The Central American Remittance Crunch – who would lose most from a Trump Presidency?

The US election campaign has surprised everyone thus far. Candidate Donald Trump has vowed to deport all of the 11 million illegal immigrants currently living in the US. He has also declared that he would impound all remittance payments derived from illegal wages. We have written before how Central America and the Caribbean would benefit from improving US growth and have been invested in various sovereigns in the region as a result. Remittances benefit receiving countries as they reduce their current account deficits and have a positive impact on domestic consumption and growth, although studies have also pointed out some negative impact through increasing income inequalities or potential for currency appreciation, making exports less competitive.

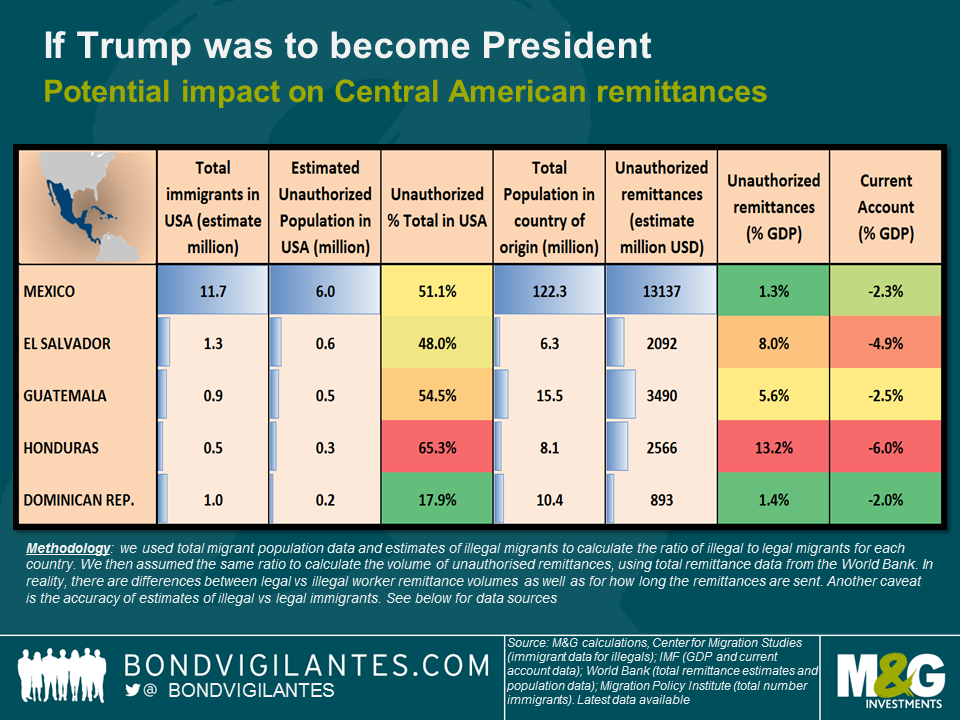

Assuming that Trump was to become President and – logistics and feasibility aside – that all the illegal immigrants be deported, how will this impact the region’s remittance flows? In the table below we used total migrant population data from the Migration Policy Institute and estimates of illegal migrants from the Center for Migration Studies to calculate the ratio of illegal to legal migrants for each country. We then assumed the same ratio to calculate the volume of unauthorised remittances, using total remittance data from the World Bank. In reality there are differences between legal vs illegal worker remittance volumes as well as the length of time they are sent for, and the accuracy of the illegal migrant data could also be questioned.

The focus of the rhetoric has centred on Mexico, as it has the largest absolute number of immigrants in the US. However, as can be seen in the table, the biggest losers would be the smaller countries of El Salvador and Honduras. Both have a much higher share of remittances vs. GDP and current account receipts because their share of illegal immigrants is higher in comparison to the size of their economies and population.

Mexico, instead, would be much more negatively affected should the existing NAFTA free-trade agreement be renegotiated, as its economy is much more dependent on exports to the US than worker remittances.

Clearly, there are other broader implications that are much harder to quantify. Larger current account deficits would lead to a combination of weaker currencies, higher debt levels and nominal price deflation in the case of dollarized El Salvador. Growth could also be lower if the increased workforce is not able to find similar opportunities at home, which would be negative for their fiscal accounts and debt dynamics. Let’s hope that common sense and the impracticality of deporting 11 million people prevails in the end.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox