Canada’s increasingly divergent rate path

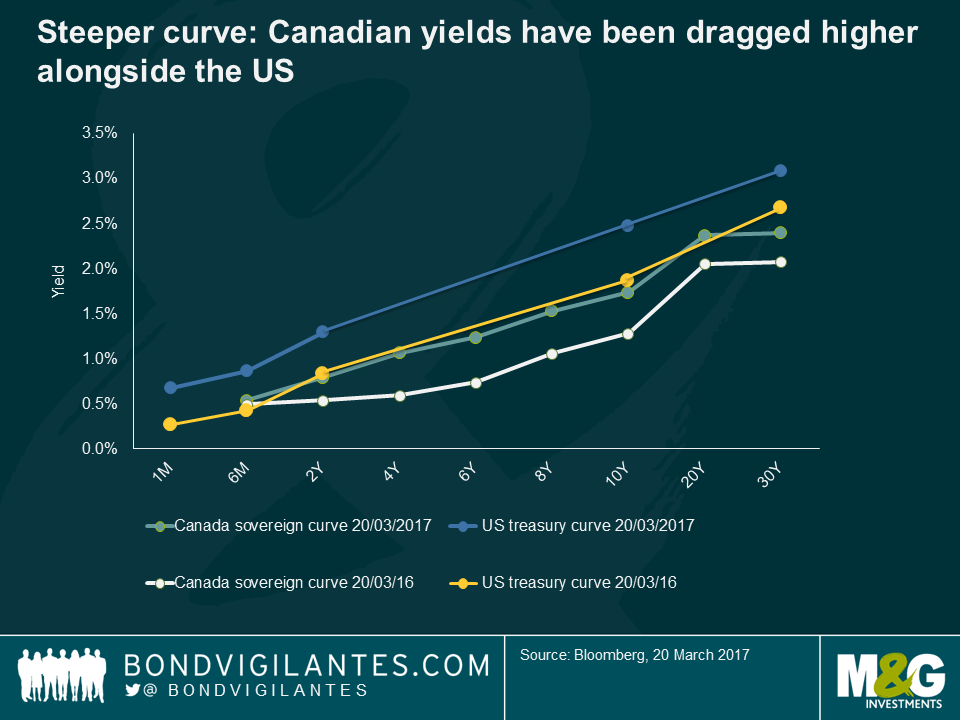

Yields on Canadian sovereign bonds have been dragged higher in recent months, with the yield on the 10-year bond recently reaching 2 year highs. This sell-off appears to reflect the US reflation narrative, rather than the economic fundamentals of the Canadian economy.

The market currently thinks the Bank of Canada will remain on hold throughout 2017, pricing in only one rate hike – a 20 basis point move – in 2018. The stance of the BoC, much like the ECB, BoE and BoJ appears increasingly at odds with the outlook for US monetary policy.

Unlike the US however, with the unemployment rate at 6.9%, this remains elevated compared to the pre-crisis years and the BoC continues to highlight the level of slack which remains in the labour market. Although headline inflation has picked up in recent months, this was downplayed by the BoC at its latest meeting, with wage growth remaining sluggish and aggregate hours worked weak.

Though the market is leaning towards pricing in a rate hike, there are a few key downside risks to this view.

Firstly, oil. The fall in the oil price detracted from Canada’s GDP growth in both 2015 and 2016 and the recent leg lower could potentially provide an ongoing headwind. Hearteningly, analysis from RBC suggests that oil is less of a concern today insofar that the price would have to drop below $25 before companies started to shut their operations. However, a price above $70 would be required for brownfield investment and above $100 for any significant greenfield investment – a significant hurdle.

Secondly, the strength of the domestic economy is an obvious concern for policymakers. The aforementioned labour market slack alongside disappointing non-energy export and lacklustre investment growth remains an area to watch (though the previous $11bn of fiscal expansion in infrastructure spending has fallen rather flat, as take up for funding new projects has been disappointing). Other noteworthy factors include a housing market where prices continue to surge nationally (particularly in Toronto) and the increasing indebtedness of consumers (as RBC pointed out, non-mortgage credit market debt to personal disposable income ratio reached a new high of 167.3% in Q4).

Finally, and perhaps most significantly, U.S. economic policy will have a significant impact on the Canadian economy. If trade tensions heighten, or the U.S. were to implement or make inroads with respect to a border adjustment tax to fund consumer tax cuts, the terms of trade shock could detrimentally affect the Canadian outlook. On the other hand, the U.S. administration’s fiscal plans remain unclear, and any fiscal boost to the U.S. economy could have a positive spill over effect on the Canadian economy.

As it stands, it is difficult to argue with implied market rates – Canadian monetary policy will likely remain stagnant, creating a larger gulf between US and Canadian policy. Over the longer term however, risks to the downside for the Canadian economy are not yet dissipating, so it’s just as likely that the next move in interest rates could be a cut. As such, a bullish view on Canadian government bonds and a bearish view on the currency is perhaps warranted.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox