exports from 2002 to 2006. Chinese demand for soybeans are often credited for many of the economic gains, although Mark Weisbrot in the Guardian says that’s an exaggeration.

Does Greece have the potential to export its way out of depression? Perhaps, although the poor quality of its land (most is unsuitable for agriculture) makes it much more difficult. Food and meat make up just 12% of its exports, compared to more than a third in Argentina. Greece’s biggest export is refined petroleum, which is a pass-through industry, priced in hard currency in any case, so with no devaluation benefits. Also, its biggest export destination is Germany – possibly problematic post a debt default…

So to conclude, those nations that have thrived post devaluations (Argentina, Canada, Sweden) have been fortunate in that their trading neighbours had been growing strongly at the time. Greece does not have that luxury, nor an economy that can respond quickly to increased export competitiveness. We should also remember that whilst Argentina grew strongly post devaluation and debt restructuring, its current real GDP rate is just 0.5% and hard currency government bond yields are around 8%. The ending of the dollar peg and debt restructuring did not prove to be a permanent economic panacea – but it is also hard to argue that the status quo was sustainable or desirable. Greek policymakers will be thinking the same thing.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox