A vision of the future? Optimal currency areas within the United Kingdom

The year is 2020 and King Henry IX, the recently installed head of state of the United Kingdom of Northern England, Wales and Northern Ireland stands in a room overlooking the Trent River. Most of his subjects still refer to him simply as “Harry”. His popularity with the electorate is seen as a key factor behind the surprise victory for the monarchists in the recent constitutional referendum for the latest sovereign entity to be carved out of the United Kingdom. Following the secession first of Scotland in 2018 and then the South of England a year later, after the so called “SEXIT” referendum, King Henry is now the constitutional monarch of a territory encompassing the North of England, Northern Ireland and Wales. As he looks out of the window, the Prime Minister continues with his weekly briefing,

“So you see your majesty, I’m afraid that the Governor really has no choice, a further cut to interest rates and allowing a devaluation of the Northern Pound is the only option in light of our fiscal position.”

The King nods to acknowledge the statement, albeit with little real understanding of what Prime Minister Andy Burnham has just said.

“This will probably mean more inflationary pressure in the short term, but a weaker currency will help our exporters compete more effectively. Nevertheless, your majesty, I feel I must bring up the fiscal pressures your government is feeling.” The Prime Minister pauses.

Harry turns around, picking up on the embarrassed tone in the Prime Minister’s voice. “Let me guess,” he says, “more cuts to the Royal Budget?”

“I’m very sorry your majesty, but we’ll have to start making more economies. I’m afraid it’ll mean further delays to the construction of the new palace here in Stoke “

Harry turns back to look over the River Trent. On the far bank, the new Houses of Parliament were taking shape in the centre of Stoke, but the future site of his palace remained untouched nearby. It is still being used as a car park for the local Lidl supermarket. How did I end up here, he ruminates, in Stoke of all places. After all the debate about where the new capital was to be located, the politicians were deadlocked between Birmingham and Manchester. Consequently the “M6 Compromise” started to take shape, with an expanded Stoke-on-Trent as the nation’s new purpose-built capital, midway between the two.

“Also, we’ll need to cut back on the regular trips to Los Angeles.” Prime Minister Burnham continues, “The flights will just get more expensive if the Northern Pound continues to slide against the dollar. I understand this may not go down well with Her Majesty, but I can only apologise for this, my hands are tied.”

Harry visibly winced. He would have to break the bad news to Queen Kendall (nee Jenner), who liked to jet back regularly to visit her family in Beverly Hills and appear in episodes of their long running reality series. Perhaps they could film more episodes here at home, he thought, after all their son, Prince Kanye, was due to start school soon.

The above snap-shot of a balkanised United Kingdom in the near future may seem far-fetched, but with the contemporary political debate about the UK’s membership of the European Union and the continued stresses and strains within the Eurozone itself, I thought it might be interesting to consider if there were potential economic fault lines within the UK too.

The currency union that underpins the UK is able to function given the regular and persistent fiscal transfers from the South East of England and London to other areas within the country. These transfers help redress the inevitable internal economic imbalances of a currency area and are part of a well-established political settlement. However, what if this political settlement was ripped up by a disgruntled electorate in a fit of economic localism, and with it the mechanism for fiscal transfer? In this instance, what would be the optimal currency areas for a de-constructed UK?

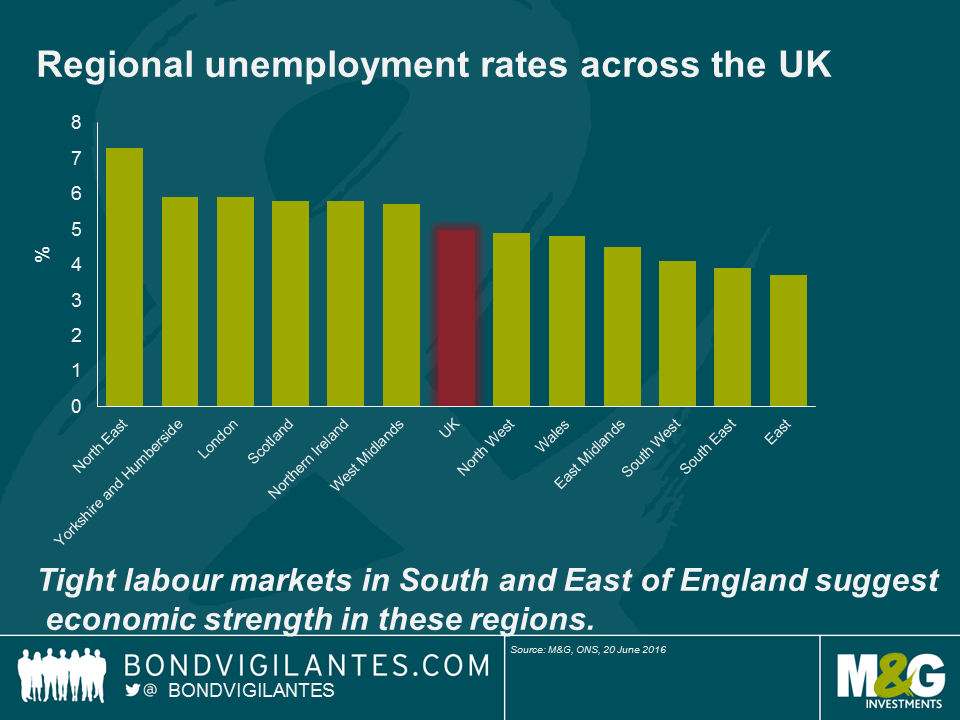

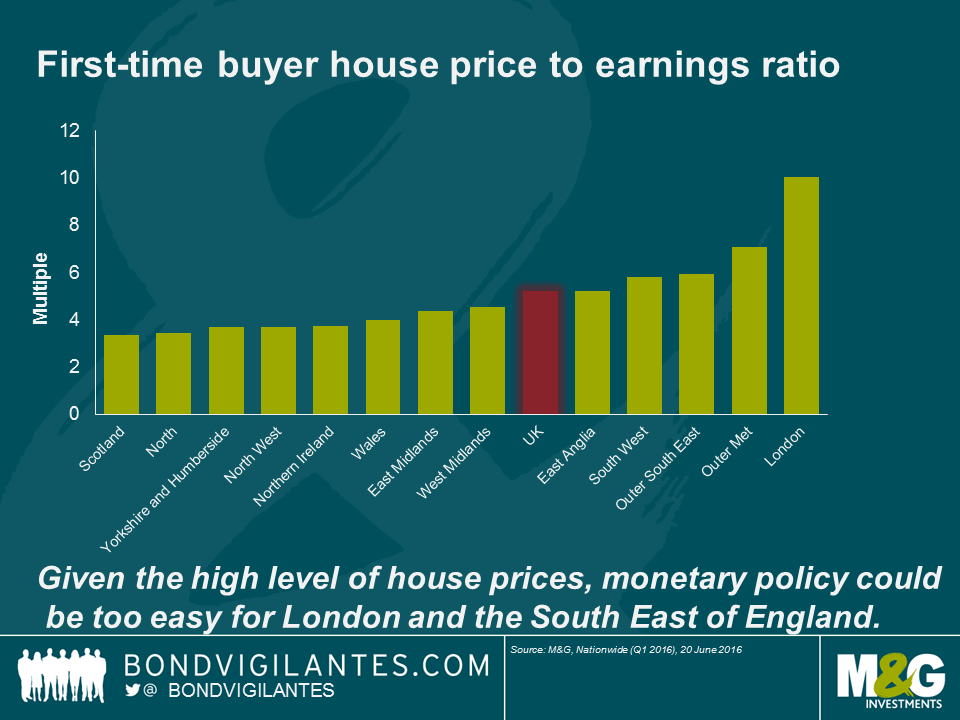

To answer this, I looked at two readily available regional statistics: unemployment rates and house price to earnings ratios. This first is to determine regional differences in the labour market and the latter to determine where low interest rates are having the biggest impact on asset price inflation. The logic is that areas that currently have low unemployment and a high house price to income ratio would arguably benefit from a tighter monetary stance, and vice versa for areas that have significantly higher unemployment and a much lower house price to income ratio.

In terms of unemployment rates, the first thing to note is that with the exception of the North East and the East of England, there is relatively little unemployment rate disparity which may suggest a lack of regional fault-lines. Indeed, it came as a surprise to me that London has a higher unemployment rate at 5.9% than the national average. Nevertheless, when we look at the three regions with the tightest labour markets (arguably well below an estimated UK NAIRU rate of c.5.0-5.5%* suggesting monetary policy is currently too loose) there is a definite geographical bias towards the South and the East of England.

This regional picture is also evident when we look at the break down of house price to earnings ratios. The South and East of England all have a higher than average ratio, but of course London is the most distorted of all at roughly twice the national average.

Taken together, this suggests that the UK could be broken into two optimal currency areas in the event that fiscal transfers became impossible. The South West, South East, London and the East of England forming one area and Northern Ireland, Scotland, Wales, the North of England and the Midlands forming the other area (roughly speaking a line from Gloucester in the West to Kings Lynn in the East would mark the border).

However, what is encouraging from the above, is that with the notable exceptions of the South East and London housing market and high unemployment in the North East, the lack of huge regional disparity elsewhere suggests the UK is not obviously a sub-optimal currency area as it stands today. There are regional differentials, but it doesn’t seem those differentials are sufficiently large to merit a monetary split.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox