Emerging markets debt: 2017 post-mortem and 2018 outlook

Emerging markets debt posted strong returns in 2017, driven by the stabilisation of fundamentals, ongoing global and EM economic recovery, a small rebound in commodity prices and a geopolitical environment in which the usual suspects (Trump, North Korea, China) have behaved in a more benign fashion thus far. One had to struggle to find an asset that produced negative returns and the only two that did, Venezuela and Turkish local bonds, reflected very different idiosyncratic factors.

Here is a recap of what happened last year and some views for the year ahead:

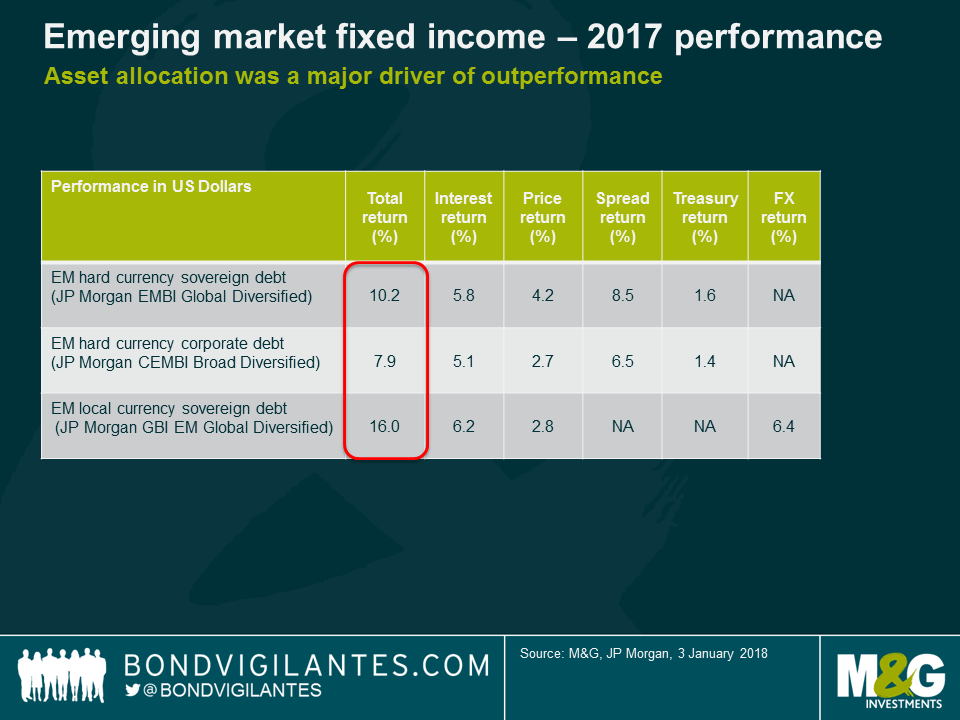

- Asset allocation was a driver of performance

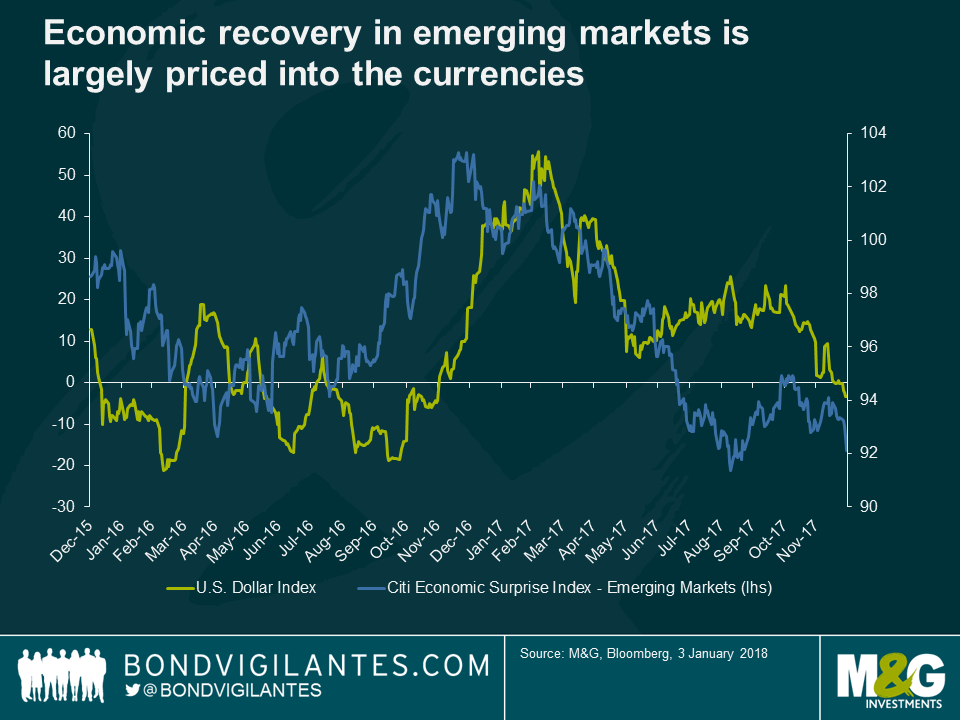

The US Dollar peaked exactly at the beginning of the year, which allowed EM local currencies to perform well. Developed currencies also posted strong returns versus the US Dollar, particularly the Euro, as the market priced out a more hawkish Fed and a stronger fiscal stimulus in the US and the continuation of a broad based recovery in Eurozone growth. This, combined with a small uptick in commodity prices and disinflation in many EM countries, allowed most currencies to rally versus the US Dollar, though many did not outperform the Euro.

For 2018, local markets may still outperform external debt given relative valuations on both, but I expect lower returns in 2018 as a fair amount of good news has been priced into EM assets. The chart above shows that economic data surprises in EM are moderating, meaning that the uplift in growth that we have been highlighting for over a year may be mostly priced in by now. Additionally, the disinflation we have seen in several EM countries in 2017 (Brazil, Russia, Colombia, etc.) is unlikely to extend into 2018 as the base effects fade away and the bulk of policy rate easing in EM is behind us. Finally, should the Fed prove to be behind the curve (2-3 hikes are currently priced in for 2018), this is not yet priced in and would provide support for the US Dollar.

EM corporates underperformed, partly due to their lower duration than EM sovereigns but also due to their increasing investment grade component, which will normally underperform in a rally. Chinese investment grade credits continued growing in importance due to strong supply and demand from onshore investors.

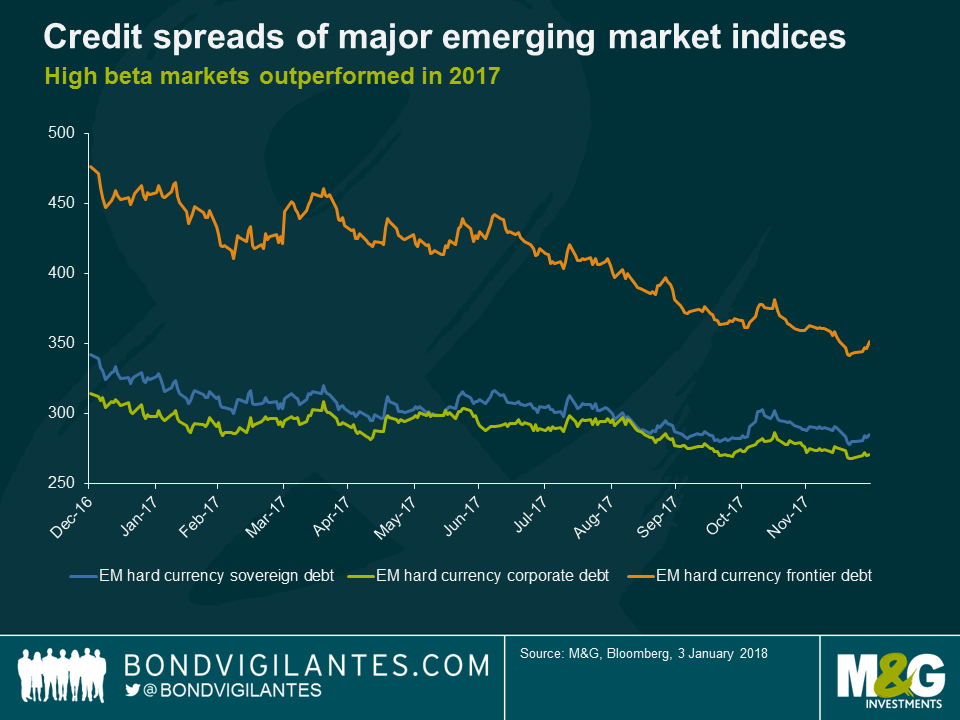

- In the hard currency space, higher beta countries outperformed

The higher beta countries outperformed and the performance of their proxy, the EM frontier index, returned 15.7%, pretty much in line with the returns on local market bonds. With the exception of distressed credits (Belize on the upside and Venezuela on the downside), returns were often similar for countries whose fundamentals are improving (e.g. Egypt or Jamaica), as well as the ones that are deteriorating (e.g. Tunisia or Costa Rica).

This reflects some indiscriminate hunt for yield and beta and the need to remain invested, as inflows into the asset class have persisted through the year. A few elections (Mexico, Brazil being the most pertinent) will shape the direction of those countries that happen to be at a critical juncture.

Looking ahead into 2018, this may still continue as long as the inflows remain steady, but I expect to see more differentiation of returns given that we are starting from tighter valuations. In other words, beta will still be an important call in 2018, but alpha should become more relevant again after a relatively muted 2017.

The strong returns we saw in 2017 are unlikely to be repeated in 2018. However, should the tail-risks (US economic policy and the Fed, China, geopolitical risks and EM elections, etc.) remain on the backburner and volatility remain contained, the EM carry of 5.5-6.5% is not too shabby, especially considering the investment alternatives in other parts of global fixed income.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox