Panoramic Weekly: Bonds take a bath

The bond sell-off that started last week with the publication of strong US data continued over the past five trading days, even if Friday’s job report came in below expectations and a slew of global data and events only confirmed a worsening momentum: the International Monetary Fund (IMF) cut this year’s world economic growth forecast to 3.7%, down from 3.9%, citing challenges to trade; Italian 10-year bond yields spiked to 3.5% as the government’s turf war with Brussels over the country’s budget intensified; Germany’s industrial output was much weaker than expected (more below); South Africa replaced its finance minister after corruption scandals, and Japan’s Tankan manufacturing report posted a third straight quarterly drop. The backdrop seemed to depress everybody as both bond and equity markets fell. In fixed income, only 9 of the 100 asset classes tracked by Panoramic Weekly posted positive gains.

The week’s few performers were led by Brazil, whose sovereign and corporate bonds rallied after far-right candidate Jair Bolsonaro won Sunday’s general election first round, facing Workers Party leader Fernando Haddad in a second and final round on Oct. 28. The real surged 5% against a rising US dollar as both candidates are seen as fiscally responsible and somewhat market-friendly. US leveraged loans, which typically bear a floating rate, also posted positive gains as they may profit from the higher rate environment. Traditional safe-haven currencies, such as the dollar and the yen, also rose. The Chinese renminbi continued this year’s downwards slope, trading at 6.92 units per dollar, far from the 6.26 level seen in April. The country cut the reserve ratio requirement for some banks as it aims to avert a slowdown at the same time that it tries to rein in leverage. Oil cooled from its recent ascent.

Heading up:

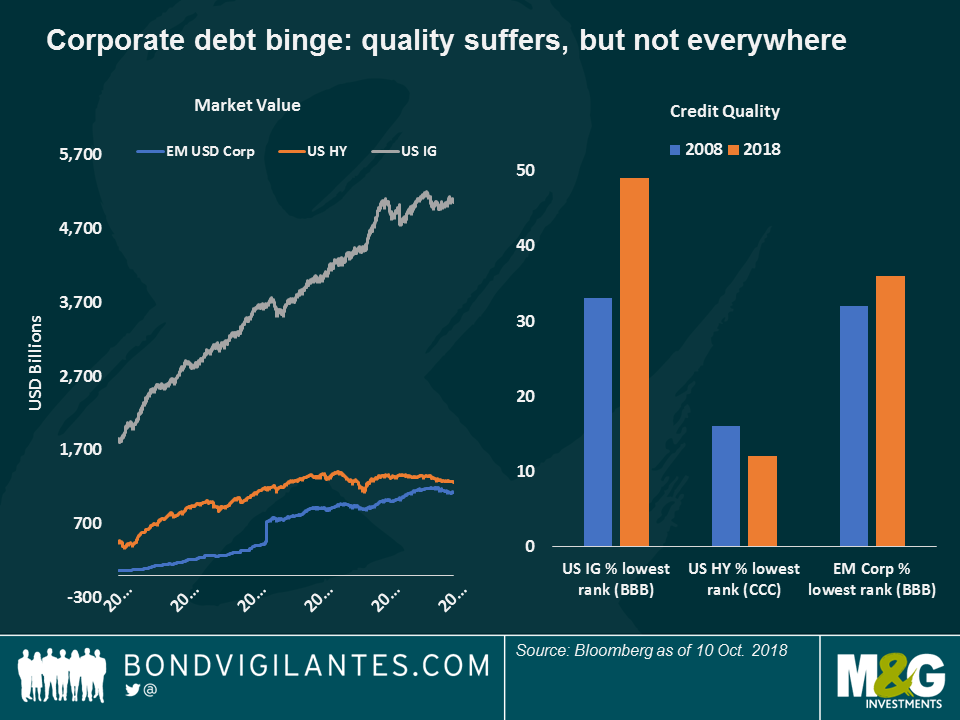

Corporate spree – time for the bill? Companies around the world have used a decade of cheap money to load up debt, not only to make investments but also to increase dividends and share buy-backs. The bill, though, may be coming soon: as rates increase, companies will find it more expensive to roll over their debt, something which could hinder profitability and damage credit quality. As seen on the chart, quality has already worsened, especially in the asset classes that have grown the most: US Investment Grade (IG), for instance, has more than doubled from $1.8 trillion to $5 tn over the past ten years – at the same time that companies bearing the lowest IG credit rank now account for almost half of the asset class, compared with a third in 2008. US High Yield (HY), instead, has also grown 2.7 times over the ten years, but has seen its lowest credit bucket fall to 12% of the total, down from 16%. USD-denominated Emerging Market (EM) corporate debt, which has ballooned to $1.1 tn (it started at $63 bn one decade ago), has also seen its lowest rating bucket increase, but more moderately. No surprise then that US HY has outperformed its rivals so far this year: the asset class has gained 1.9%, while US IG has dropped 3.2%, and EM Corporates have lost 1.9%. Fundamentals matter.

Brazil’s assets – jogo bonito: Brazil’s currency and bonds rallied as 147 million voters chose two allegedly fiscally-responsible leaders to run in the election’s final round, with hope that they will bring the country’s recent miseries to an end: at 12.2%, the unemployment rate has doubled from 6% four years ago, while the government’s deficit has swollen to 7.4% of GDP, from c. 2% between 2010 and 2013. The optimism pushed the real higher to 3.7 units per dollar, the strongest level since August, and completely wiped out the summer losses triggered by the recent Argentinean and Turkish sell-off. Both left and right-wing candidates are expected to tone down their views towards the centre in order to seize more votes ahead of the Oct. 28 final round.

Heading down:

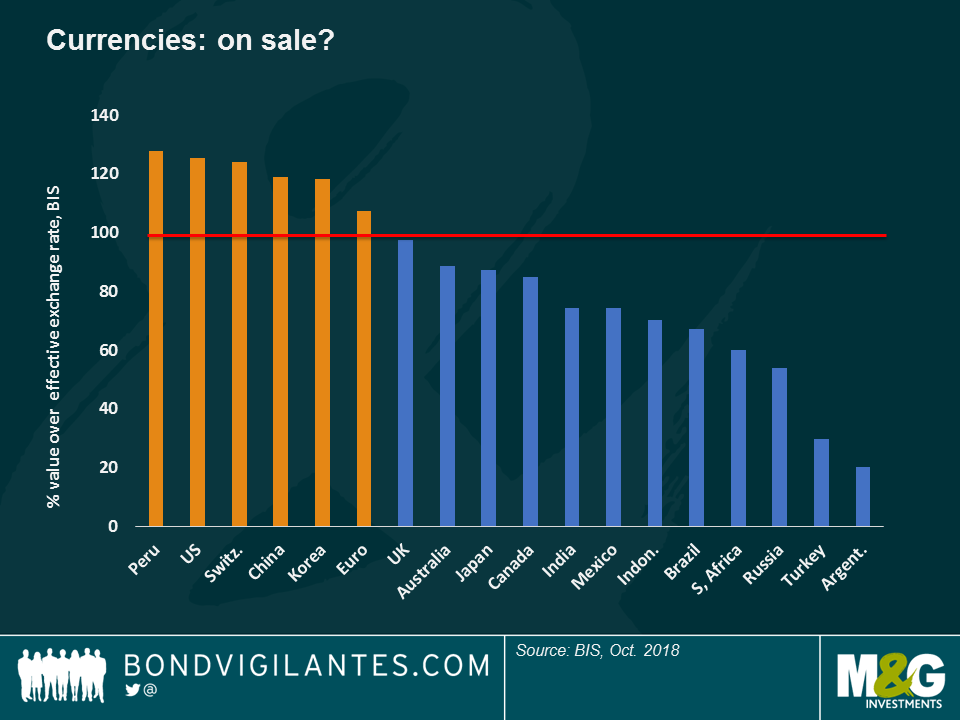

EM currencies – on sale? EM currencies have mostly plunged against the US dollar since early August, just before the deterioration in the Turkish and Argentinean economies led to a general EM sell-off. According to the Bank of International Settlements (BIS), known as the bank of central banks, recent moves have dragged down some EM currencies’ effective exchange rates, leading some investors, such as M&G’s Eric Lonergan, to believe that they now have some value – click here to watch Eric explain his views. Not all EM currencies have been affected, though: according to the BIS, the Peruvian sol is overvalued, perhaps given the country’s fundamentals: the economy is growing at a 2.3% annualised pace, while the Current Account deficit is at a moderate 1.4% of GDP. Inflation, at 1.3%, is also modest. A leading copper exporter like its neighbour Chile, Peru has posted eight consecutive months of investment growth. The sol, however, appears less sunny: it has dropped 2.8% against the dollar so far this year.

German industry – Oktober-rest? German industrial production fell 0.3% in August, well below expectations of a 0.3% increase and the third drop in a row. While export weakness is not showing on the country’s trade balance – as many had feared given the ongoing US-China trade wars -, Europe’s leading country is now becoming increasingly worried on another trade front: the Cologne-based IW economic institute warned this week that a no-deal Brexit could sink German exports to Britain by 57%.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox