Oil price slump is a drag on emerging markets. But wait, why?

Oil price moves and their impacts on emerging markets will continue to be a hot topic in 2016. It is true that economies which rely heavily on oil exports and fiscal revenues, such as Saudi Arabia, Russia or Venezuela, have been facing an extremely challenging macro environment with the decline in oil prices. But, overall, there are more net oil importers than exporters amongst the developing economies. Moreover, at the corporate bond level, the Oil & Gas sector accounts for a relatively small share of emerging market corporate bonds, according to various hard-currency bond indices. So why are sliding oil prices consistently dragging emerging market asset prices down?

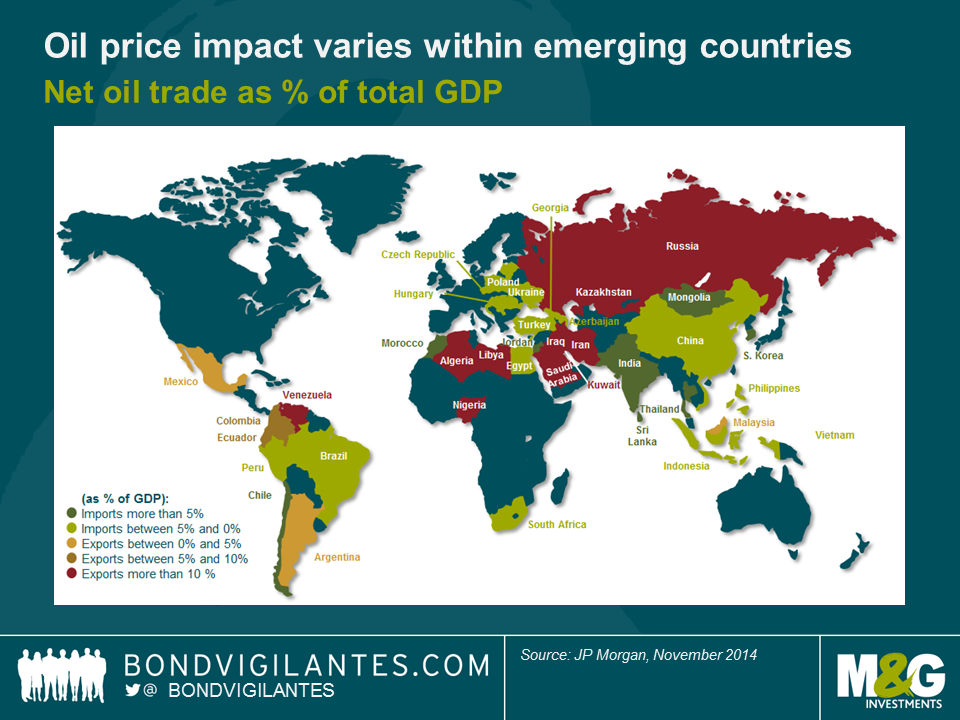

A large number of developing economies directly benefit from lower oil prices.

Asia is the biggest winner of this new oil price environment, with the exception of Malaysia which is a net exporter, as can be seen in the above chart. Within the region, India, China, Thailand and South Korea are likely to benefit the most, notably via cheaper oil imports, reduced input cost, lower fuel subsidies and/or increased consumer spending. Outside of Asia, some other large developing economies are net oil importers, e.g. Turkey, South-Africa and Brazil. Eastern European countries, in particular Hungary, Poland and Czech Republic, also benefit from lower oil (and gas) prices. Finally, it is arguable that the Caribbean and Central America indirectly take advantage of boosted US consumption through lower oil prices.

Energy names account for 13.6% of the most widely used EM corporate bond index.

Quite counter-intuitively, albeit very much in line with the fundamentals of developing economies, the Oil & Gas sector accounts for only 13.6% of the most widely used EM corporate bond index (JPM’s CEMBI BD index). However, the macro factor needs to be taken into consideration because for example financials in the Middle-East are likely to suffer from lower oil prices. Therefore, when looking at oil exposure investors must add another filter to their investment process: looking at corporate bonds that are exposed to countries with oil exposure. According to our calculations, EM corporate bonds in net oil exporting countries account for 30.3% of the index. This leaves two thirds of the index potentially immune to oil volatility… in theory.

Commodities and currencies are the main channels of contagion.

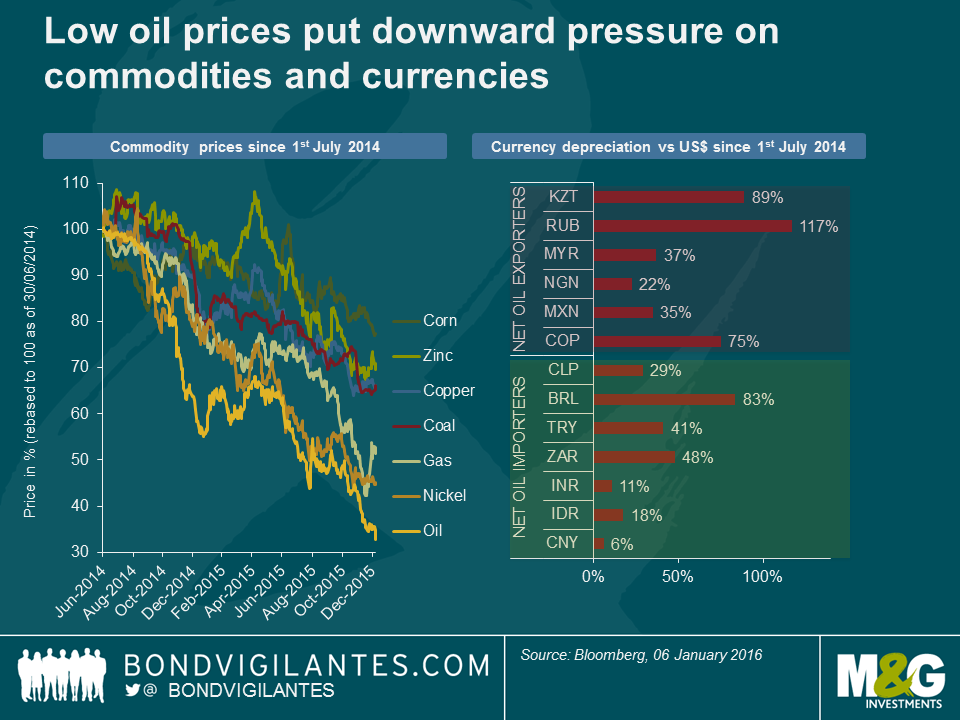

Despite the fact that there are more net oil importers than exporters in the developing economies, falling oil prices continue to drag emerging market asset prices down because commodities ex-oil and currencies act as channels of contagion.

When oil prices started to collapse, countries relying to a large extent on oil revenues saw their currencies depreciating sharply, sometimes by way of devaluations (eg Kazakhstan). The first effect was (and continues to be) technical, with a negative sentiment spillover to all emerging market currencies, as well as commodities. The second effect, more fundamental, was twofold:

(i) oil as a significant input cost influences the breakeven cost of producing metals and food; in an environment of slowing growth and commodity overcapacity, low oil prices therefore put downward pressure on other commodity prices;

(ii) the side effect of currency depreciation was that the oil-exporting countries improved their competitiveness in other commodities exports, e.g. Russia with fertilisers. This resulted in increased pressure on currencies of the non-oil exporting countries as their metal or agricultural commodities had become less competitive.

Oil is everywhere. But what matters most are the idiosyncratic stories.

Within this context, it is fair to say that an emerging market bond portfolio is unlikely to be fully immune to oil. Looking into 2016, this is good news if you are bullish oil: any significant oil price increase will in most cases drive a rally in emerging market assets. If you are bearish oil, you may still find interesting investment opportunities: the Oil & Gas sector in emerging markets generated a negative return of -3.0% in 2015 but the dispersion of corporate bond returns was huge and not necessarily correlated to oil prices. For instance, the fall in Petrobras bonds was more driven by the ongoing corruption scandal in Brazil and the group’s debt levels than the actual decline in oil prices. On the other hand, despite their country exposure, PDVSA (Venezuelan state-owned oil company) or LUKOIL (Russia-based oil producer) bonds had double-digit total returns in 2015. In what might be a good lesson for 2016, it shows that in emerging markets, in many cases, macro and credit idiosyncratic stories matter more than oil.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox