As economists predict a Fed rate hike, can we learn anything from the 2013 “Fed Fake”?

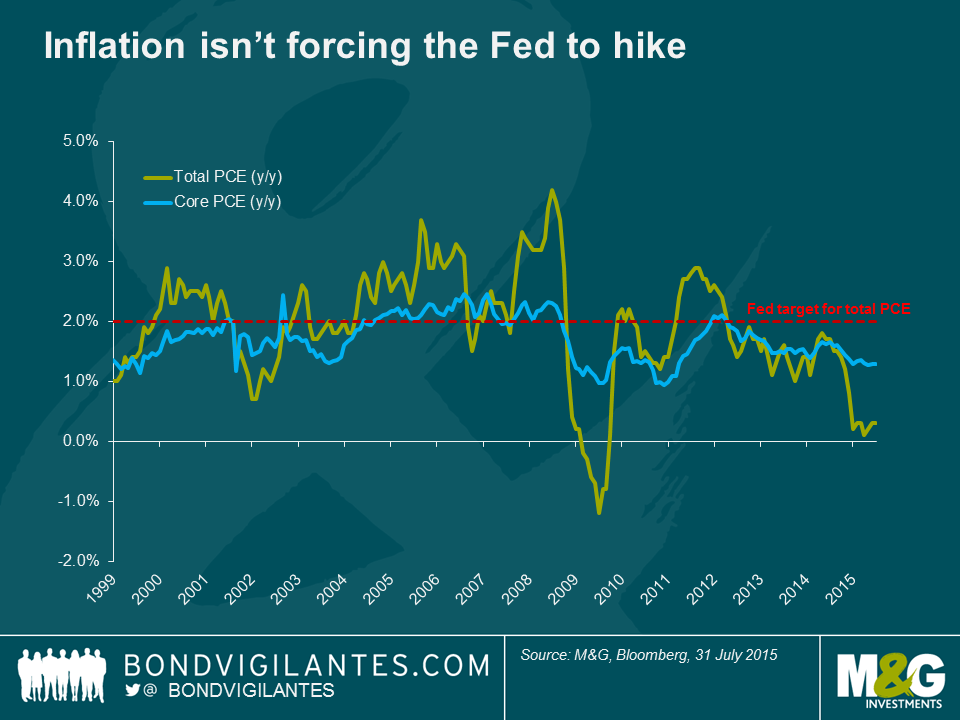

Thirty-five out of forty-one economists surveyed by Bloomberg currently expect the FOMC to hike the Fed Funds rate on September 17, thereby starting a period of policy normalisation. Most have pointed towards the July FOMC statement which noted better data on net in June and suggested some progress toward the conditions for lift-off. Those economists forecasting a rate hike will tell you that the US economy is rebounding from the winter soft patch, the labour market continues to improve and core inflation is relatively sticky (core PCE is 1.3% y/y), giving the FOMC comfort to begin the long process of unwinding ultra-easy monetary policy.

Markets on the other hand are pricing in a 50% chance of a rate hike. September is clearly not a done deal, particularly after the soft ECI report released last Friday. The 0.2% rise in the ECI through June broke an acceleration in wages and salaries that had begun a year ago. For an FOMC that is keenly monitoring labour market conditions, the weak ECI data put some doubt into the thinking of economists.

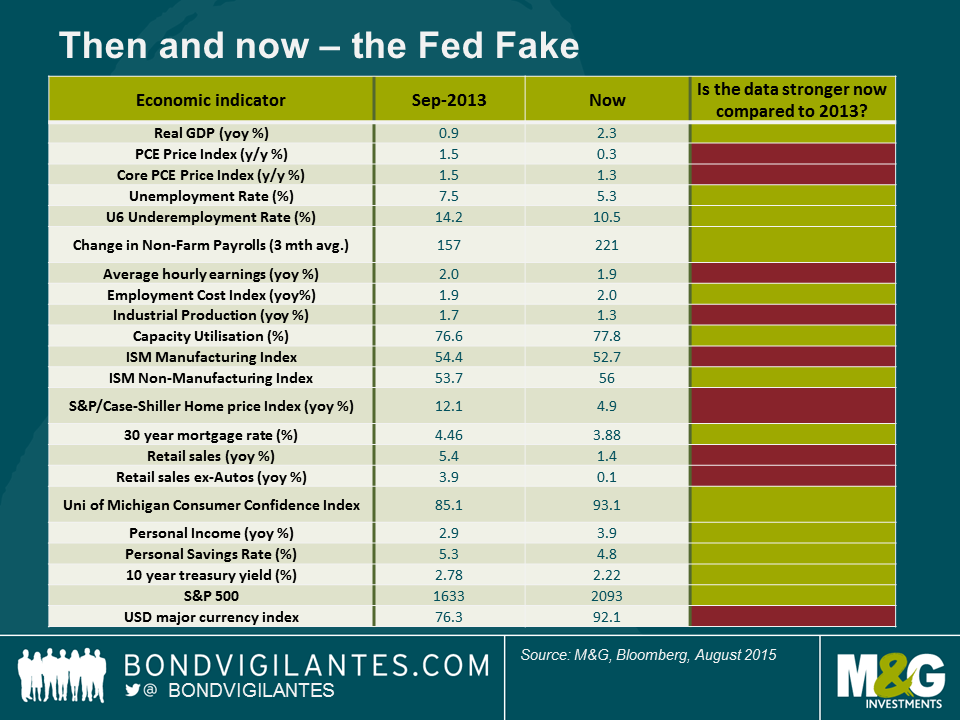

It was only a mere two years ago that many economists were kicking themselves for predicting that the Fed would taper its QE programme of asset purchases. At the time, there was an overwhelming consensus that Ben Bernanke had signalled a taper as early as May 2013 and many had factored this in to their forecast. Of course the Fed did not act, there was a lot of soul searching amongst the financial economic community, and a catchy phrase was coined (“Fed Fake”) to make light of how wrong most economists were.

The Fed has continually told us that monetary policy is data dependent and not predetermined. This Friday’s employment report will be extremely important in determining whether the Fed actually hikes or not – the decision appears to be that close. But can we learn anything from how the Fed behaved in September 2013, when it chose to surprise the markets and maintain QE?

Looking at a number of domestic economic data points it appears that the US economy is on a firmer footing compared to September 2013. Growth is solid, the unemployment rate is low, consumer confidence is higher and the ISM suggests that the economy will continue to expand. Unfortunately for those calling for a rate hike, inflation is much lower, core retail sales are flat and the US dollar will act as a headwind for US companies for the foreseeable future. Additionally, the global economic backdrop is weaker than 2013 given the concerns around Chinese economic growth and associated EM weakness, the risk of spillover effects in Europe coming from uncertainty around Greece, and a potential British referendum on Europe in 2016.

This analysis suggests that a Fed rate hike in September is not a given. Economists surveyed by Bloomberg are probably finding some comfort in going with the crowd. I believe that whether the Fed hikes or not is less important than determining where the terminal Fed Funds rate is in a potential rate hiking cycle. Fed tightening in this cycle will likely be unusually slow, cautious and well communicated to markets. If this is the case, then the reaction in bond markets would likely be relatively benign compared to prior Fed rate hikes. In order to see bond yields move much higher, a reassessment of inflationary expectations would be required. A rising US dollar, benign wage growth, high consumer debt levels and falling commodity prices suggests to us that this is unlikely to occur in the short-term. As a result, any market reaction to a rate hike in September will likely be muted compared to the historical experience.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox