Panoramic Weekly: Ignoring Trump

Most global fixed income asset classes gained over the past five trading days, despite an escalation of the ongoing US-China trade war and the inclusion of new tariffs between the world’s two largest economies. Reduced trade, however, may bring more harm than good to the US economy, as levies usually generate inflation and, therefore, higher rates. Indeed, the benchmark US 10-year Treasury yield exceeded 3% for the first time since May, which was also due to news that China’s holding of Treasuries fell in July. The US dollar weakened as manufacturing data disappointed, alongside the potential negative effects of the trade dispute. Some observers believe that it will not be easy for the US to replace Chinese products, since the economy is almost at full employment and manufacturers, before making an investment, weigh up whether the tariffs will outlive President Trump. The yuan remained relatively stable, partially because China buys less US products than the US does from China (read more below about China and its Asian friends).

Traditionally riskier asset classes seemed to ignore the trade wars, as High Yield (HY) spreads tightened and Emerging Markets (EMs) bond prices and currencies gained. The Russian ruble surged almost 4% against the dollar, following the country’s first and unexpected rate hike since 2014. The recently-battered Turkish lira added 3% after the central bank also raised rates – 6.25% to 24% – in order to contain the ongoing crisis. The currency is still down almost 40% against the dollar so far this year. The Brazilian real was also up after a poll showed that far-right and recently-stabbed candidate Bolsonaro now has more chances to win next month’s election – click here to read M&G fund manager Claudia Calich’s views on the forthcoming election. Other recently-troubled asset classes also strengthened, including Italian government bonds, on hopes that the next government’s budget will be close to European Union limits. Traditional safe-havens, such as bunds and the yen, dropped.

Heading up

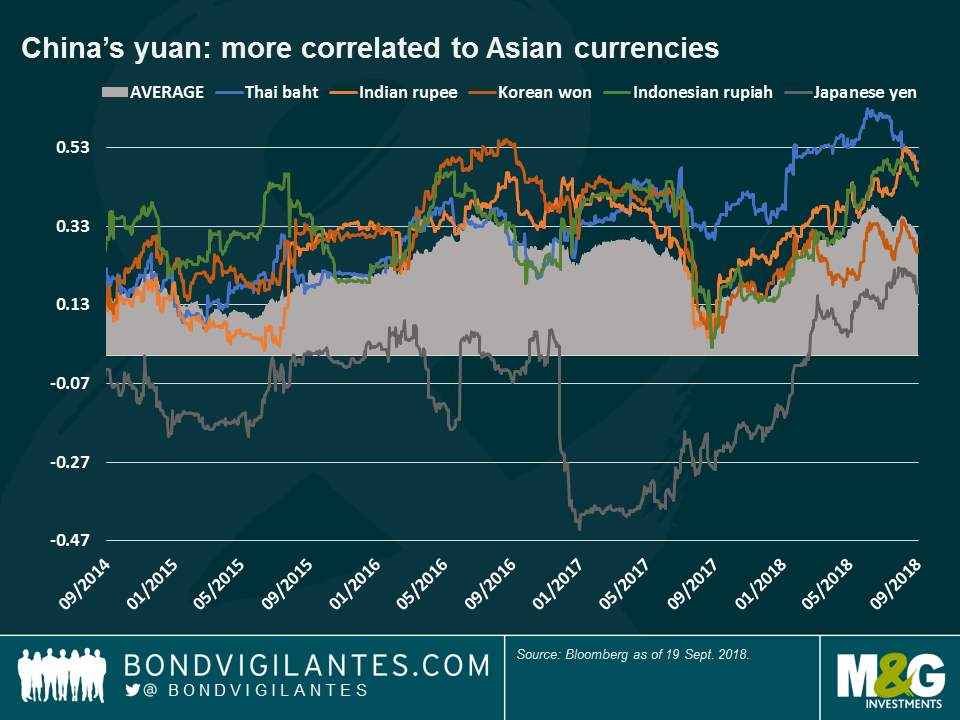

China in Asia – making friends: Chinese officials reiterated this week that they will not use their currency as a trade weapon – read: they will not devalue it in order to keep the country competitive in the export markets. As seen on the chart below, more than a weapon, the yuan is becoming a magnet, mostly in Asia: the correlation between the yuan and an average of 9 Asian currencies reached in late June the highest level since at least 2013, and has this year even become positively synched with the yen, after years of trading in opposite directions. This happened as the yuan was seen as an EM currency, while Japan’s currency has traditionally behaved as a safe-haven. This negative correlation has now changed, given the yuan’s recent stability and also given China’s rising imports from the rest of Asia, making the region’s currencies more attuned. Asian partners like trading with each other, and not only because of their proximity: with 2017 annual growth at 5.7%, Asia is the fastest-growing region in the world and the main engine of the world’s economy. According to the International Monetary Fund, Asia contributed more than 60% of global growth last year, three-quarters of which come from China and India.

European CoCos – no longer coo-coo: European banks’ contingent convertible bonds, known as CoCos, have now more than recovered August’s lost ground, when they were hit by the Turkish crisis, given their exposure to the country. CoCos had also suffered especially after the Italian election in May, in which anti-euro parties earned a place in the coalition government. The asset class has now recovered, as Turkey and Italy’s woes have waned, although it is still down 1.6% so far this year. The price loss has been partially mitigated by an income return of about 4%. Click here to watch M&G fund manager Wolfgang Bauer’s comments about European credit.

Heading down:

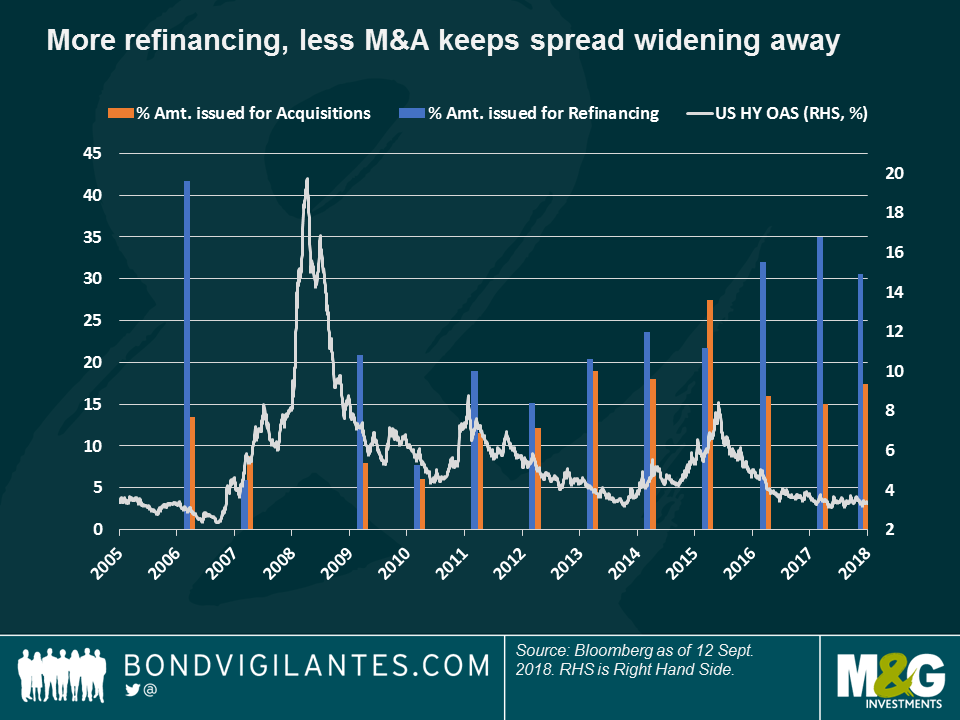

HY Spreads – follow the money: US HY spreads sharply tightened over the past 5 trading days, trading 315 basis points (bps) over Treasuries, the lowest since April. The optimism came on the back of the risk-on general market environment, but also reinforced a deeper trend: as seen on the chart, HY spreads (white line) tend to tighten when more of the money companies raise is used for refinancing purposes (blue bars) rather than to make acquisitions (orange bar). Since merger activity is typically seen as a late-cycle signal, investors see the present relatively contained level of acquisition financing as a sign that the cycle still has more room to run. Corporate defaults are also low and earnings, up. HY is also favoured given its lower interest rate sensitivity, especially in a rate rising cycle, such as now: US HY has a duration of almost 4 years, compared with an average 6.9 years for Investment Grade names. Click here to read Stefan Isaacs’ recent “HY spreads: the story behind the story.”

Gilts – feeling the heat: UK 10-year government bond yields rose to 1.61%, the highest since February, after August inflation growth reached 2.7%, ahead of expectations. The rise was mostly driven by clothing, transport and theatre prices, which rose in one the hottest summers on record. The acceleration lifted market-implied chances that the Bank of England will lift rates in February next year to 35%, up from 25% the day before the data was published. Sterling strengthened, reducing its year-to-date drop against the dollar to 2.5%.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox