Emerging Markets debt: 2015 returns post-mortem and 2016 outlook

Following on from Gordon’s review of the best and worst performing fixed income asset classes last year, I wanted to take a more in depth look at how emerging markets performed in 2015 and what to look out for in 2016.

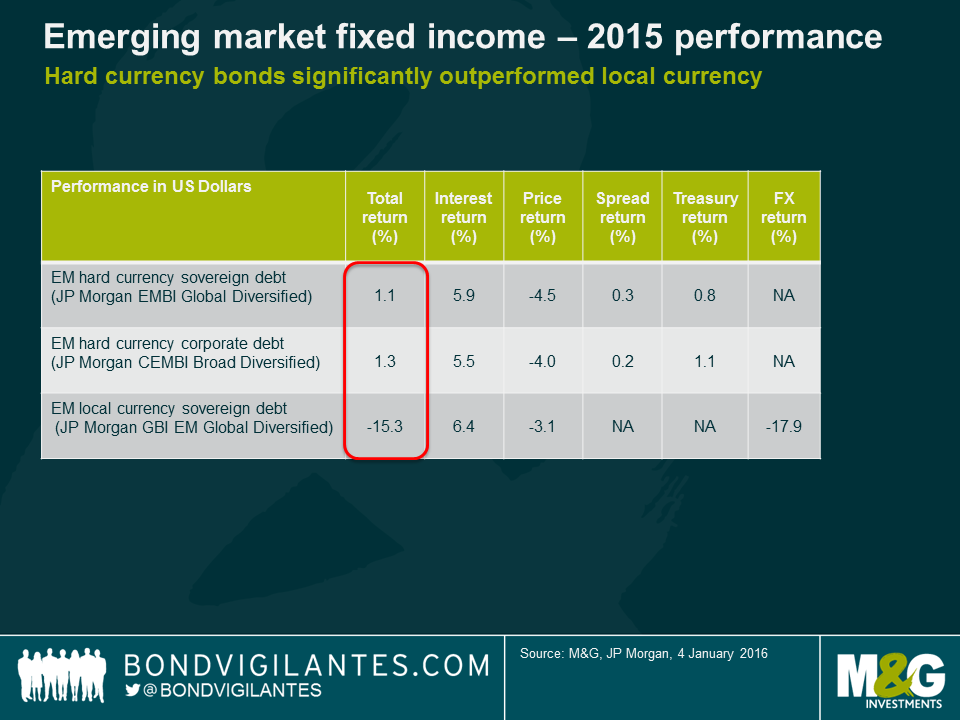

Some themes that drove the market in 2015 were the same themes than drove it in 2014. Once again, asset allocation was critical. Local currency debt, for the third year running, has underperformed hard currency debt. Within hard currency, sovereigns and corporates performed roughly in line at the broad index level.

However, as I wrote a year ago, return dispersion did increase in 2015 and avoiding the tail-risk underperformers was key. These were the main themes from 2015:

1. Duration was not a major driver of performance

Although the Fed has finally started tightening US monetary policy, 10-year Treasury yields ended 2015 just marginally higher, as the market had long been expecting, and pricing in, such a move. As long as the Fed delivers what is currently priced in by the markets in 2016 (i.e. 50-75 bps tightening), I expect emerging markets to be able to cope considering they have already been adjusting to this for a few years through weaker currencies, reduced capital inflows and more expensive funding costs.

2. Currency depreciation continued, but the good news is that it should not be as bad in 2016

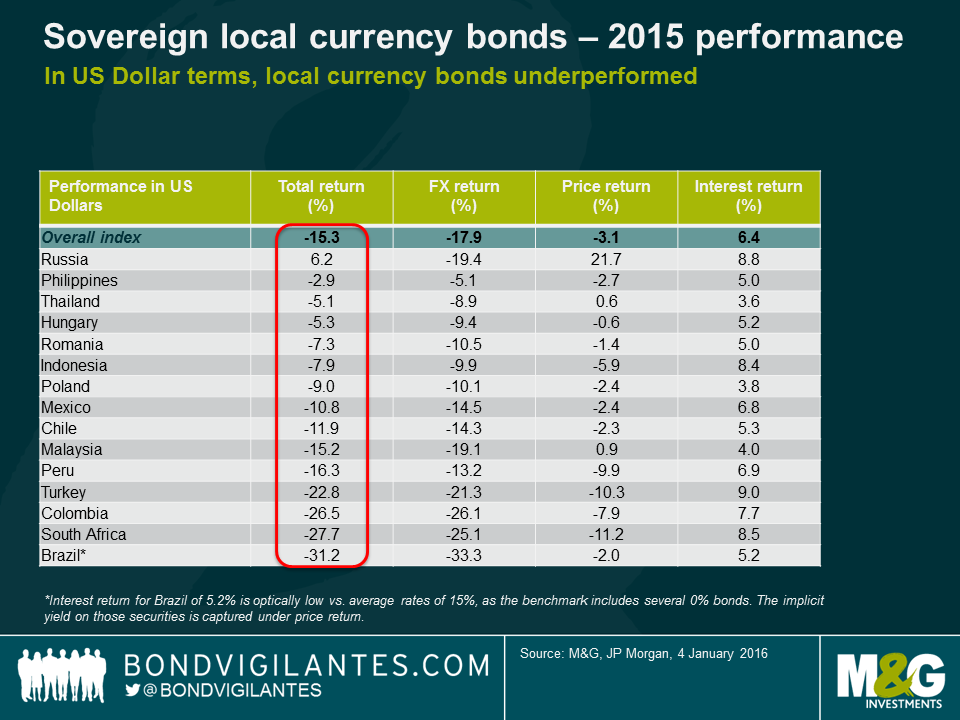

As the table above illustrates, much of the underperformance in local currency debt came from currency moves, though some of this is still about USD strength and not necessarily an emerging market move in itself. In other words, many EM currencies performed in line or even better than major currencies such as the euro or commodity currencies such as the Australian (AUD) and Canadian Dollar (CAD). I expect the USD to start stabilizing in 2016, based on past Fed tightening cycles when a large part of the USD appreciation happened before the first hike. This year’s local currency underperformance suggests that many EM currencies are no longer overvalued and, in cases such as the Polish Zloty, the Hungarian Forint or the Chilean Peso, has led to an improvement of current account balances or will allow for an ongoing adjustment such as in the case of Brazil. Fixed and heavily managed currencies, however, remain vulnerable to low oil prices (i.e. GCC pegs, Nigerian Naira). Perhaps the most critical of all is the Renminbi, where Chinese authorities face a difficult trade-off between maintaining the status quo of low volatility and some degree of overvaluation or allowing a faster devaluation that risks a disorderly spill-over into Asian and commodity-related currencies.

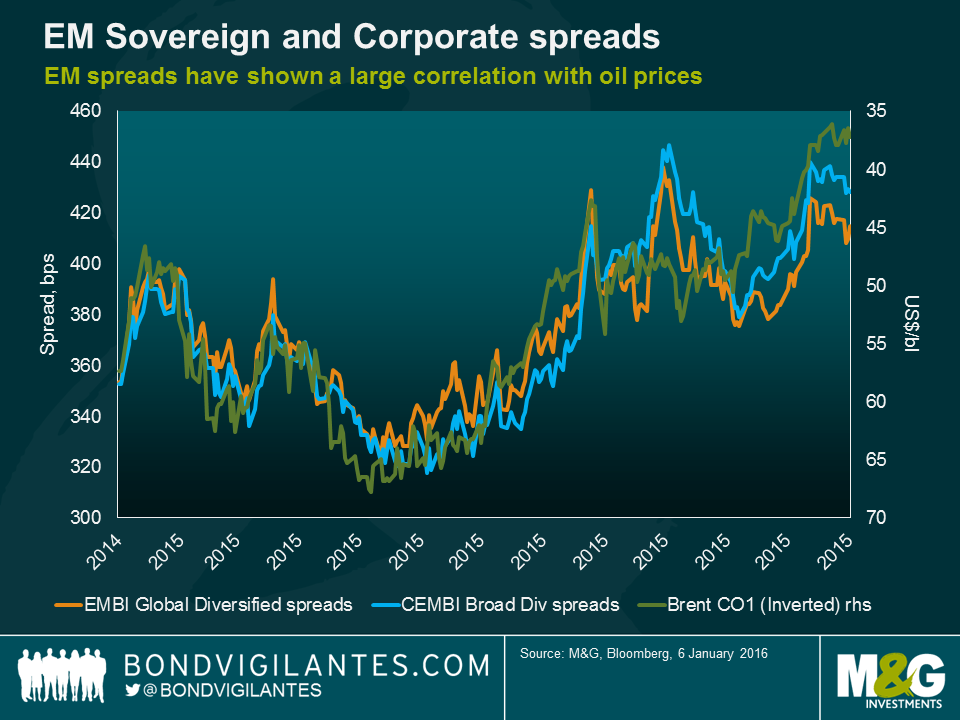

3. Spreads widened, particularly in commodity related credits

Like 2014, spread performance was again a tale of two halves. As the chart below illustrates, even though many EM countries are actually net commodity importers, overall spreads have shown a relatively high correlation to commodity and oil prices this year (Charles will explore this in greater depth in another blog to be published shortly). Overall, I believe that spreads are already reflecting a large part of the credit deterioration that we have seen in recent years but do not expect them to tighten as it is unlikely that we see any major credit improvements in the near term. However, that could change if we were to witness a rebound in commodity prices, or the Fed signalled that the tightening cycle will be very shallow.

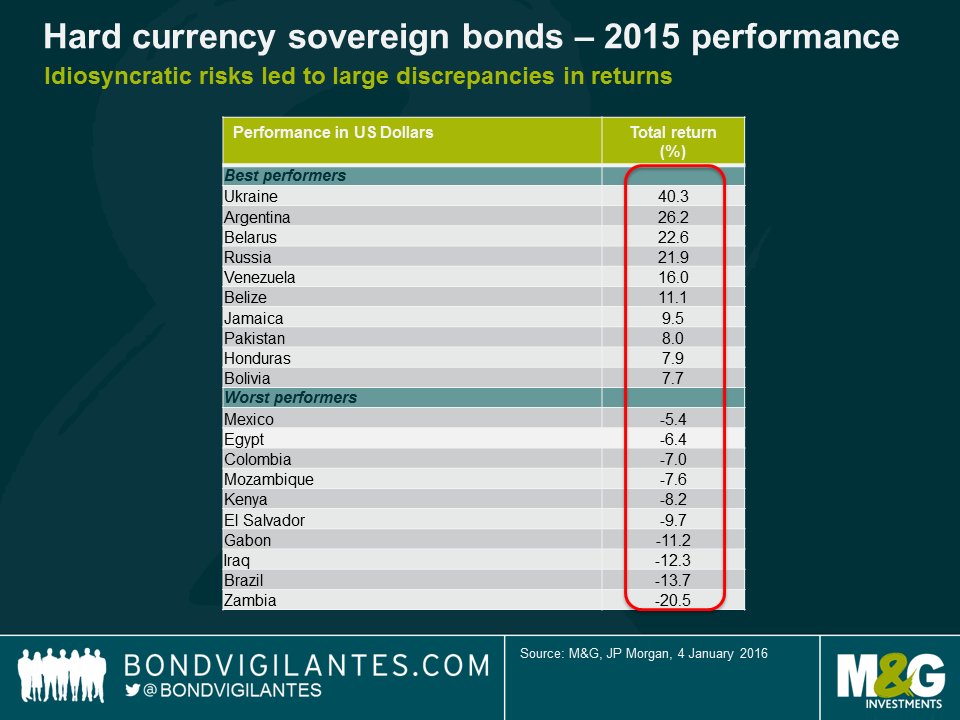

4. Idiosyncratic risks remain elevated and will not subside in 2016

Several of the top performing countries in 2015 are distressed credits that avoided defaulting (i.e. Venezuela, Belarus). Ukraine’s returns benefitted from a benign restructuring, Russia recovered from the oversold levels of 2014 as the conflict with Ukraine did not escalate and Argentina rallied on the prospect of a more market-friendly Macri government. Most of those cases, however, are unlikely to be the main outperformers in 2016 as the trigger for additional good news is less likely and valuations are also more expensive after the 2015 rally. Venezuela remains a binary credit; it will either be one of the top performers this year if they do not default, or one of the worse, if they do. The opposition victory in the recent assembly elections is positive, but not enough to remove large uncertainties over the country’s economic policy direction under low oil prices.

In terms of the worst performers, Brazil will be one of the key calls for 2016. As discussed in a prior blog entry, I remain cautious on the credit given the large political headwinds, which will make an economic and fiscal recovery more difficult. Sub-Saharan Africa remains under pressure from low commodity prices and a debt burden that is increasing rapidly in most countries given their large fiscal deficits and, in some cases, large currency depreciations. While there is little debt roll-over risk in 2016, that will start rising in a few years’ time when I would expect to see some credit events. The willingness to adjust and pay will be tested and we do not have a long track record of bonded debt repayment and recovery values as most bonds have been issued over the last few years.

In sum, I expect asset allocation between hard and local currency to remain a smaller driver in 2016, as currency depreciations finally stabilize. Sovereign and corporate credit selection within the hard currency space will remain critical as I expect return dispersion to become high. Finally, avoiding the tail-risk underperformers and corporate defaults will be a key call for emerging market investors in 2016.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox