Panoramic Weekly: Keep calm and ‘gradually’ hike

After a turbulent start to the month, the second half of August has turned out to be a much calmer period for financial markets. While geopolitical tensions have not gone away, investor sentiment is currently being well-supported by the favourable economic outlook in the US, coupled with the prospect of a continued period of low interest rates. Global equity and credit markets produced further steady gains over the week, with several of the major US equity indices hitting all-time highs.

Jerome Powell’s first speech as Fed chair at the annual Jackson Hole symposium was arguably the standout event of an otherwise quiet week. The key message was the expectation of ‘further gradual’ interest rate rises as the US economy continues to strengthen. However, the new Fed chair also emphasised the lack of inflationary pressures and noted that he saw little sign that the economy was overheating. This was interpreted by some as a dovish signal, which helped push 10-year US Treasury yields to a 3-month low following the speech. Meanwhile, the US Treasury curve continued to flatten, with the 10-2 Year Treasury Yield Spread falling below 0.2%. Fed governors, however, have openly said that they wouldn’t vote for any measures that might intentionally flatten the curve, something which could also be viewed as a dovish signal.

It was also a generally positive few days for emerging market assets, with continued strength in oil prices and a fall in the US dollar acting as a welcome tailwind. The majority of EM currencies strengthened over the week, although as ever there were one or two exceptions. The Brazilian real fell sharply on fears that the former president Lula – currently serving a 12-year jail sentence for corruption – may choose to run again. The Mexican peso also lost ground over the week – the initial rally following the news that the US and Mexico had agreed to revamp the NAFTA trade agreement was quickly reversed as a lack of detail led to more questions than answers.

Heading up:

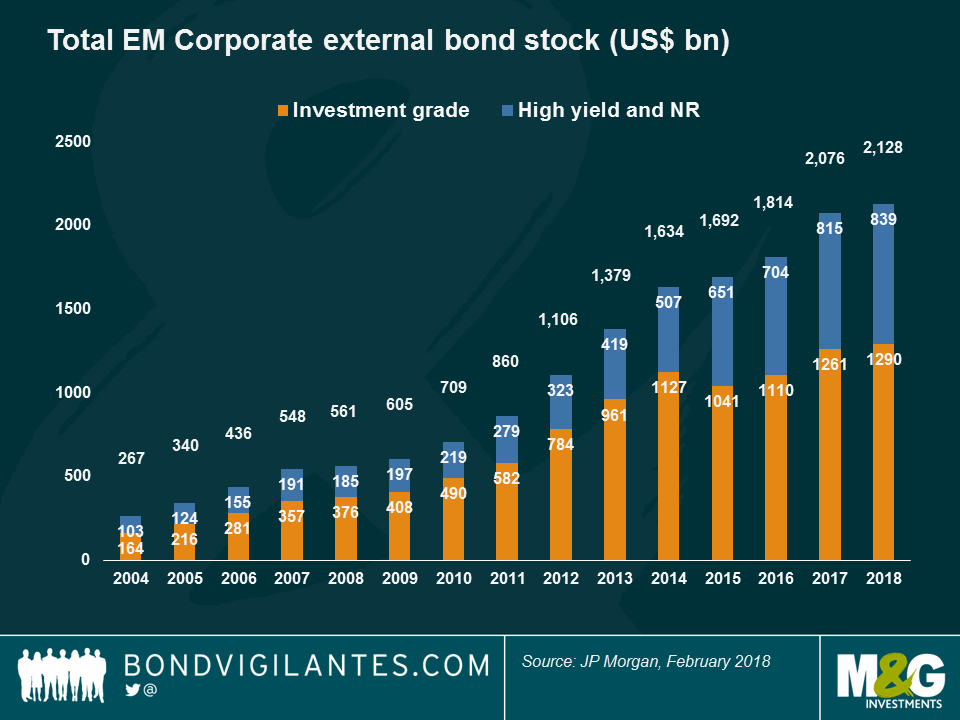

EM Corporate Debt Market – getting bigger, and better? The Emerging Markets (EM) corporate debt market is forecast to add another year of continuous growth as EMs catch up with developed markets in terms of financial penetration and as EM companies improve their corporate governance. The growth, however, has also increased the proportion of High Yield (HY) issuers in the universe, which now represent almost 40% of the total, as seen in the chart. This, and their natural link to their sovereigns, makes them more vulnerable to external or idiosyncratic shocks: recent crisis in Argentina, Russia and Turkey, for instance, have taken the spreads of the JP Morgan Corporate EM Bond Index (CEMBI) to 340 basis points (bps) over US Treasuries, the highest level since Trump won the US election in 2016 (and EMs sold off on concerns of more trade barriers). This year’s crises have so far dragged the JPM’s CEMBI index 2.3% lower, although some specific countries have delivered positive returns, including Nigeria, Ghana, Hungary, Bahrain and Paraguay. For an analysis of EM Corporate valuations, read M&G fund manager Charles de Quinsonas’ “EM HY: is there value after the sell off?,” or watch Charles on: “EM Corporate debt: indiscriminate sell-off?” For a video on how to find opportunity in less high-profile EM Corporate markets, watch M&G’s Mario Eisenegger’s video: “A tale from Chile – and other off-radar EMs.”

Mexican bonds – sombreros off: When Mexican debt and the peso plunged in November 2016 after Trump’s victory, few imagined the country’s bonos would be the 2nd best performing Fixed Income Asset class in the first 8 months of 2018, out of a list of 100 – with a total return of 8.1%, and only behind US non-agency Residential Mortgage-Backed Securities. Fears of a trade wall between the US and Mexico have waned as talks between the two countries to reach a new NAFTA (North American Free Trade Agreement) deal have developed positively over the past few months. Investors have also been encouraged by recent inflation prints, below the 5% level since March. Some market observers believe that inflation peaked at 6.7% at the end of last year, being now on a more positive path. In-coming president López Obrador has also calmed fears of rising deficits as he has committed to fiscal prudence.

Heading down:

US Trade Deficit – growth matters: Trying to fuel economic growth and starting a series of trade wars to reduce a country’s external deficit may be easier said than done: as seen on the chart, economic growth (orange line) is quite correlated to the trade balance (blue line) – the more growth, the bigger the trade deficit and viceversa. This happens because growth helps people import more from abroad, and also tends to increase the local currency, making exports less competitive. According to a study from the International Monetary Fund (IMF), a positive fiscal shock of 1% of GDP widens the trade deficit by about 0.7% over 2.5 years and, in the case of the US, boosts the dollar by 8% over 1.5 years. Also, holding the world’s leading currency usually comes at the price of having a Current Account deficit, since foreign investors and governments need to buy US assets to build up their reserves. This leads to a Capital Account surplus which, by definition, needs a Current Account deficit to even out the Balance of Payments. So: holding the de facto world’s reserve currency, having low interest rates, a trade balance surplus and strong economic growth, all together, may be also easier to say, or to tweet, than to get it done.

Yield curve – unnerving investors: Much is being written about the ongoing flattening of the US yield curve, with many experts, including the US Federal Reserve (Fed), arguing that flat is not down and that a decade of record low rates has made the curve naturally flatter. Others say that this widely-used recession indicator stayed flat over five years in the late 1990s and that the same could happen again. While all these arguments fill the financial press pages, the difference between 2-10 year US Treasury yields continues to drop: it has now reached a meagre 20 bps, the lowest since mid 2007, just ahead of the Financial Crisis.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox