Contrary to popular opinion, the Bank of England’s next move will be a monetary easing

On the 7th of September £38bn worth of UK gilts (4.75% 2015) will mature. The Bank of England (BoE) own just under half the issue, having purchased the bonds through its £375bn quantitative easing (QE) programme. At this point in time, the BoE have indicated that they are committed to keeping the size of the QE program at £375bn. As a result of the 2015 bonds maturing, the bank will therefore have about £17bn to invest back into the UK government bond market.

In my view, this is the equivalent to an easing of monetary policy. This is because the average duration of the BoE’s gilt holdings will increase, and therefore the £17bn re-investment in gilts will have a larger (downward) effect on gilt yields than it currently does today.

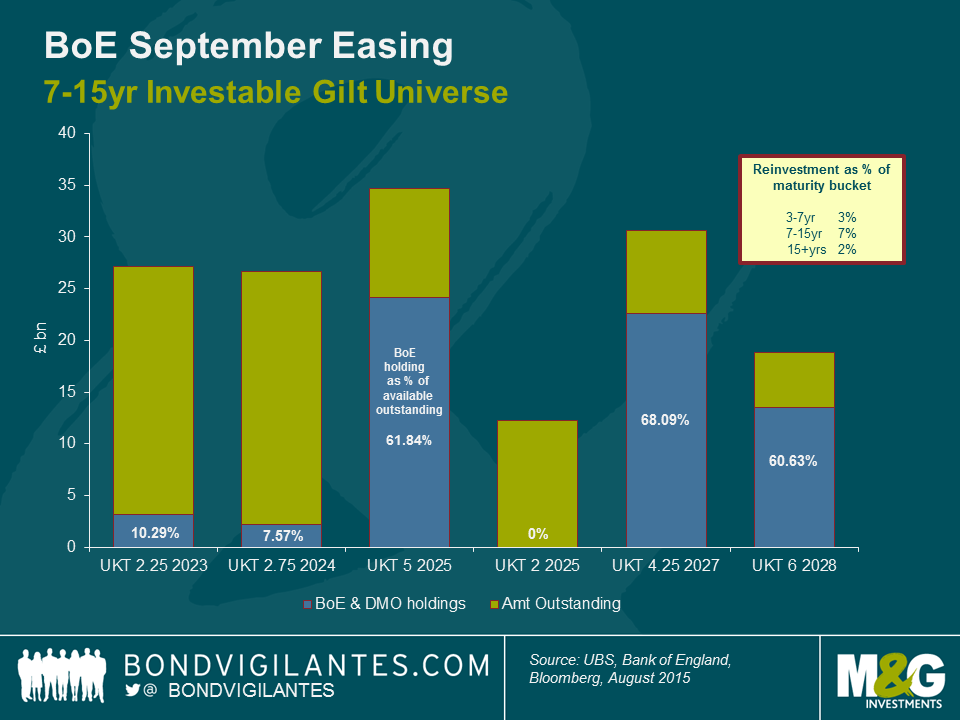

The BoE has helpfully laid out a few rules as to how they execute this sort of reinvestment. Firstly, the cash will be invested equally (£5.6bn) across three maturity buckets; 3-7yr, 7-15yr and 15+ yrs. Secondly, the BoE has stated that they will not purchase more than 70% of an individual bond issue.

All else being equal, an inflow of £17bn into the gilt market will clearly put downward pressure on yields along the length of the curve – and that doesn’t even take into account the other £21bn that private investors will have to find a home for. As there are fewer bonds in the 7-15yr bucket than either the short or long dated buckets my feeling is that the reinvestment should have a disproportionately positive effect on this part of the yield curve.

The individual bonds that the bank will buy and hence which yields could be the most squeezed is -unsurprisingly – something of a debate within the gilt market. Focusing on just the 7-15yr maturity bucket, we can see below that the bank own a substantial amount of the 4.25% 2027’s whilst owning a very small percentage (or none at all) of some of the other outstanding gilt issuance.

My view is that the gilts that the BoE already has a fairly large holding in (over 60%), but not so large that there isn’t much room for them to buy more before hitting their 70% ceiling are likely to benefit the most (such as the 5% 2025s and 6% 2028s). Given these technical dynamics, gilt investors could benefit from lengthening duration and focusing on the belly of the gilt curve in coming weeks.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox