Turkish banks: this time it’s different?

Guest contributor – Elsa Dargent (M&G Financials Credit Research team)

Turkish banks have been subject to closer scrutiny over the past weeks as political events have triggered a confidence crisis with a run on the Lira (down by 38% year-to-date vs the dollar and by 26% since end-June, the banks’ last reporting date), a sizeable widening in Turkish govt yields, and an even sharper widening in banks’ unsecured debt yields.

From a fundamental standpoint, there are valid reasons to be concerned about the Turkish banking sector due to the deteriorating macro outlook aggravated by structural weaknesses:

– Asset-liability mismatch: Banks are reliant on overseas investors for “stable” funding due to the under-developed local debt market and the popularity of short-term deposits in Turkey. The weighted average maturity for external debt is about 5 years and it needs to be rolled over to fund long-term loans to local borrowers (the system loan-to-deposit ratio was about 120% at end-June); so far banks have been able to roll-over funding (between 90 and 110% roll-over ratio over past 5 years) but their ability to do so at a reasonable cost depends on market confidence.

– Foreign currency (FC) exposure: Turkish banks’ net FC positions are hedged off balance sheet meaning general open FC positions have been close to zero, however they are reliant on overseas banks to roll over those hedges. This does not mitigate the indirect risks to asset quality and capital that represent FC loan exposure. Foreign currency lending which is limited to corporates represented 36% of the banks’ loan book at end-June 2018. Not all those FC borrowers have FC liquidity and/or generate cash flows in FC, which poses a threat to banks’ asset quality in a prolonged currency crisis when debt service costs become more problematic. Lira depreciation also impacts banks’ regulatory ratios – the banks’ core equity is mostly in Turkish Lira with some having issued subordinated debt in foreign currency which provides a partial hedge; the large banks have disclosed that a 10% depreciation in Lira impacts their Tier 1 and Capital Adequacy (total capital) ratio by 40 to 60 bps on average.

– Loosening of regulatory standards: This has resulted in weaker fundamentals (capital buffers and asset quality) and importantly reduces visibility and undermines confidence in reporting. The loosening in regulatory standards have mainly been the relaxation of risk-weighting requirements (for instance allowing banks to choose a more favourable rating agency for sovereign exposure weightings) and the relaxation of rules around restructuring and provisioning. Some of the most recent measures such as the temporary suspension of mark to market valuation of available for sale security portfolios in equity and lowering the limit on swaps with foreign banks were meant to cushion the impact of the market sell-off on banks and stem the currency devaluation, yet, we believe the best way to restore investor sentiment is to present a strong bank supervision and regulatory framework.

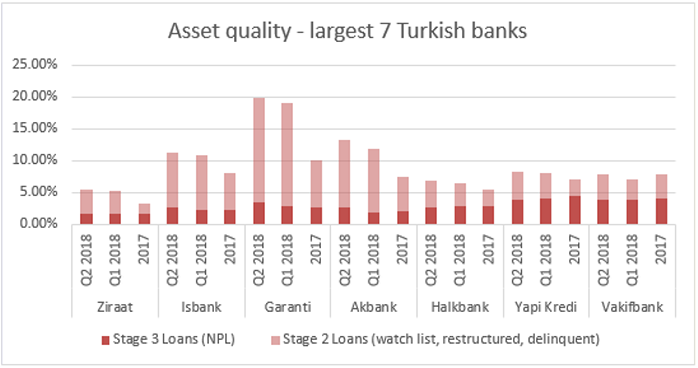

– Evidence of an increase in restructured loans at banks. There are signs that the economy has been over-heating, especially last year when above potential GDP growth was recorded (+7% GDP) fuelled in part by government guaranteed lending scheme (about TL220 billion in 2017 or 7% of GDP). Bank loan growth has been high teens for some time and corporate leverage deteriorated from 63% of GDP in 2012 to 85% of GDP in 2017 (source: BIS). Most of the rise in corporate leverage has come from bank credit which accounts for almost 3/4 of the total. Banks have also reported a sharp increase in watch list/restructured loans (see chart), partly due to the shift to a new reporting standard (IFRS9) which compels banks to recognise losses early on and which banks have interpreted with various degrees of conservatism. There has been a couple of high-profile restructuring of large corporates and some anecdotal evidence of divergence in reporting the same exposure.

Sources: M&G, banks’ financial statements.

In this environment, can public or foreign-owned banks benefit from external support if the crisis worsens?

The willingness and capacity of a parent bank (and shareholders) to provide support for capital and funding is quite unpredictable although foreign banks have so far been supportive of their Turkish subsidiaries. For instance, BBVA acquired an additional stake of 9.95% in Garanti in 2017, raising their interest to just below 50%. In June, Unicredit injected $500 million of equity to support Yapi Kredi, held through a JV with an industrial Turkish group. Low level of public debt (28% of GDP) indicates that in theory there is some capacity to support the state-owned banks. Yet, state-owned banks have been penalised by the government push to fuel lending and cost of risk may have been mispriced. Finally, there are also idiosyncratic issues as well, with state-owned Halkbank facing US sanctions for involvement in Iran.

Is this the early 2000s crisis all over again?

Whilst it is tempting to draw parallels between now and the last severe currency and banking crisis two decades ago, we believe that despite the current challenges the banking system looks a bit different, which doesn’t mean that the current trends are not worrisome. Today, supervision is generally tighter/better, and banks run very little open FX positions – although as said before the indirect impact of FC exposure is a real concern. Back in the early 2000s, banks were under-regulated and failures occurred amid fraud and corruption scandals which undermined sentiment. Banks’ balance-sheets were also quite different, as they mostly held government debt securities, financed with short-term funding. Liquidity was quite poor, and the weaker banks eventually had to fire-sell their bonds in exchange for liquidity. Banks also did not hedge their currency risk and experienced FC-related losses.

Sources: BDDK, TCMB, banks reports, management transcripts, BIS, Bloomberg, European Commission.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox