CPI wHat?

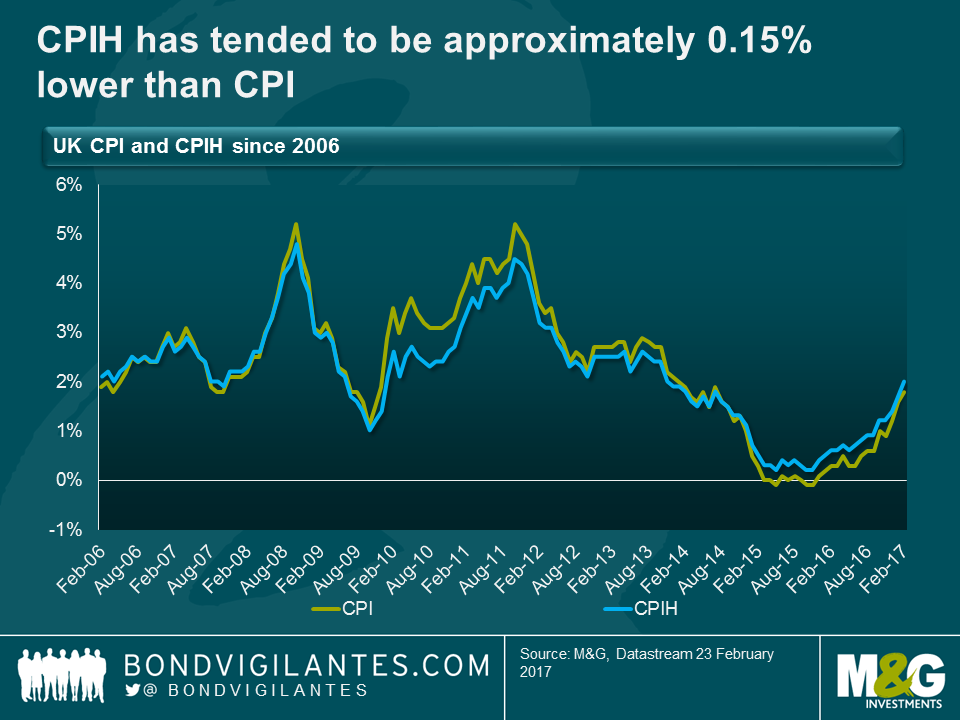

In the UK, as of next month the official measure of consumer prices will become CPIH, with the H standing for housing. As at today, the only difference between CPI and CPIH is the inclusion of owner-occupied housing in the latter, on a rental equivalence basis (“how much would it cost to rent the home I own?”, a similar measure to the Owners’ Equivalent Rent component of US CPI), which has a weight of around 16%. So when rental inflation runs below CPI (as it did in 2009 and 2010), CPIH will tend to be lower than CPI, and vice versa. Recently, given the greater weighting of the residual (i.e. non-rent) items in CPI, falling food and energy items have had a larger downward impact on CPI than on CPIH. Interestingly though, over the longer-term, CPIH has tended to be approximately 0.15% lower than CPI.

The different long – and short – term dynamics of the two indices has some interesting policy ramifications. Given that CPIH is now the preferred measure of consumer price inflation, it may well have future implications for the Bank of England’s price stability mandate (though it won’t automatically become the Bank’s target, the Chancellor could change this), as well as for the indexation of pensions and state benefits, and potentially for CPIH-linked gilt issuance. Remember that in the 2011 consultation on CPI linked gilts, one of the main objections to acceptance of such a programme was the uncertainty about CPI’s suitability given the lack of housing in the index. RPI, the measure on which existing UK index-linked gilts pay interest, does include a measure of housing cost (via a “depreciation” element and mortgage interest payments).

Over the long term, with CPIH expected to be circa 0.15% below CPI, one could argue that the BoE will find UK inflation (CPIH) even further below its desired 2% target (it’s unlikely, but not impossible that the inflation target would be lowered from 2% to 1.85% to reflect the typical wedge between the two measures). This might enable rates to stay lower for longer, or additional QE to be justified. A more hawkish reading might point to the UK’s housing scarcity and current pressures in the rental market as putting persistent upward pressure on CPIH, although perhaps surprisingly given the media coverage of the problems faced by Generation Rent, the official rental inflation number fell at the end of 2016 to equal its lowest reading since the series began in 1997, with year on year growth of just 1%.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox