Three reasons we like UK residential mortgage backed securities

The residential mortgage backed securities (RMBS) market has had a good run of late, so is the sector still good value and is there room for it to rally further?

The short answer: Yes.

The longer answer: There are a number of factors that should prove supportive for RMBS going forward, a few of which are discussed below.

- Structure

The Big Short has been available on Netflix for a couple of months now, so I’ll assume that readers are already fairly familiar with mortgaged backed securities. What the film failed to mention however, was that these instruments are typically floating rate assets and are therefore a natural hedge to interest rate increases, as coupons reference LIBOR benchmarks. An additional feature is that they typically amortise: every month the cash value of bonds outstanding falls, as the mortgage loans backing the bonds are amortising (capital is repaid along with the interest). This means that the size of the universe shrinks naturally and investors are returned cash that they need to find a home for. This supply and demand dynamic may prove supportive for the asset class – more on this later.

- Relative pricing

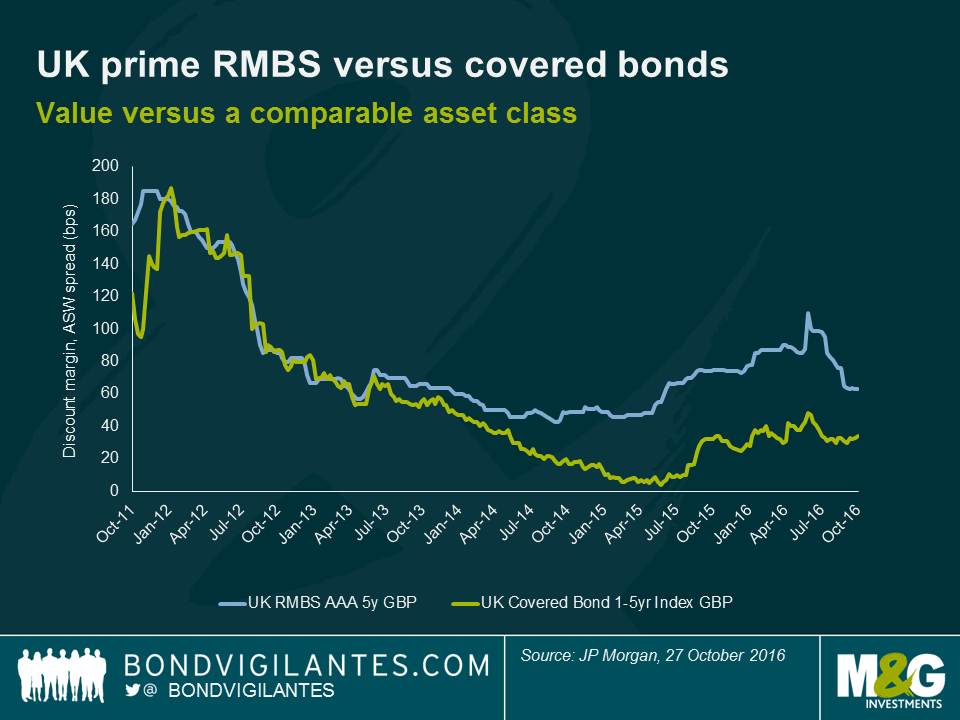

When it comes to spread levels, the RMBS sector continues to look attractive when compared to corporates. At the top end of the market, AAA rated bonds backed by UK prime mortgages (standard loans that high street banks provide) offer around a 30bp premium to covered bonds of similar maturities, even though these are backed by practically the same collateral.

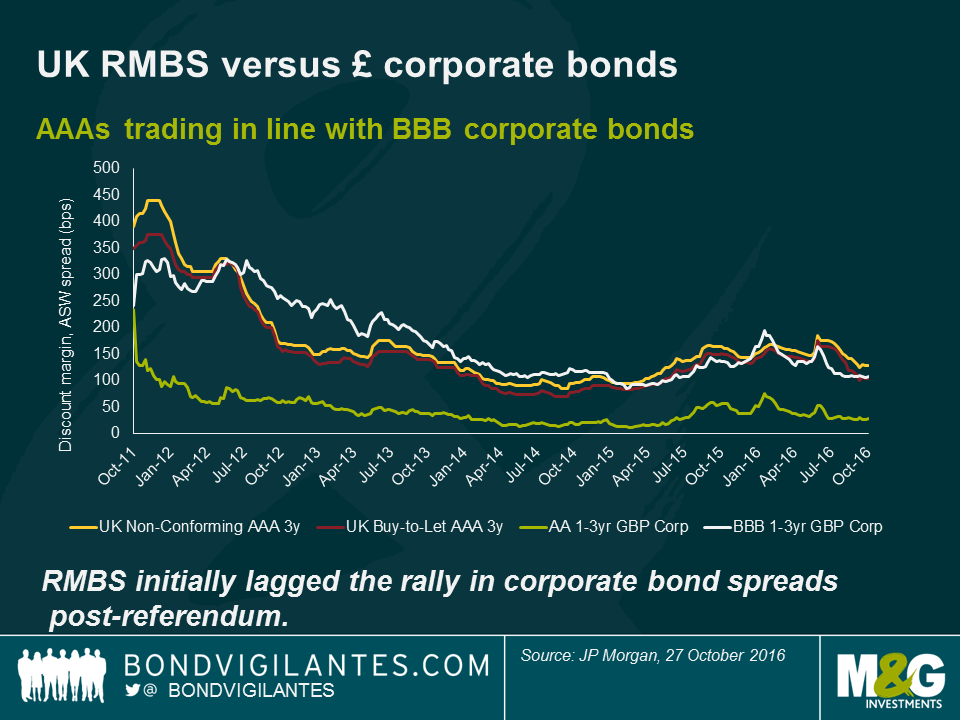

The non-conforming and buy-to-let (NC & BTL) sectors are riskier due to the profile of the underlying borrowers, and so offer a higher credit spread. Even after the recent rally in RMBS however, the spreads on AAA rated NC and BTL bonds continue to trade closer to BBB corporate spreads than those of bonds with a similar rating (we’ve used AA’s in the chart below due to the scarcity of AAA corps).

We are mindful that some of this extra spread may be attributed to a relative illiquidity premium (it would be remiss not to acknowledge that these RMBS bonds can be less liquid than comparable corporate bonds), but they are far from being untradeable. Liquidity is however something to keep an eye on, particularly given the expected lower net issuance going forwards, which leads nicely on to the third point.

- Supply and demand dynamics

There has been markedly less supply of UK RMBS since the inception of Bank of England’s Term Funding Scheme (TFS), which allows banks to borrow close to the 0.25% base rate to fund lending to the real economy. One long-time issuer has explicitly announced that they will no longer be issuing RMBS as it makes less economic sense for them to do so. Instead, they prefer to use the TFS for their funding needs. Something similar is happening in the Eurozone with the ECB’s TLTRO diminishing a comparable pool of European assets.

On the demand side, the ECB is having an influence on the market by buying RMBS as part of its QE program. This has resulted in a tightening of spreads of both the bonds they are buying and those that they aren’t as investors move into other areas of the market. As yet, the Bank of England hasn’t been buying the asset class as part of its own QE program, but it is currently buying corporates. It’s perhaps therefore not a huge leap to imagine the BoE’s list of eligible assets widening to include RMBS, if they feel more monetary easing is necessary. A further source of demand for UK RMBS has come from large institutional investors entering the market in recent times, presumably to take advantage of the relatively wider spreads and the strong credit quality.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox