A message to Brazilian tourists: stop travelling abroad and help your country

S&P placed Brazil’s foreign currency ratings (BBB-) on negative outlook yesterday, only one small step away from junk. S&P’s negative outlook implies that there is a probability higher than 33% that Brazil’s rating will be subject to a downward revision in the next 18 months. According to the statement, S&P “could lower the ratings if there were further deterioration in Brazil’s external and fiscal indicators resulting from what we might view as a backtracking by Brazil from its commitment to its stated policies and from the various policy corrections underway.”

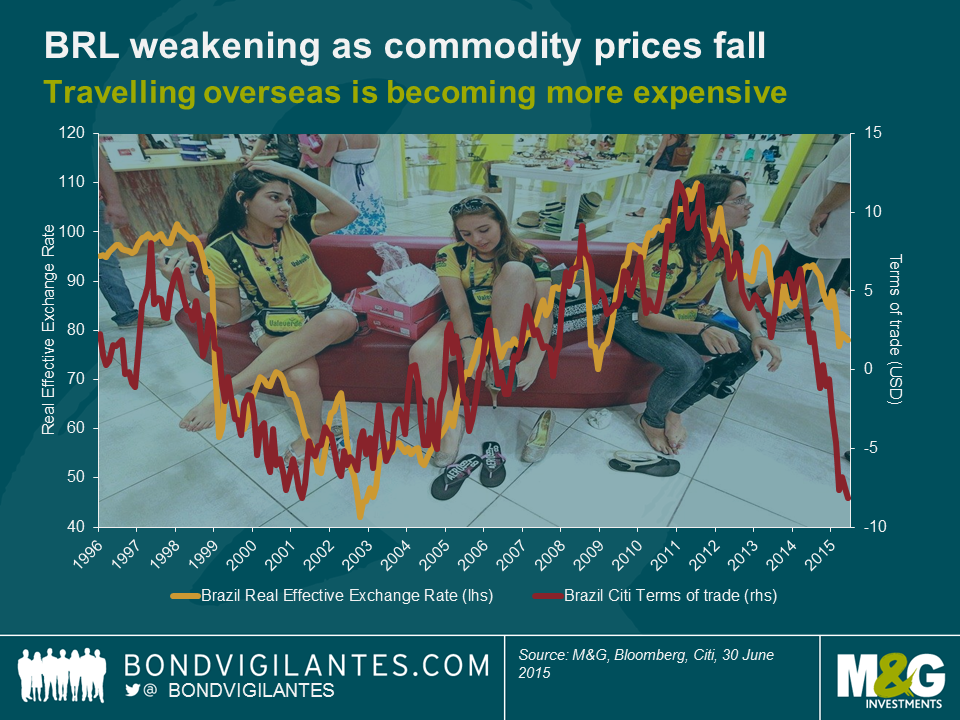

In our view, a rating downgrade is inevitable. Brazil is suffering from challenges on a number of economic fronts, including a recession, high inflation, rising debt levels, a weak fiscal framework and negative terms of trade caused by weak demand for commodity exports. On the political side, the controversy caused by the massive Petrobras corruption scandal is resulting in political instability and investor aversion. It is difficult to see many positives in Brazil at this point in time apart from the fact that foreign exchange reserves remain at adequate levels when measured by various metrics. In addition, the Central Bank has been reducing the amount of currency intervention through swaps, a credit positive.

If we examine the current account trends, one factor that has deteriorated over the past decade has been the travel component. While the amount spent by foreign tourists in Brazil has remained relatively stable, the main deterioration is the result of Brazilians travelling abroad and spending their hard earned cash. This has been driven by the Real’s real appreciation.

It is interesting that the travel deficit did not begin to improve as the Real started to depreciate in 2011. One explanation can be that real wages were still rising until early 2014. With the economy now in recession, real wages have begun to fall and unemployment (a lagging indicator) has started rising as well.

Given these factors, we believe that the travel deficit will start shrinking over the next few quarters. If Brazilians stopped travelling overseas and chose instead to travel domestically, they would be accomplishing two things: reducing the current account deficit and stimulating the struggling domestic service economy. While that is a small step in context of this complex macroeconomic environment, every little bit counts.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox