How long until China reaches the floor of the recommended reserve adequacy range?

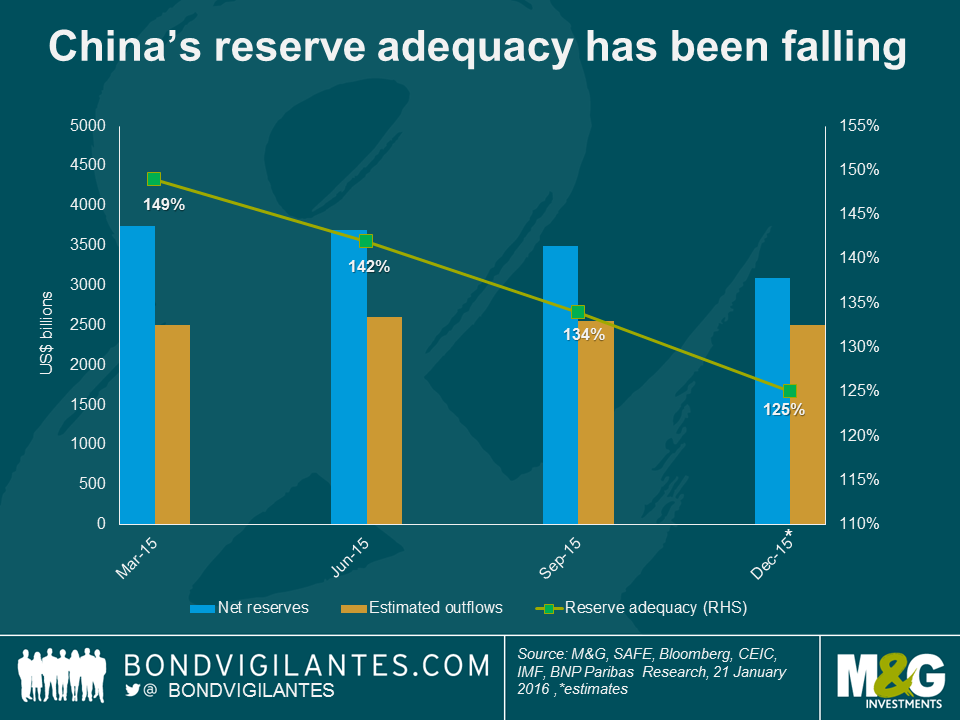

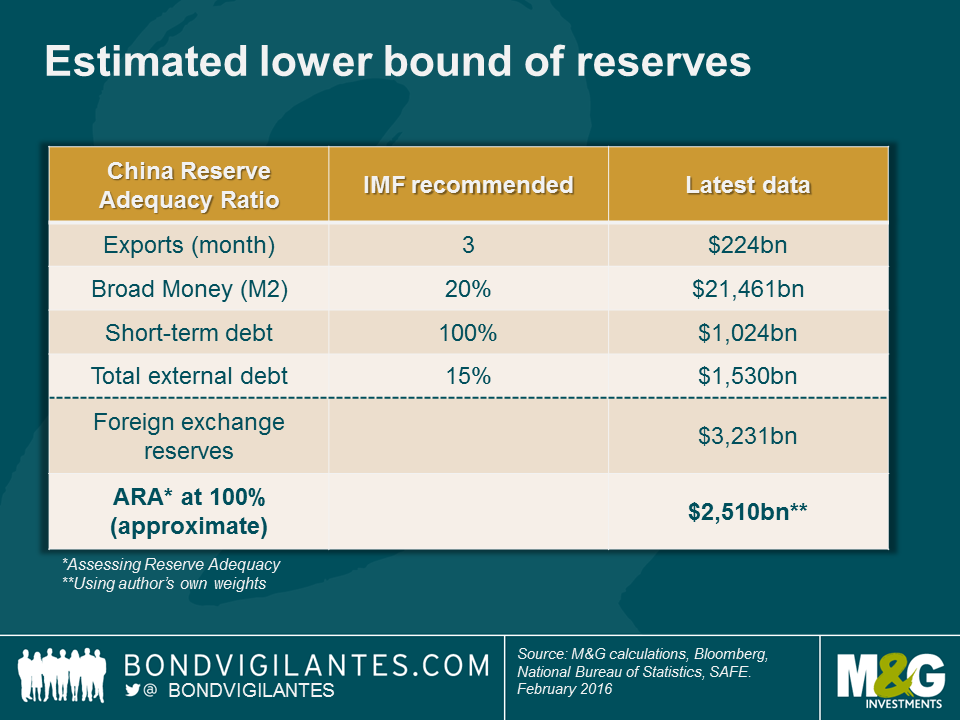

Much has been discussed on the topic of the optimal level of foreign exchange reserves. One of the common methodologies is the IMF’s ARA (Assessing Reserve Adequacy) metric, which essentially provides a range based on a country’s trade, broad monetary aggregates and external liabilities. How much weight should be given to each factor varies according to the economic structure of each country, including whether it is a relatively open or closed economy in terms of trade and capital flows and whether the exchange rate is floating or not. Based on past EM crises, the IMF has recommended a range which is normally expressed in terms of 100-150% of the metric. The ongoing pressures on the Renminbi and China’s attempt to smoothen its depreciation through currency intervention beg the question of how much firepower China has, given declining reserves.

Using the IMF’s standard framework, we calculate that China has approximately 6-7 months until it reaches the lower bound of the recommended range (100%). Arguably, this includes several large assumptions, including that the ongoing capital flight and reserve loss (at around $100 billion per month) and current account surplus remain at the same pace. We also do not know how much intervention there actually has been in the currency forward market, and some data, like debt stocks, are reported only quarterly with a lag (the last data is from September).

Any policy response from the authorities is likely to aim for faster depreciation of the Renminbi than we have seen so far, though we do not expect a large one-off move. That would require a strong coordination with global central banks to minimise financial contagion, given China’s systemic impact on global markets, and we do not think we are there yet. Tighter capital controls for residents have been gradually adopted and this is the most likely policy option in the near term, but is never 100% effective. Higher rates and tighter domestic liquidity would be problematic, given China’s large domestic debt levels.

In the spirit of the Chinese New Year – and wishing all our readers a rally monkey – we hope that our calculations are wrong and China has far more time than 6 months. For one, the number 6 is thought to be an unlucky number in Cantonese – it has a similar pronunciation to that of “lok6” (落, meaning “to drop, fall, or decline”), quite apropos.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox