Russia Trip Notes – catching a cold but still standing up

Russian corporate bonds were one of the best performing asset classes last year, with a total return for the JPM CEMBI Russia index of +26%, despite Russia’s GDP dropping by -3.7% on the back of a hugely challenging economic backdrop and geopolitical headwinds. I recently spent a week in the cold of Moscow’s early spring, meeting banks and corporates to help me assess whether the economic sanctions and low oil prices would continue to, paradoxically, benefit bond investors in 2016. Here are some of the key takeaways.

The crisis is nothing like 1998 but the economy is struggling

Importantly, sanctions have had little impact in the short term compared to lower oil prices and the resulting depreciation of the Ruble, which has made imports more expensive, resulted in squeezed margins of businesses and lower living standards for millions of Russians. The locals I talked to said the current environment is nothing like the 1998 crisis though, when the country had no reserves and a large budget deficit. But most also recognise that the current crisis is more pernicious (as a slow, prolonged deterioration) and question where a rebound could come from in the near term should oil prices stay low and the sanctions remain in place.

At the micro level, talking to various local banks is always a good start to understand the real economy. Almost all the (public and private) financial institutions I met were concerned about asset quality deterioration, in particular for corporate loan books, with an expected rise in non-performing loans. Sectors such as construction, metals & mining, automotive, commercial real estate or transport have been hit hard. It’s not much better in retail lending and appetite for risk is small. The bright spots come from (i) exporters, which have been helped by the weaker Ruble as their costs are in local currency and their revenues are in US dollars, and (ii) the food agriculture business, which benefits from the Russian counter-sanctions on European food exports to the country.

Russian corporates are resilient and refinancing risk is low in the short term

My meetings with various non-financial bond issuers (oil & gas, metals & mining, telecom and transport) confirmed the above trend but gave me a different perspective. Management acknowledge the headwinds and most of them seem to be taking the necessary steps to optimise their business for this new environment. Military history is replete with examples of how incredibly resilient the Russian people are, and the corporates I met gave me the same impression.

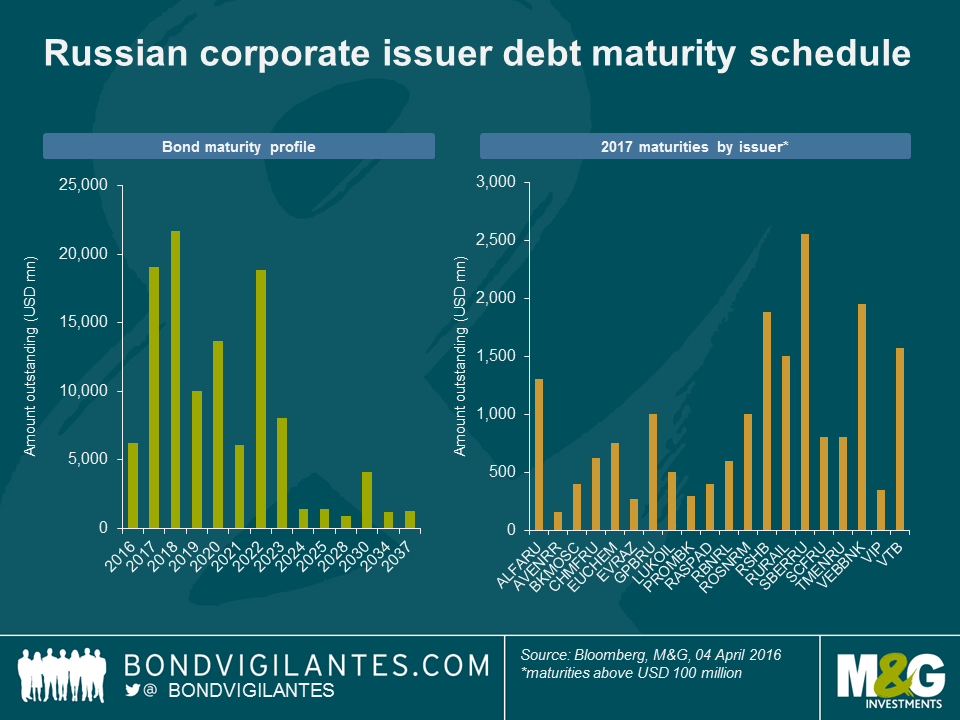

With a primary market virtually closed for the past 18 months, the sanctions have pushed Russian corporate bond issuers to financial discipline by maintaining relatively low leverage and adequate cash levels in order to meet hard-currency debt maturities. The availability of the Ruble in the country’s financial system is another contributing factor explaining how well bond issuers have been able to weather the financing sanctions by the West. In the near term, and as can be seen in the above graph, the debt maturity schedule of Russian corporate issuers (including financials) looks manageable with the largest maturities due in 2017 being mainly bonds issued by state-owned banks.

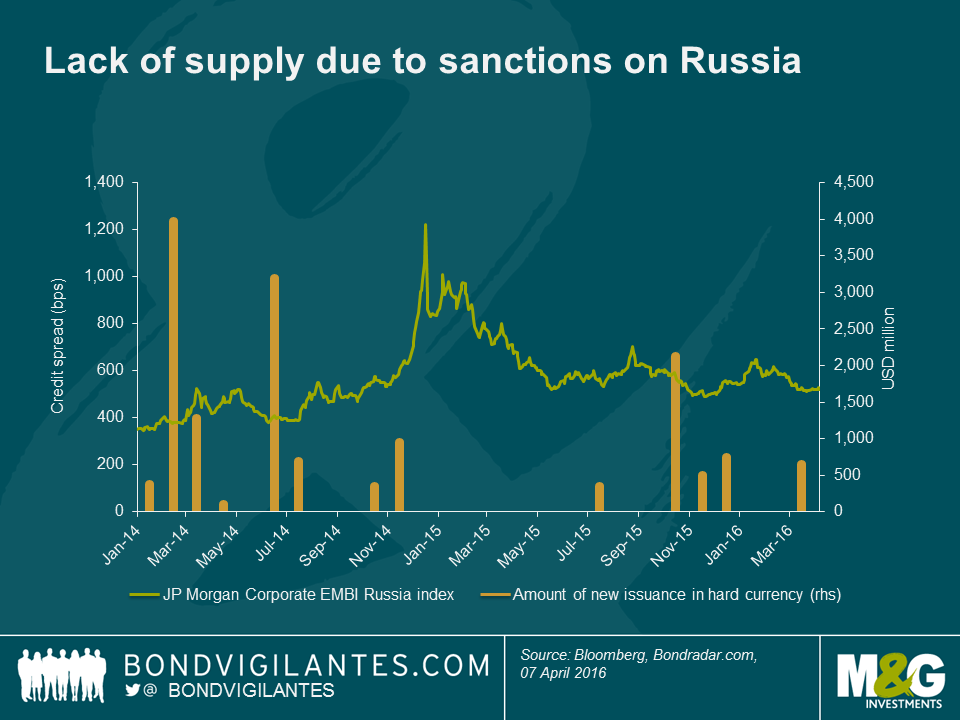

Sanctions create scarcity value but valuations are very different from early 2015

From a bond supply perspective, the sanctions have been very supportive of bond returns in 2015 and continue to help the technical backdrop in 2016. While some issuers were able to issue bonds late last year and in 2016, the local market (RUB-denominated bank loans) is expanding and hard-currency bond issuance is expected to remain low this year. In terms of demand, I would expect the picture to be very different from early 2015, when spreads reached very attractive levels (around +1,000bps) on the back of external threats (geopolitical tensions, oil price, RUB) rather than imminent risk of defaults among Russian corporates. At about +520 bps, the Russian USD-denominated corporate bond market has now come back closer to fair value levels of spreads and total returns were 5.1% in the first quarter, which was justified in my view given the fundamental resilience of Russian issuers and relatively improved geopolitics. Looking forward and playing devil’s advocate, it’s questionable how sustainable this resilience can be in a prolonged period of crisis.

Credit differentiation will be critical in a period of low oil prices and sanctions

Assuming low oil prices and sanctions remain in place, corporate fundamentals should deteriorate more significantly throughout this year and in 2017. One of the main fundamental risks to corporate cash flows in the near future is Russia’s widening budget deficit.

First, low oil and gas prices have resulted in lower government revenues. And because oil & gas companies have actually been very resilient through the crisis due to their export-driven nature, the government is contemplating raising taxes on the sector.

Second, the sanctions have prevented Russia from tapping the bond market as much as needed to fill the budget gap. Hence, the government is considering increasing the dividend pay-out ratio of state companies to 50% from 25%. For oil & gas state companies, this could be another drag on cash flows. Indirectly, the private sector and in particular steel companies could also be affected if the stretch on corporate cash flows results in reduced public investment and lower underlying demand.

In light of this potential deterioration, corporates would have to draw on their cash balances and the refinancing of the >$20 billion of hard-currency corporate bonds maturing in 2018 could become more problematic for some issuers.

The bottom line is that credit differentiation will be critical. Unlike the 2015 macro call that took place in Russia, investors should be pickier in terms of bond selection as the long-term impacts are likely to result in credit profile divergence across the Russian corporate bond universe.

Finally, one may nevertheless not rule out another macro call this year if oil prices rebound materially (upside) or, bearing in mind that Russian politics have almost always caught investors by surprise, if geopolitical tensions with Ukraine revive (downside).

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox