Economic surprise indices highlight bulls in the US and bears in Europe

Another month has drawn to an end, which presents a good opportunity to take stock and review recent events and Bloomberg’s surprise monitors – true to their name – have provided some unexpected results in August.

1) UK: back in the green, surprising to the upside once again

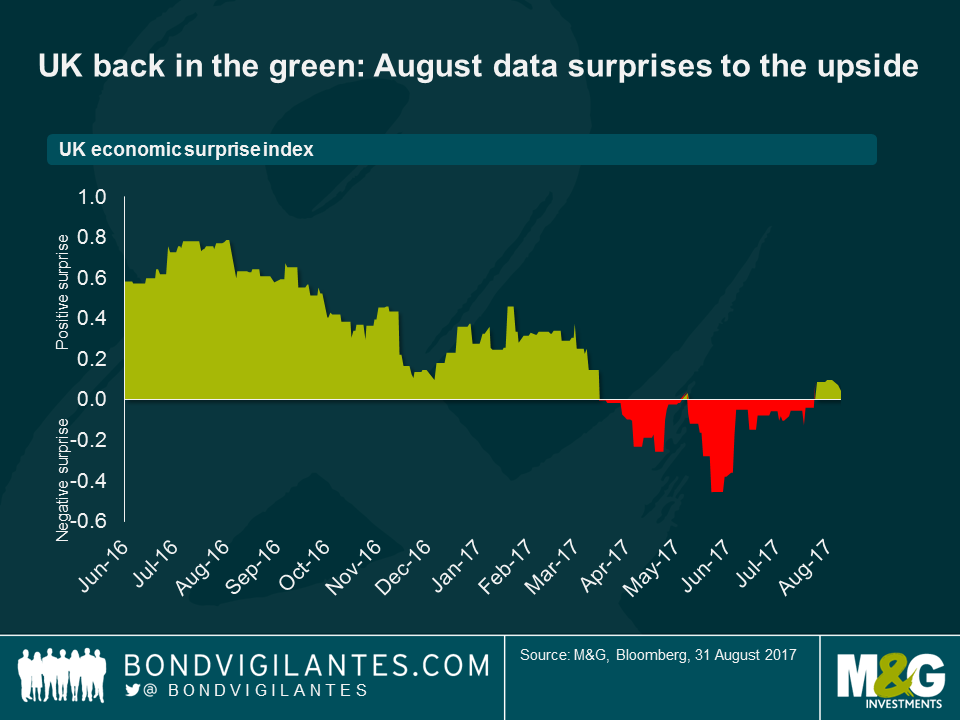

Economic analysts appear to have been too pessimistic in August, suggesting that perhaps too much doom and gloom has been priced into the UK rates market.

Given the Brexit backdrop, I’ve been pessimistic on the economic outlook for the UK, which is in-line with many economists’ thinking (in fact, since the EU Referendum, I’ve not met with a single research house that is bullish or in the least bit optimistic). Although the economic data for the UK held up well into the 2016 year end, this has since rolled over with consumer readings a particular concern. Earnings growth remains subdued, retail sales are trending downwards and the YouGov/Cebr consumer confidence survey recently indicated that consumer perceptions of household finances deteriorated for the fifth consecutive month (the longest negative trend since records began 8 years ago).

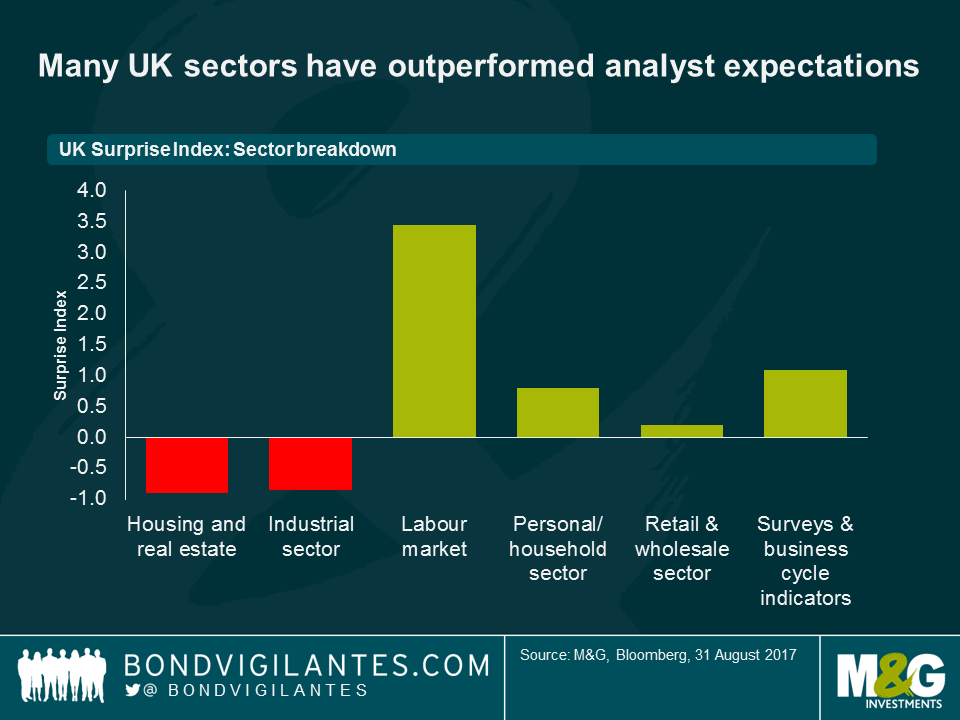

Despite these outcomes, the ingrained low expectations mean that the UK economic data has managed to outperform the low base of expectations. Bloomberg’s surprise indices monitor economic analysts’ expectations and indicate where the underlying business cycle under or overshoots their forecasts. As you can see below, many sectors – particularly the labour market – surprised to the upside in August.

What’s interesting is the effect that this has had on the overall index, where the aggregate UK surprise index moved back into the green in August. This indicates that the economy has outperformed economist expectations, after a run of data surprises to the downside since April of this year. If this trend continues with economic forecasts continuing to underestimate the UK, we could see rates sell off on individual data releases, as market participants start to price in the surprisingly robust fundamentals.

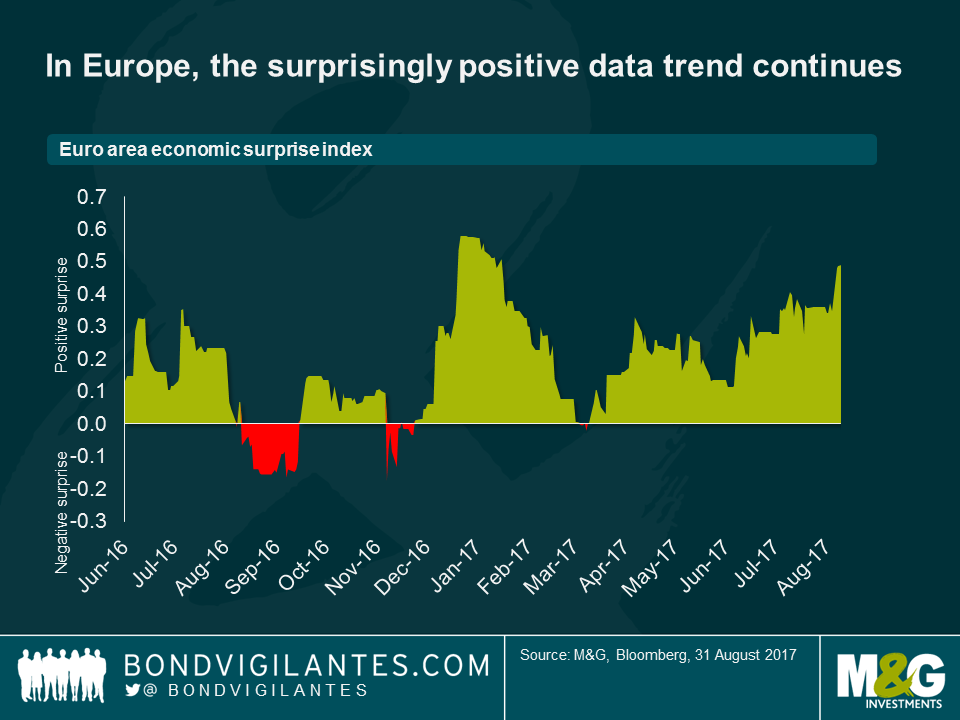

2) Euro Area: the surprisingly positive trend continues

In contrast to the UK, Europe has exhibited an upward trend of positive data surprises over the same time period (i.e. post the EU referendum), with the retail sector and business surveys the main drivers of late. The consistency in positive surprises indicates that economists have perhaps been too cautious in forecasting the Euro area recovery, in line with Draghi’s careful dovish messaging. After this strong run of data releases, if economists were to turn more bullish from here, I would expect to see core Euro area rates sell off, reflecting the improvement in the underlying economy and expectation of more imminent policy normalisation from the ECB.

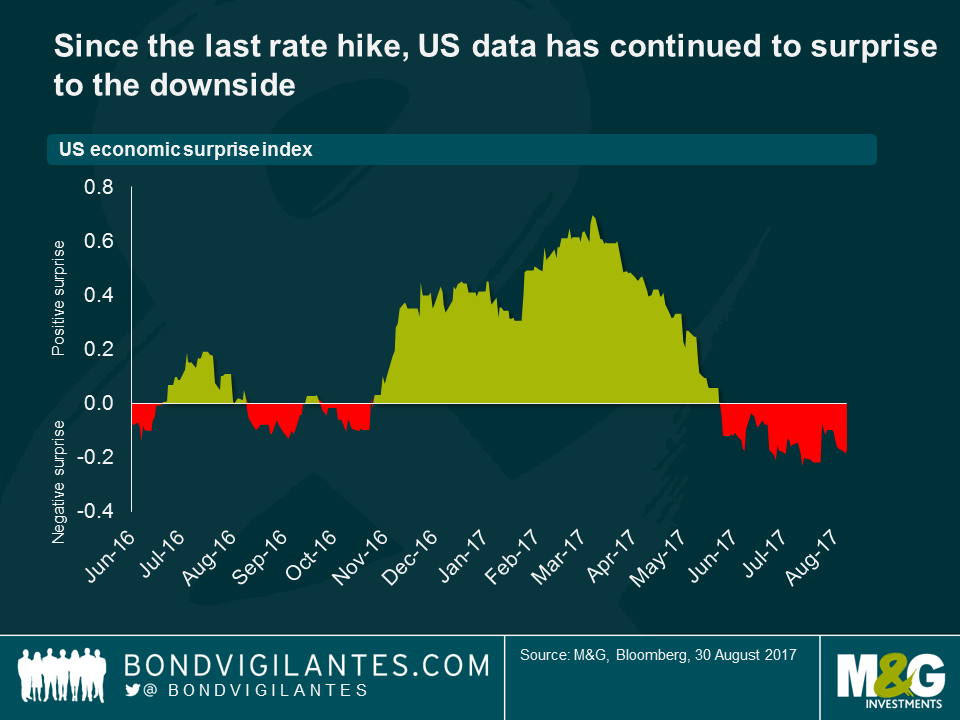

3) US: Consistently surprising to the downside since the last hike

What’s surprising about the US, is that since the FOMC’s last rate hike in mid-June, the data from the underlying economy has constantly undershot analysts’ bullish forecasts. This is in contrast to the previous two hikes in December 2016 and March 2017 where data continued to surprise to the upside for months afterwards. That’s not to say that the underlying economy is slowing down (Q2 GDP was revised up from 2.6% to 3% at the end of August, driven by solid momentum in domestic demand with both the consumption and investment contributions increasing. Retail sales also surprised to the upside etc.), but rather that analysts have been supremely optimistic on the data front.

What’s clear from these charts is that most recently, economists have been too bearish on the UK and Euro area, but too bullish on the US. This does not bode particularly well for those advocating an aggressive rate hiking path from the FOMC. Indeed, the underwhelming data in the US has been reflected in market expectations for Fed rate hikes, with 60 basis points of rate hikes priced out from the Fed Funds curve (over the next 3 years). The pessimistic view on the Euro area, however, arguably makes it a tad easier for the ECB to follow its slow and gentle plan towards policy normalisation, as forecasters are similarly reticent about being too bullish too soon. In the UK, this has made me ponder the Bank of England’s policy rate. The “emergency rate cut” of August 2016 to 0.25% could be reversed should this trend continue (there already are a couple of hawks in the MPC), though this is certainly not what most economists are expecting.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox