Four years of the ECB doing “whatever it takes”

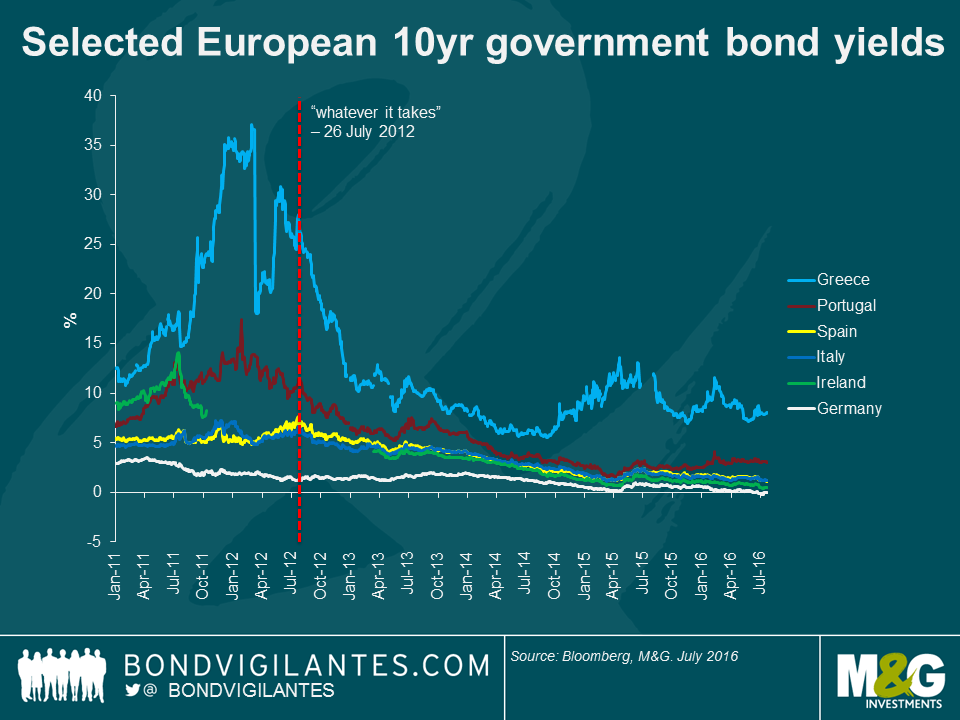

Transport yourself back to July 26, 2012. Borrowing costs for the “peripheral” European nations are uncomfortably high. Ireland, Portugal and Greece were in the process of applying for bailouts, while the Spanish banking system was dangerously close to falling over. It wasn’t a question of when an EU member would leave the single currency bloc, but who? Step forward ECB President Mario Draghi, who in an address delivered to a room full of business leaders and investors, proceeded to deliver the most important sentence delivered by a central banker in modern times – “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough”.

The big question at the time was what is it?

Fast forward to today, and we have some understanding of what President Draghi meant. He was referring to a range of conventional and extraordinary monetary policy measures, including a cut in the ECB’s main refinancing rate from 1 to 0%, a cut in the deposit facility from 0.25 to -0.40%, long-term refinancing operations that reached over 1 trillion euros in size, emergency liquidity assistance for Greece that currently stands at 54 billion euros, and an asset-purchase programme worth 1.1 trillion euros (subsequently extended, expanded and increased by around a third). As a result, the ECB balance sheet now stands at 3.2 trillion euros (or 131% of Euro area GDP).

That’s the it. Was it enough?

Looking at peripheral bond yields suggests that it was. Investors are no longer demanding the credit premium they once were, resulting in a collapse in bond yields.

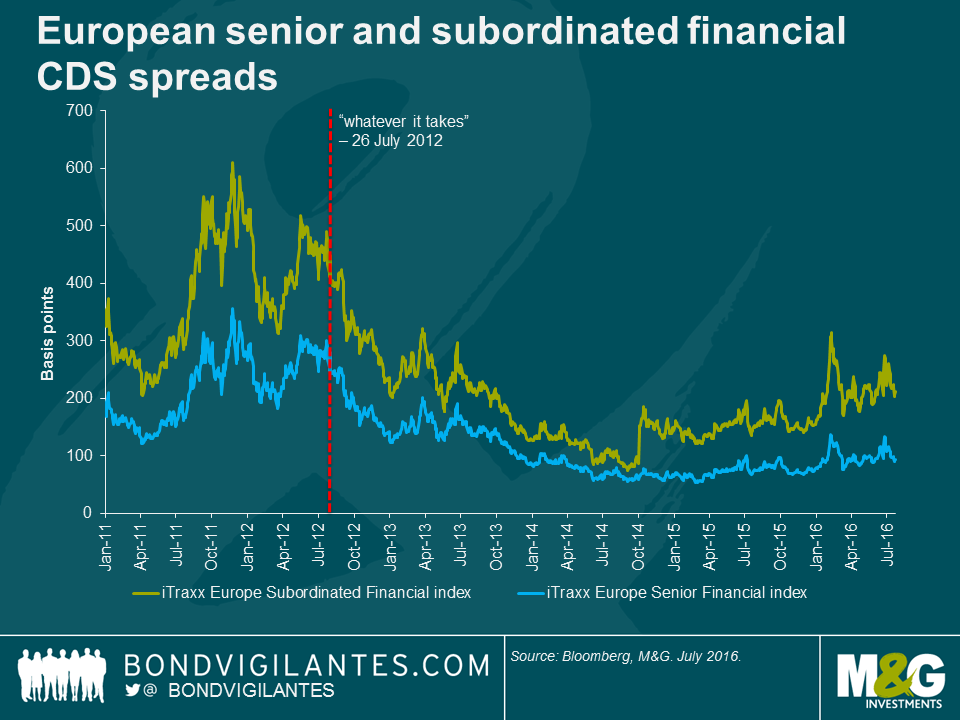

In his speech, Draghi referred to the spike in risk aversion being linked to counterparty risk. As shown below, CDS premia have collapsed in the Euro area from 2012 levels but sub-financials have been on a widening trend since Q4 2014. More recently, investors are questioning the amount of bad debts that a number of European banks have on their books and whether these losses can be sustained in some of the more fragile financial systems of the Euro area.

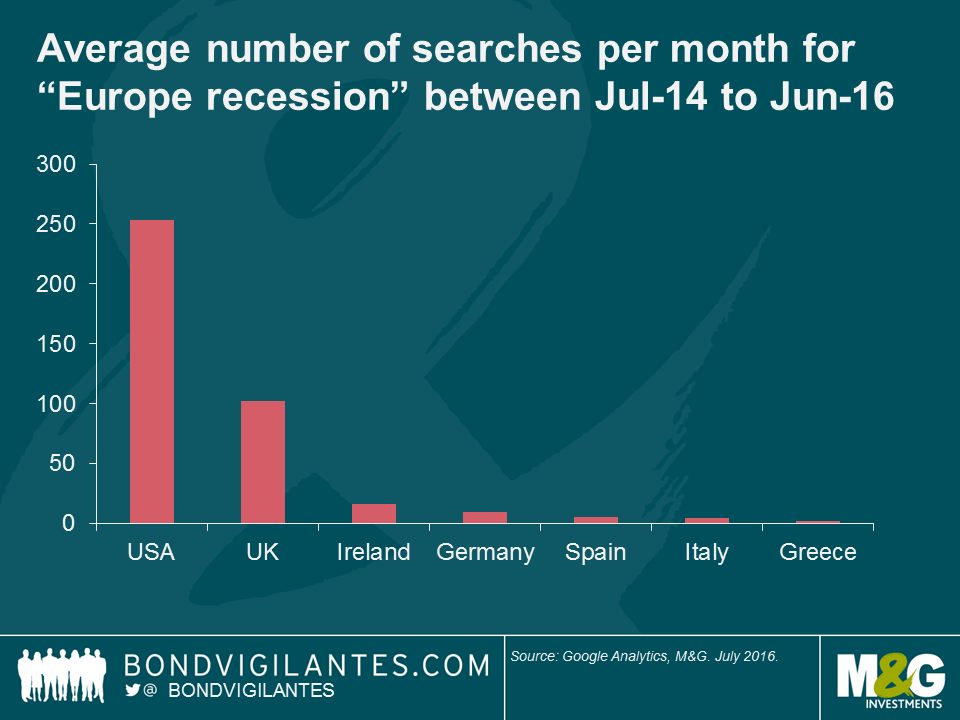

Finally, using Google, it appears that people from the US and UK are more worried about a European recession than Europeans themselves over the past two years. The vast majority of searches for “Europe recession” come from the US or UK (I also checked for local language equivalents: there are 7 searches per month on average in Germany for “Europa rezession”; and “recessione Europa” registers 5 searches in Italy for example).

President Mario Draghi brought calm and stability to very volatile markets four years ago through his speech. His words acted like a risk-off circuit breaker, and European government bond markets and the financial system benefited from that. It goes to show that a central banker with a mandate does have the ability to heavily influence financial markets. Indeed, President Draghi may have saved the single currency bloc, as it appeared the ECB was the only European institution that had the ability to act quickly, decisively and in a large enough magnitude to support the European economy in the absence of a European fiscal union.

Unfortunately, not much has changed on the fiscal front. Europe still faces some significant structural issues, with a significant divergence in economic outcomes across the Euro area member states. Brexit will also likely prove to be a headwind for economic growth. Economically, Europe is still struggling with high unemployment rates and very low inflation despite four years of extraordinary monetary policy. With the markets expecting more monetary stimulus in September, it appears that the ECB’s job of doing “whatever it takes” is still not over.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox