Five years on from “whatever it takes”

Today marks five years on from Mario Draghi’s now famous ‘whatever it takes’ remarks, widely credited with sparking a reversal in the Eurozone’s fortunes.

Below are five charts offering some insights into the European Central Bank’s successes and failures in the ensuing period, as well as some of the challenges that remain.

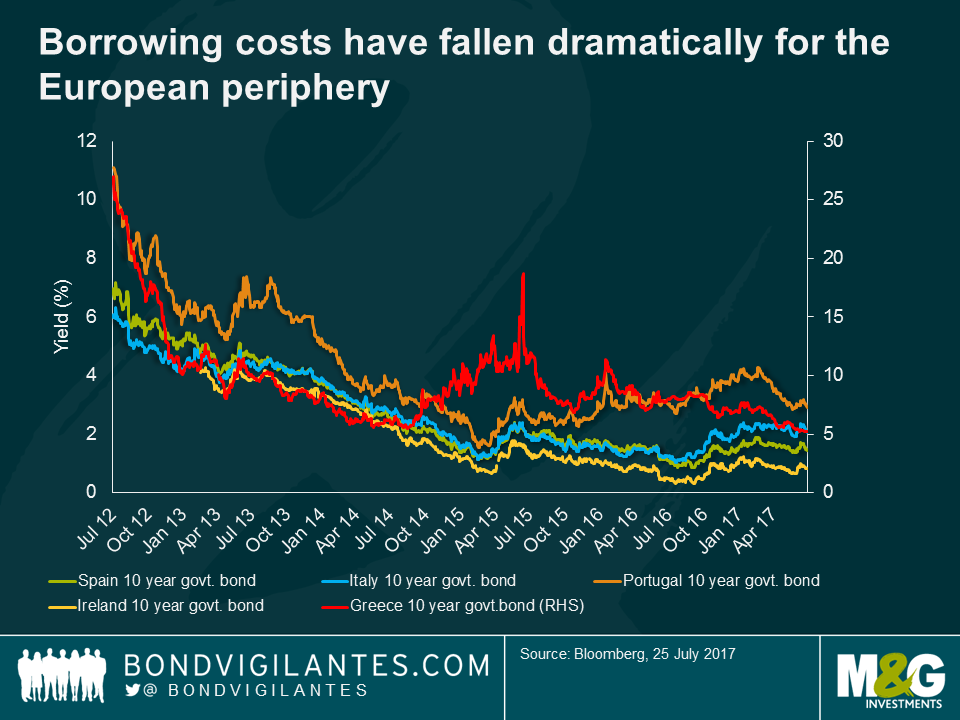

- Funding costs in the periphery

Five years ago, funding costs for the periphery had climbed to unsustainable levels. Spanish ten year debt traded at 7.5%, Italy at 7%, Portugal at 11% and Greece a whopping 27%. In part this reflected the redenomination risk into local currency. Finally acting as the lender of last resort, the ECB significantly decreased this risk, reopened market access for the likes of Spain and Italy and with it lowered their implied cost of funding. Over time (some) structural reforms, further monetary easing and improved growth has seen funding costs fall towards, and in some cases below current growth rates, offering a real prospect of debt sustainability for these economies. Greece’s return to market completes an astonishing recovery in fortunes.

- Growth

Ultra-loose monetary policy penalised saving, reduced debt servicing costs and encouraged investors to take on risks. This has served as a backdrop for improved consumer sentiment, higher asset prices and a pick-up in consumption. The Eurozone has surprised recently as the global outperformer growing well above potential. Yesterday’s record print for the German IFO suggests growth may be tracking around 3% in H2 2017.

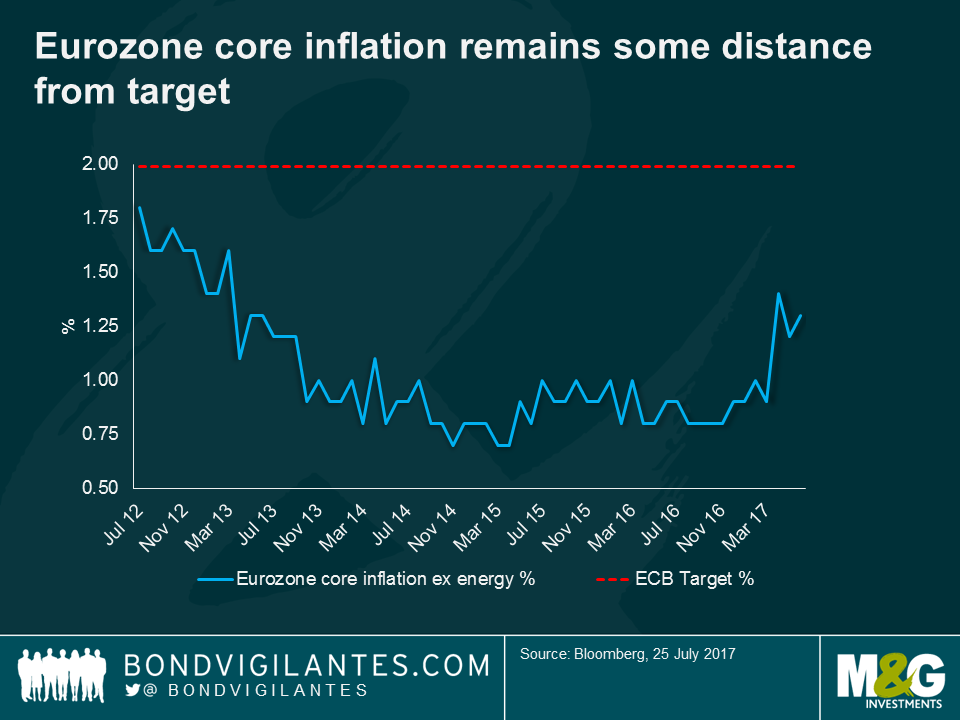

- Inflation

Despite the stabilisation seen in the Eurozone, lower borrowing costs and a generally improved economic outlook, the ECB continues to miss its inflation target. This has proven problematic given the ECB’s sole target is to deliver inflation of close to but below 2%. Whilst there are signs that inflation is trending back towards the Bank’s definition of price stability it has been very slow in the making. Any tightening of policy will likely be a protracted affair.

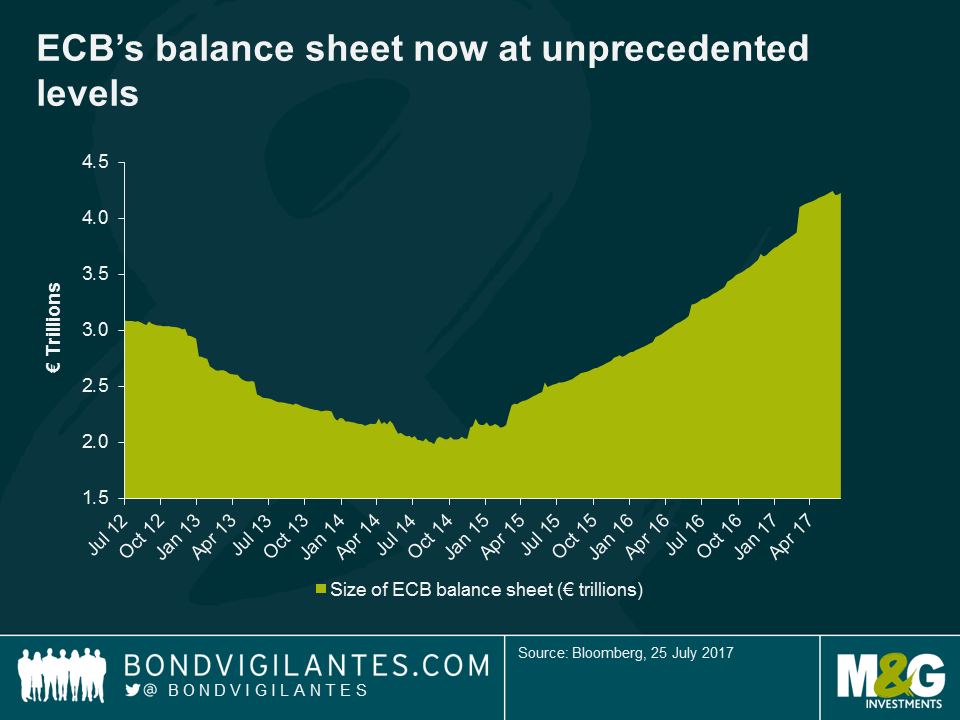

- Balance sheet

Having taken the refi-rate below the ‘zero-bound’ in 2014 the ECB still found itself facing the risk of a self-reinforcing deflationary spiral. Ultimately the Bank followed other central banks announcing in Jan 2015 that it would inject €1.1 trillion via bond purchases through to September 2016. The problem? Despite the significant expansion of its balance sheet the ECB was forced to extend its quantitative easing programme both in terms of length and to include corporate bonds. It now sits above a whopping €4 trillion. Draghi has since gone to lengths to stress that any tightening of monetary policy will be done in a gradual fashion. But there are clearly some on the Governing Council who worry about the negative consequences of an ever expanding balance sheet, the implications for the banking system, the Eurozone’s ‘addiction’ to debt and consequently the ECB’s ability to exit its ultra-loose stance.

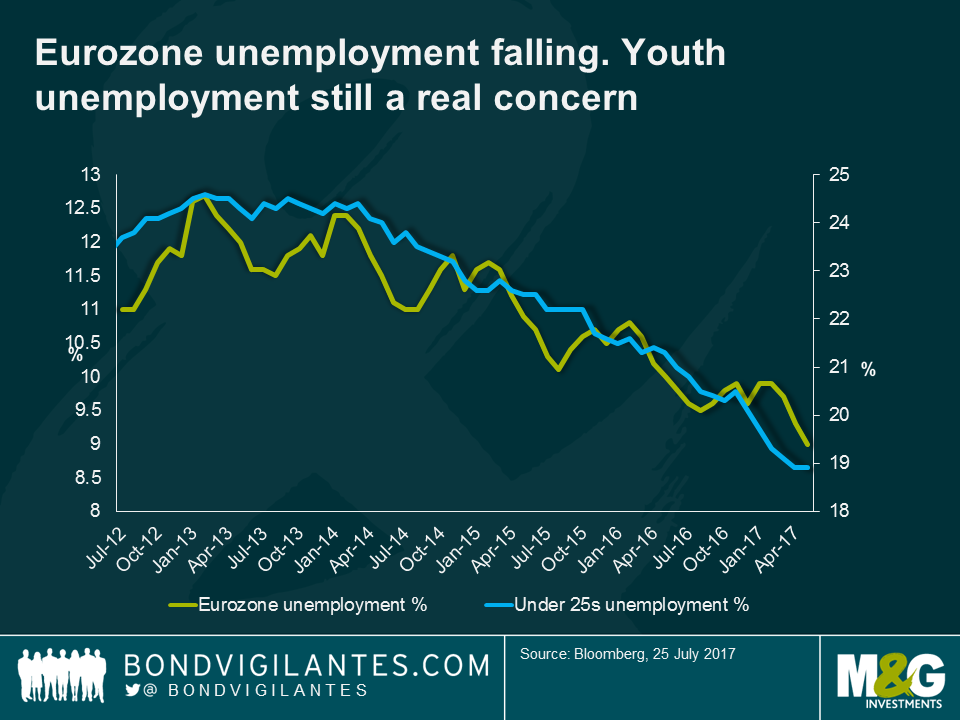

- Politics (unemployment)

Whilst populism appeared to be sweeping across the developed world, the outcomes in the Dutch and French elections suggest that the Eurozone may have taken a different approach. However Italy’s lagging economic performance and a general election in 2018 offer the potential for an upset. Although levels of unemployment in the Eurozone have come down somewhat they remain elevated, especially amongst the younger cohorts.

Doomsday predictions claiming the beginning of the end for the Eurozone were two a penny back in 2012. Investors and economists queued up to argue that the single currency would not hold. Either peripheral countries would be forced out or the core would walk away so went the argument. Despite all the speculation, no country has left the Eurozone and markets currently appear much less concerned. This is perhaps the single most important measure upon which to judge the effectiveness of ECB policy over the past five years.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox