Panoramic Weekly: Summer storm

An escalation of diplomatic tensions between the US and Turkey and Russia triggered a global fixed income sell-off that particularly hit Emerging Markets (EMs), and led to a safe-haven rush, with US Treasuries, Swiss and German bonds in heavy demand. The risk-off mode intensified towards the end of last week, when the Turkish lira plunged 18% in two days as a deadline for Turkey to release a US pastor lapsed, and also as the US proposed new sanctions on Russia amid the country’s alleged involvement in US elections. Investors’ fears spread to other countries, pushing the central banks of Argentina and Indonesia into emergency rate hikes to defend their currencies. The beleaguered Turkish lira and the Russian ruble, however, stemmed losses earlier this week as investors pondered whether the crisis is idiosyncratic or a signal of an underlying, deeper problem – watch M&G fund manager Wolfgang Bauer’s “Markets go cold Turkey” video for some insights.

China’s soft July data also made things worse: both Industrial Output and Fixed Investment came in below expectations, dragging the renminbi down to 6.91 units per US dollar, the lowest since January 2017. Few asset classes survived the tumultuous week, with more than half of the 100 bond sectors tracked by Panoramic Weekly posting negative returns. Winners included long-maturity US Treasuries, up 1.2% over the past five trading days despite strong US inflation figures on Friday. Long-maturity UK inflation-linked bonds also rose. Instead, European banks with Turkish exposure and Italian sovereign debt, also hit by budget uncertainty, sank. Oil fell to almost a one-month low on concerns that the new and proposed trade barriers could weaken the global economy. On a positive note, Japan and the Eurozone posted higher than expected GDP growth.

Heading up:

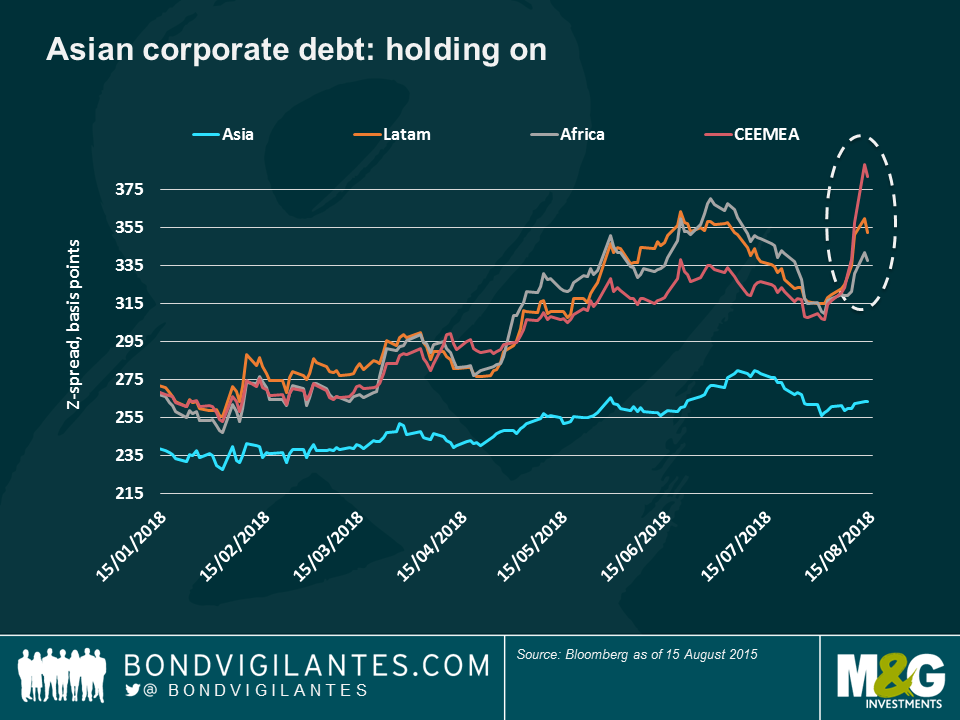

Asian corporates – good crisis: As often happens in turbulent times, Asian government and corporate bonds did better than the EM average, given their often more positive fundamentals: Since the 1998 South-East Asian currency crisis, partially triggered by ballooning Current Account deficits, most Asian EMs have rebuilt their economies, reducing their deficits and focusing on domestic growth. The risk premium that investors receive to hold Asian corporate debt over US Treasuries, already below its Eastern European, Latin American and African equivalents, barely rose 4 basis points over the past five trading days, little compared to the jump seen in other EM regions, as seen on the chart. The spread widening was minimal in export or domestic consumption-centred countries, such as China and South Korea, with the exception of Indonesia, whose increasing Current Account deficit makes it more vulnerable to external shocks. With a yield of 5.12%, well above the 2.8% offered by US 10-year Treasuries, or the negative yields still prevalent in Europe, investors continue to be attracted to Asian debt.

Bond – Call me bond: In the traditionally low-liquidity month of August, investors sought refuge in the Futures and Options markets, which allow them to trade the risk, or lack of, associated to an underlying asset without the need to own the cash bond. Call options to buy US Treasuries or German bunds traded more than any other sovereign option, with their prices rising as much as 1.8%, in the case of Treasuries, and 1.4%, for bunds. This implies investors expect the price of the cash asset to rise in the future, at which point they will have the right to buy the bond at the price established today – selling it at the higher price in the future.

Heading down:

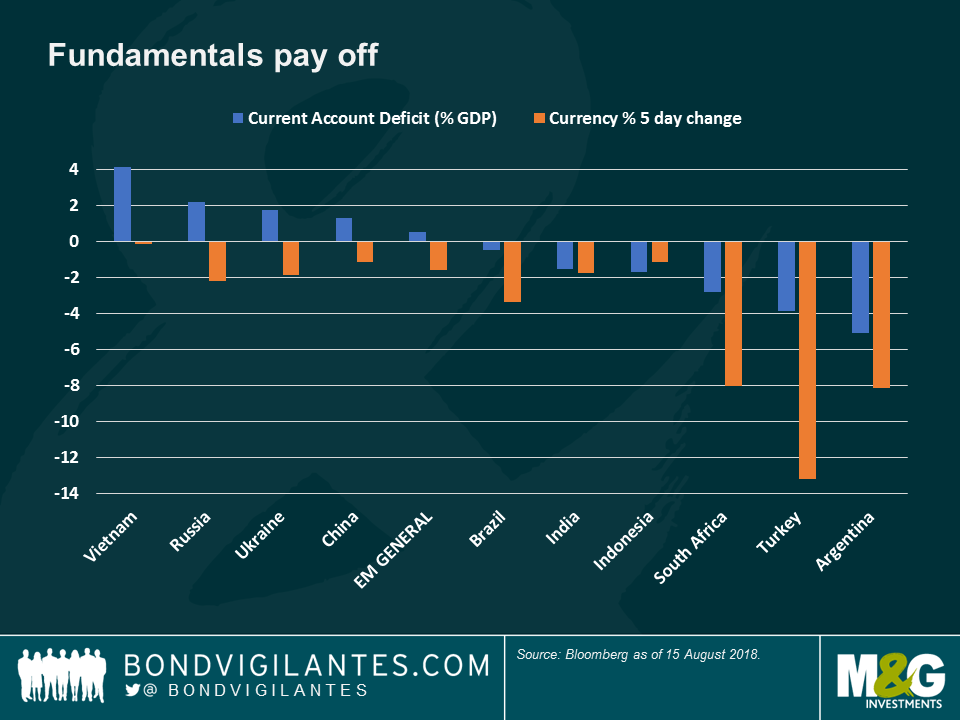

EMs – indiscriminate sell-off? Most EM currencies sank and sovereign bond yields spiked over the past five trading days, reflecting mounting investors’ concerns over the asset class following the tensions in Turkey and Russia. The Mexican peso, the Polish zloty, the Brazilian real and the South African rand all lost more than 4% against a surging US dollar, even if in some cases nothing specific actually happened in those countries. However, and as seen on the chart, currencies of countries with a Current Account surplus suffered a bit less than Argentina, Turkey and South Africa, all more dependent on foreign capital. In Russia’s case, the ruble dropped following the proposal of new US sanctions on the country – but with an external surplus and given the currently high oil prices (Russia is a major exporter), some say that the effect of the new restrictions could not be as dramatic as the currency indicates: read M&G fund manager Claudia Calich’s blog: “Can Russia stomach new US sanctions?”

The Fed and Trump – different opinions: During a week in which US President Donald Trump announced new tariffs on Turkish products and proposed new sanctions on Russia, a New York Federal Reserve (Fed) blog stated that import tariffs are likely to reduce both imports and exports, questioning Trump’s plans to lift tariffs in order to cut the country’s trade deficit – the US has a Current Account deficit of 2.3% of GDP. According to the NY Fed, while higher prices, derived from the increased tariffs, would make consumers switch to domestic products, an increase in input costs would also make US exports less competitive, making them fall alongside imports.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox