The election result impact on US high yield markets and the healthcare sector

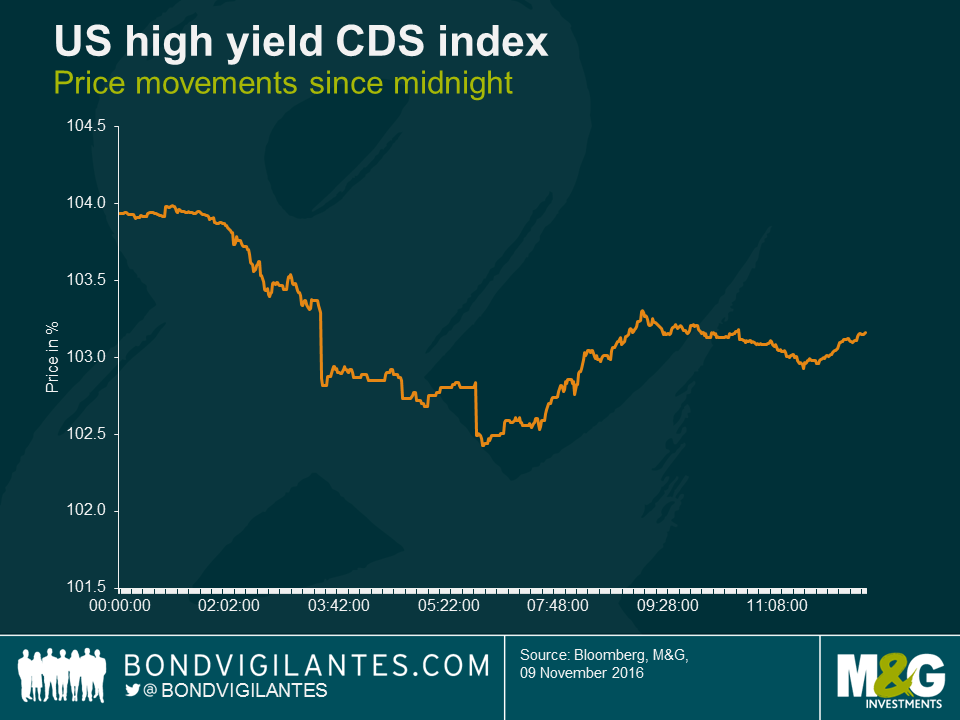

As James mentioned this morning the European high yield markets’ response to the Trump election victory has been fairly benign. The U.S. high yield market, as one would expect, has been a bit more pronounced, although not as severe as European equities or S&P futures. The U.S. CDX Index, a CDS index of U.S. high yield issuers much like Europe’s iTraxx Crossover, initially dropped nearly two points or 1.3% but has since recovered, currently down about half a point or 0.5%.

We will have to wait for the U.S. market to open fully to see how this will play out over the course of the day, but it’s worth noting that individual sub-sectors will react differently to the result. We would highlight health care as one sector in particular to keep an eye on. The Trump victory will likely create volatility both positively and negative in this sector.

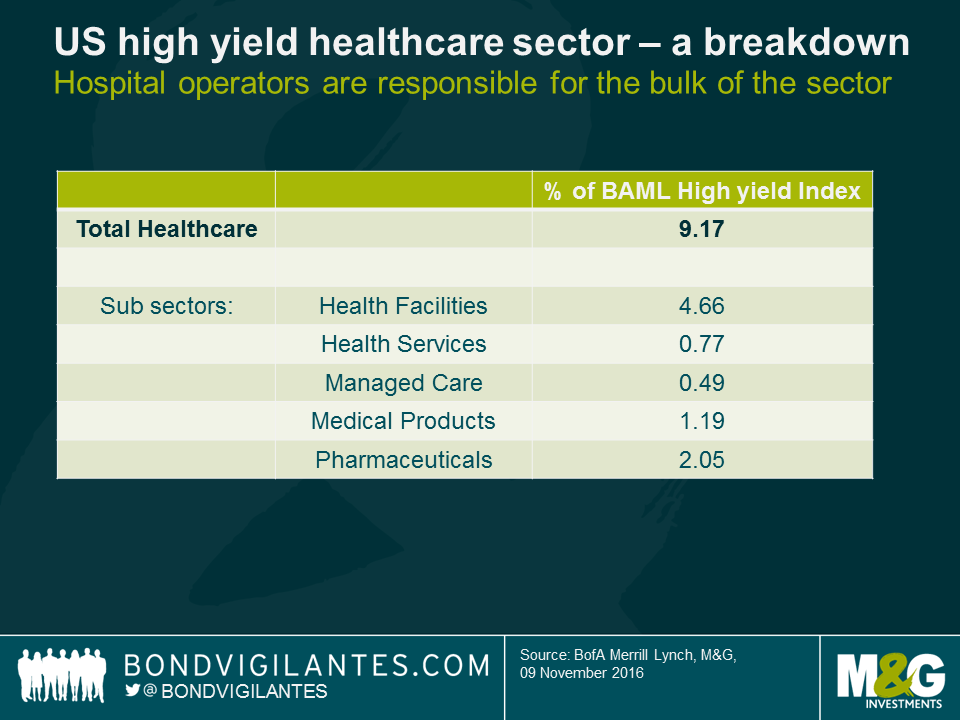

With a Trump presidency and Republican Congress there will undoubtedly be renewed calls for the repeal of, or at least significant adjustments to, the Affordable Care Act (ACA) or Obamacare. This could lead to negative pressure on hospital operators, which make-up a meaningful percentage of the broader U.S. high yield index (nearly 5% of the Bank of America U.S. High Yield Index). Theoretically, these operators could see an increase in the number of uninsured patients under such a scenario. In addition, the uncertainty about the future of the ACA could lead to negative pressure on U.S. managed care companies. Although the majority of these companies are investment grade, there are a handful of high yield issuers that could be affected.

Conversely, it is expected that there will be less pressure on drug pricing and costs under a Trump administration and Republican congress. This could serve as an uplift for high yield specialty drug manufacturers in particular. Further, there is likely to be bi-partisan support for the faster approval of generic drugs, which would benefit generic manufacturers, albeit to the potential detriment to branded manufacturers.

Trump has also called for direct price negotiation of Medicare Part D drugs, and for drug re-importation, which could translate into modest negatives for pharmaceutical manufacturers. These policies have not been a focus of Trump’s campaign and are not anticipated to gain much traction in Congress.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox