Research trip: Mexico & Trump – a key call in emerging markets

President Trump’s anti-Mexico rhetoric has made Mexican assets one of the key calls in emerging market debt. I have just returned from a research trip to Mexico where I met with local economists, analysts, and corporate bond issuers. Below are a number of observations from my time there.

Donald Trump won the election on a fairly protectionist rhetoric – with a special focus on Mexico – and the pressure to fulfil electoral promises (unlike most seasoned politicians) is therefore likely to see the implementation of some of the things he has proposed. Whilst the intentions are clear, the measures that he will implement to satisfy his electorate are more uncertain. Despite the symbolic nature, building a wall at the Southern border of the US would have a limited impact on the Mexican economy. However, other policies that Trump supports may have a significant impact on the economy and asset prices:

(i) Border adjustment: Trump has promised fiscal reform with US corporate tax being lowered to between 15% to 20%, from 35%. The new corporate tax could be based on the location of consumption, meaning imports would be taxed at 15% to 20% while exports would see a full or partial exemption in tax. Trump seems to prefer pure tariffs between trading partners, rather than allow this discrepancy on the application of the new corporate tax rate to occur.

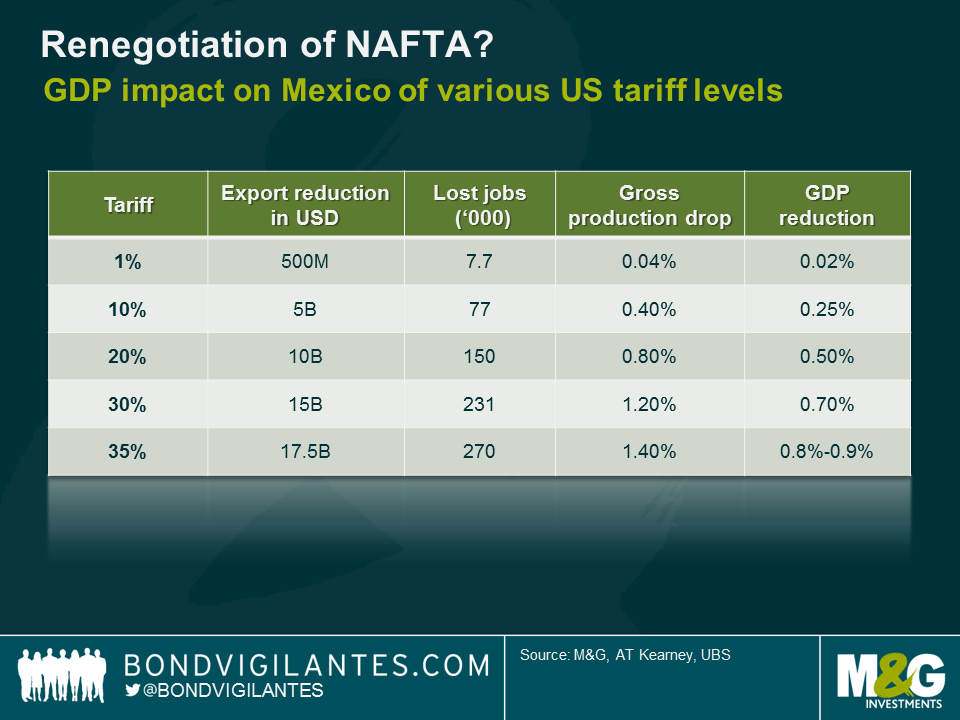

(ii) Tariffs: Mexico’s exports to the US account for 80% of the country’s total exports. Goods and services traded under the North American Free Trade Agreement (NAFTA) account for approximately 25% of GDP. Under NAFTA, there are no tariffs for exporting qualifying goods to the US. Putting in place any sort of tariffs would mechanically hit hard the Mexican manufacturing industry and in particular the auto-part sector. As can be seen in the below chart, a 35% tariff would result in a c. 0.8% to 0.9% reduction in Mexico’s GDP – just as a primary effect, i.e. without considering the collateral damages such as investment, consumption, etc. Given that Mexico is expected to grow at between 1 to 2% this year a 35% tariff could lead to a recession. At 35%, however, this level of tariff would imply a breach of the NAFTA and the US exiting the World Trade Organisation.

(iii) Taxing remittances: Cash sent by legal and illegal Mexican immigrants from the US to Mexico accounts for 2% of GDP. Trump has threatened to tax and block money transfers. A vast majority of people I met in Mexico think this measure is unrealistic because it presents many constitutional issues for the US and immigrants will always find a way to send money (e.g. through friends).

(iv) Other measures such as security and sanitary trade barriers: these non-tariff measures, which don’t require Congress approval, would most affect sectors such as Mexican agricultural products.

Unfortunately for Mexican government officials, their negotiating position is weak. Mexican officials have reportedly been sitting around the table with the Trump cabinet for weeks, if not months. The Mexican government has been moving key personnel around in order to attempt to get the best deal with the US that it can. The Mexican Finance Minister, Luis Videgaray, who invited Trump to Mexico in September, has now become Mexico’s Foreign Affairs Minister (mainly because of his good relationship with the new US President).

The problem is that Mexico has few levers to pull around the negotiation table. For example, threatening to open the country’s Southern border with Guatemala and let all immigrants go to the US appears unsustainable because obviously Mexico itself would not enjoy massive immigration from the other Central American countries. However, the argument that the economy of Texas – a large exporter to Mexico with more than 1 million jobs linked to exports – would suffer in a trade war could play in favour of Mexico given the large number of Republicans in Texas.

In my view, the most relevant argument is the mutual economic dependency between Canada, the US and Mexico, created by NAFTA. The auto industry, the most at risk from a NAFTA revision, is for instance highly integrated. The day after 9/11, the US closed their border with Canada for obvious security purposes. On 12th September 2001, not a single car was produced in Detroit. This is because the supply chain is highly integrated, and US original equipment manufacturers (OEM) in Detroit are reliant on auto-parts supply from Canada. Furthermore, having talked to auto-part manufacturers during my visit to Mexico, many have manufacturing platforms with an average lifespan of seven to eight years. This compares to a Presidential mandate of four years (or eight at best). US companies like General Motors or Ford are unlikely to abruptly interrupt existing contracts which involved prior investments. Likewise, a major increase in tariffs would result in Mexican companies passing through the cost on to US OEMs. Therefore, the US implementation of a 35% tariff is highly unlikely because US consumers would feel the pain very quickly when buying a new car. What OEMs and other US companies might well do is to suspend/cancel future investment plans. Early January, Ford cancelled a US$1.6 billion investment in a new plant in Mexico. Ford mentioned they would instead invest $700m into their existing facility in Michigan.

Looking at the bigger picture, it will certainly be a year of noise for Mexico. Noise (and tweets!) will bring uncertainty and uncertainty will almost inevitably adversely impact investments. Foreign direct investments (FDI) amounted to about $25bn last year and are now expected to drop significantly in 2017 as a result of the uncertainty surrounding the US protectionist rhetoric and NAFTA. Between 2008 and 2015, Mexico’s current account deficit was covered by FDI. Even though the deficit is not foreseen to increase, lower FDI pose the problem of how Mexico is going to finance its current account deficit going forward. Secondary effects of lower investment on unemployment and domestic consumption may also amplify the deterioration of the country’s credit profile. Add to the above potential outflows from local-currency government bonds (70%-owned by foreigners) and the picture looks increasingly grim.

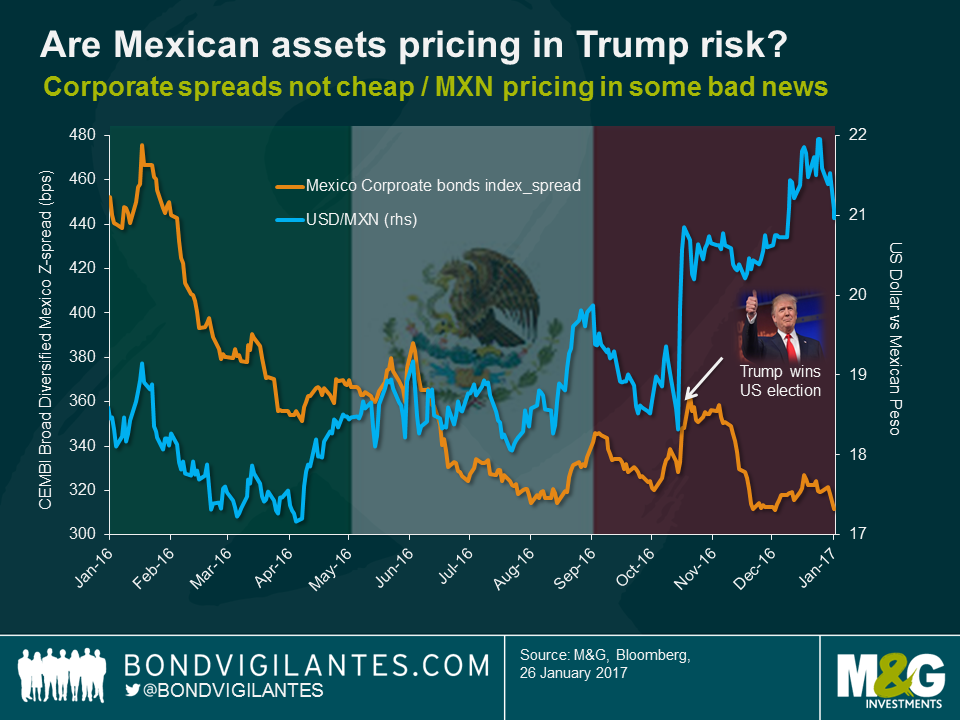

In light of this backdrop, what’s priced in to current investment markets? The answer is almost nothing in the US dollar corporate bond market. As can be seen in the chart below, bond spreads of Mexican corporate issuers trade at around 300bps currently, down 10bps from the pre-US election level. Of course, some sectors such as tourism benefit from a weaker Peso but on the other hand a lot of companies, such as in the telecom sector, suffer from currency depreciation. As for the manufacturing and consumer sectors, they are highly dependent on the NAFTA and the reward in bond spreads does not reflect the risk of tariffs being put in place. If anything, bond spreads are already pricing in the upside of higher potential US growth driving increased trades with Mexico. Personally, I don’t share this optimism.

There is likely more value in the Mexican Peso which is pricing in quite a bit of bad news already. Is it pricing in a 35% tariff? Certainly not. But the currency has sold off versus the US dollar by more than 15% since the US election in November and, by making the Mexican economy more competitive for exports, seems to incorporate some degree of revision of NAFTA which is a sensible scenario.

From a global market perspective, how the new US administration reshapes its relationship with Mexico in the near future might well set the tone for even bigger matters – in particular the US relationship with China – making the Trump-Mexico trade a key call for most global investors.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox