Knowing your Nordics: An overview of central bank policy and the negative rate environment

There has been a barrage of G7 central bank coverage in March, culminating in much talk, but resulting in – on the whole – little new action. The Bank of Japan remained on hold (after adopting a surprise negative rate policy at the end of January), the Federal Open Market Committee (FOMC) delivered a “dovish hold” (keeping interest rates unchanged while lowering their longer term rate guidance) and the Bank of England voted unanimously to keep the interest rate at 0.5%.

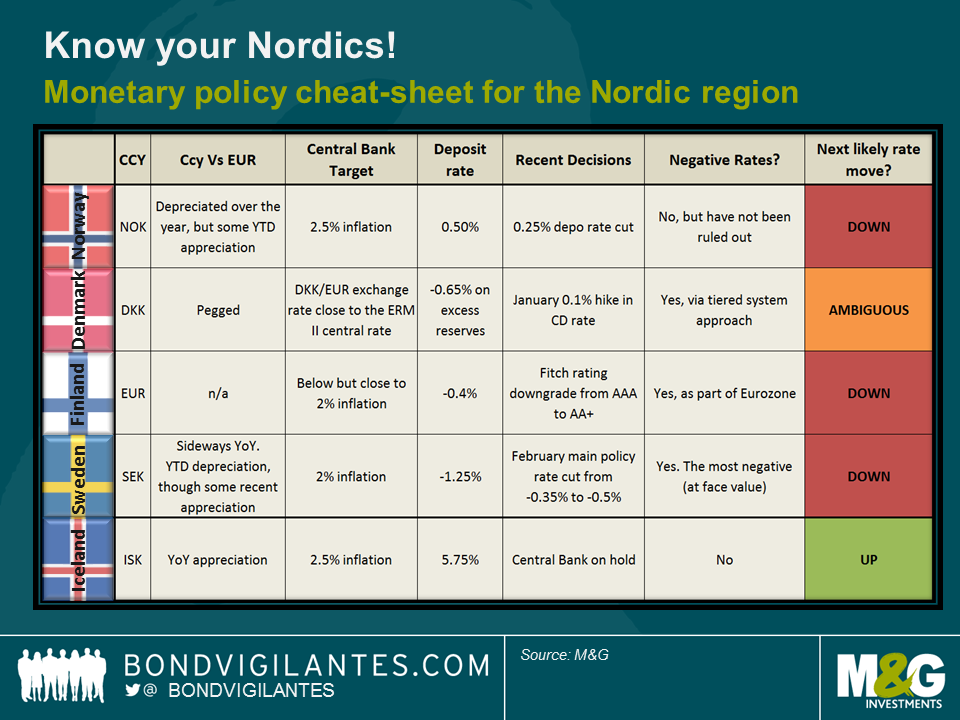

Some of the more interesting policy action has been in Europe where the European Central Bank (ECB) unveiled a raft of additional measures in its latest round of monetary easing, which included a further cut to its already negative deposit rate. Again, this has been well covered by market commentators. But perhaps some of the lesser discussed – though no less deserving – coverage of late has been given to the Nordics, where negative nominal rates have been a feature of some of these markets for some time. If the Nordic region is the gaping hole in your monetary policy bank of knowledge, the following discussion should go some way to address this.

Norway: Eased in March, more to come?

On 17th March – the day after the FOMC meeting – the Norges Bank cut its deposit rate from 0.75% to a new low of 0.5%. The weaker external growth environment, looser policy abroad and renewed oil price swings were some of the reasons cited for this move.

The Norges bank has an inflation target of 2.5% and whilst the CPI inflation forecast was revised upwards in the short term (from 2.6% to 3.2% for the first quarter of this year), much of this is due to the lagged impact of the Krone depreciation experienced in line with the fall in the oil price in 2015. Given the YTD rebound in the Krone, the currency effect is likely to dissipate in the longer term. Teamed with a potentially slowing global demand environment as well as subsiding domestic wage pressures, inflation is forecast to end 2019 at 1.6%, well below target.

Like many of its developed country peers, Norway now too finds itself flirting with the zero lower bound. What is of particular interest is that the central bank has not ruled out the use of negative nominal interest rates declaring that “should the Norwegian economy be exposed to new major shocks, the Executive Board will, however, not exclude the possibility that the key policy rate may turn negative”. Perhaps one to watch in the race to the bottom.

Denmark: Protecting the peg

Several developed market economies have now embraced the negative nominal rate experiment, but it was the Danmarks Nationalbank (DNB) that was the pioneer. Unlike the majority of other central banks in the area, inflation is not the target, but its commitment to keep the DKK/EUR exchange rate close to the ERM II central rate with a narrow fluctuation band of ±2.25%.

At the start of this year, the DNB hiked rates from -0.75% to -0.65% in defence of the band. Though this move was a tightening, the bank also made tweaks to its tiered deposit system, by lowering the current account limit from DKK 63.05bn to DKK 32bn. The limit caps the amount of commercial bank reserves that can be held with the DNB at the 0.0% current account rate, while the excess above this limit gets charged at the more punitive certificate of deposit rate (-0.65%), which should stimulate bank lending – an act of credit easing.

The next move in rates is ambiguous. If there are further sizeable capital outflows and reserve shrinkage, the central bank will likely hike rates again. Conversely, should capital flows reverse and require intervention by selling DKK, the central bank could cut the policy rate or accumulate FX reserves again.

Finland: Part of the Eurozone’s quest to ease financial conditions

On the 11th March, rating agency Fitch downgraded the sovereign from AAA to AA+ naming continued weak economic performance as the driver (2015 GDP expanded by 0.4%, the lowest growth rate in the EU with the exception of Greece). With no decisive evidence of a meaningful pick-up in potential growth over the medium term, public debt dynamics continue to weaken.

As a Eurozone country, Finland works as a proxy for the ECB’s monetary policy in the Nordic region. In line with its Euro peers, Finland is on the receiving end of monetary easing as the ECB lowered deposit rates to -0.4% at the 10th March meeting. Unlike Denmark however, this is not a tiered system and banks are arguably penalised more heavily for using the deposit facility. Although the deposit rate is more likely to move lower than higher in the short term, the ECB appears to be tilting its focus towards QE and other extraordinary methods. Indeed, the expansion of QE into investment grade corporate bonds as well as the new TLTROs proffers two such measures.

Sweden: Deposit rate is not what it seems

The Riksbank’s deposit rate is hugely negative at a whopping -1.25%. At face value this looks highly punitive, although this facility is barely used. In practise, Swedish debt certificates (issued weekly with interest set at the base repo rate of -0.5%) soak up the majority of the banking sector’s surplus liquidity, with any excess dealt with in daily fine-tuning operations that cost an extra -0.1% (interest rate becomes -0.60%). As a result of this, unlike in the Eurozone where the interbank rate trades close to the deposit rate, Sweden’s interbank rate instead trades closer to its base rate of -0.5% (reduced from -0.35% on 11th February). Moving the deposit rate further negative would therefore do little to change banks’ decision making. Instead the main base repo rate is the more important focus.

Another aspect to bear in mind is the appreciation in the krona versus the euro over the past couple of months. If this continues, the Riksbank may need to extend its QE programme beyond June to prevent this from dampening inflation. The current programme of SEK 200bn represents approximately 30% of the outstanding government debt, leading some to speculate that any additional QE would be in the form of corporate bonds purchases, similar to the ECB’s recent move.

Iceland: In hiking mode, the next move is up

For completeness of the Nordic region, we turn to Iceland, which breaks the mould somewhat. Whilst a lot of the region has been battling with “missingflation”, Iceland has growing domestic inflationary pressures, a relatively high deposit rate and subsequently, a central bank in hiking mode. Though the next move in rates is likely to be up, the appreciation in the Icelandic krona alongside low global inflation perhaps gives the central bank scope to raise interest rates more slowly than was previously considered necessary.

Though one may be tempted to assume that the whole of Europe (or indeed the developed world) is suffering from low inflation and that all central banks are preoccupied with inflation targets, the Nordic region shows just how diverse policy truly is. It’s not just an issue for the G7 countries. Despite being geographically close, central bank policy in the Nordic region is incredibly varied, even when sometimes the objective is similar.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox