What do global government bond indices look like in a QE adjusted world?

Richard recently wrote about how government bond indices should be adjusted to account for quantitative easing (QE) purchases, thereby better reflecting the actual availability of investments in the market. A key argument indicated that given the absence of this adjustment, European government indices are incorrectly skewed towards more highly rated sovereigns, even though their issuance is not freely available to purchase.

I have expanded on this work to assess this idea on a global scale using the ICE Bank of America Merrill Lynch Global Government Bond index (i.e. reweighting the index to adjust for the QE undertaken in Europe, the US, UK and Japan). Though the premise remains the same – i.e. that bond indices should look different in a QE adjusted world – the impact at the global level differs from the European analysis in two key ways.

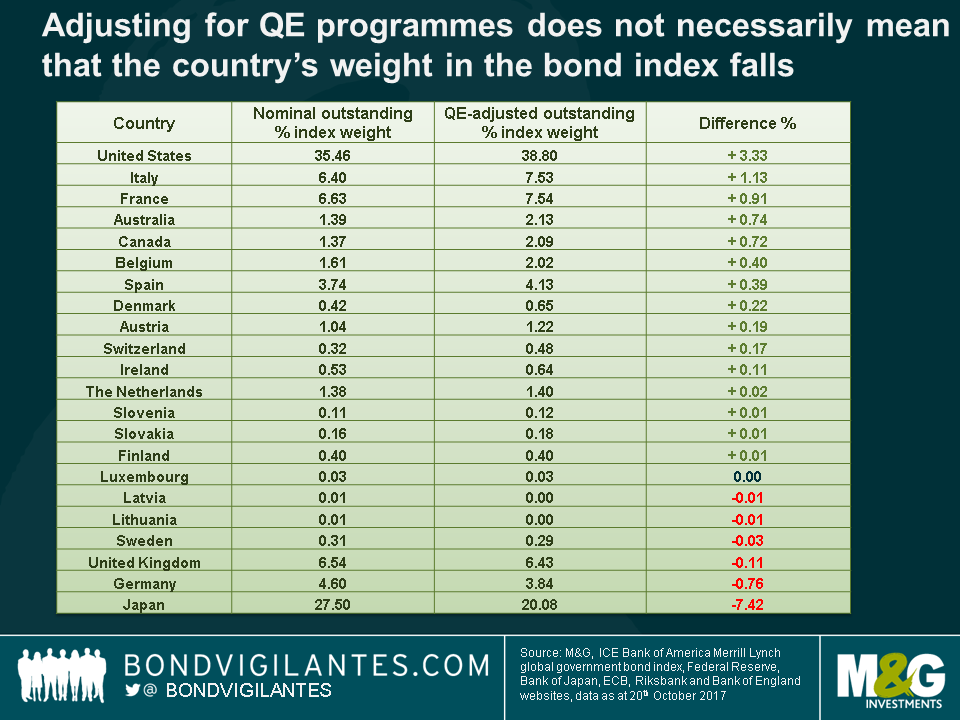

- Adjusting for large QE programs does not necessarily mean that the country’s weight in the bond index falls

Broadly speaking, I had anticipated that countries which had undergone QE would see their weights in the index reduced, while other country weights (i.e. those which did not do QE) would rise. Looking at the table below, though this was indeed the case for countries where central banks continue to undertake wide-scale QE (e.g. Japan, Germany, Sweden) or where this has been conducted previously (e.g. in the UK, most recently after the EU referendum), I did not expect the change at the top of the table where the US has increased its weight by 3.33%.

Though the US has itself completed $2.5tn worth of government bond QE, this is dwarfed by the ¥400tn (approx. $3.5tn as at 20th October) worth of ongoing QE conducted by the Bank of Japan. Adjusting the index for the free-float of government bonds, Japan – the second largest weight in the index, but the country with the largest QE program – sees its available investment universe fall considerably and hence its index share is reduced from 27% to 20%. On the other hand, though the US investment universe has also decreased, its outstanding issuance remains large. As a result, the US manages to retain its proportional top spot in the index, increasing its weight from 36% to 39%.

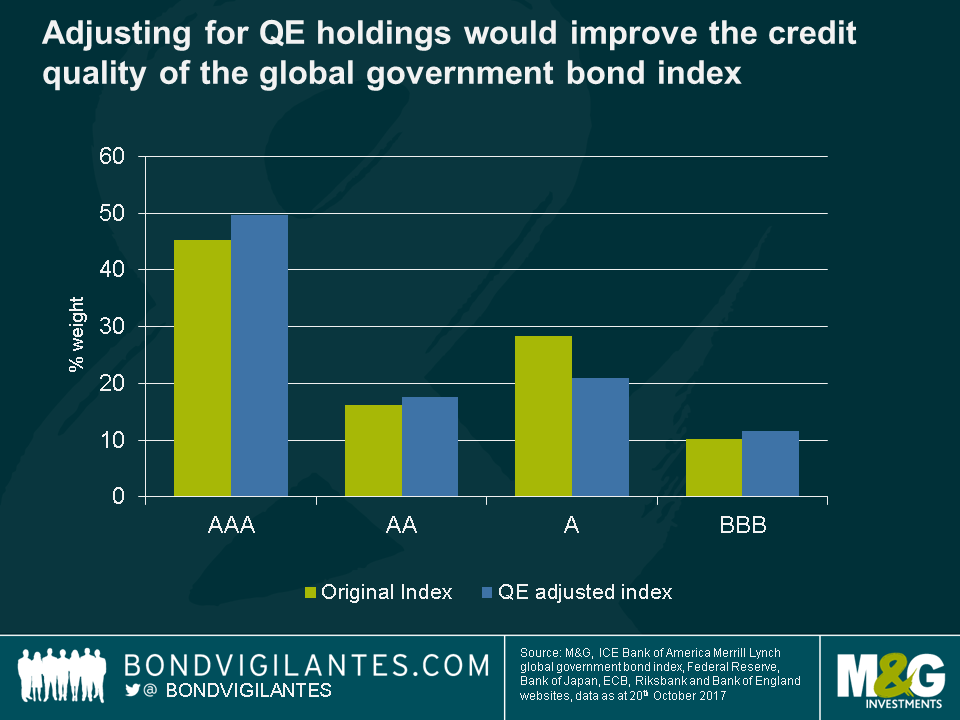

- Adjusting for QE on a global scale would improve the credit quality of the index

In the previous European focused blog, we showed that adjusting for QE causes higher rated countries like Germany to lose weighting in the index to lower rated countries such as Italy and France. This trend does persist at the global level, but the aforementioned reduction in Japanese holdings has a secondary meaningful impact. Since Japanese government bonds are rated A, the reweighting away from this country towards others such as the US, Australia, Canada which are more highly rated, means that the overall index actually improves in credit quality (67% rated AAA or AA, compared to 62% previously). This is in contrast to the European index where the credit quality deteriorates.

This analysis has interesting practical implications. We argued previously that tracker funds, following European indices that are not QE adjusted, are potentially driving up European government bond prices (i.e. being forced buyers in an environment with reduced free-floats). Although the same case could be made for Japanese government bonds, US Treasuries are arguably under bought.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox