Panoramic Weekly: Loan Vigilantes emerge as uncertainties rise

Corporate, Emerging, Currency and Commodity markets – almost everyone but traditional safe-havens – had an early Halloween week on mounting concerns over challenged US corporate profits and dismal European PMI and Chinese growth data. As much as 75% of the 100 Fixed Income asset classes tracked by Panoramic Weekly fell, also dragged down by rising tensions over Brexit and as the European Commission rejected Italy’s proposed budget. Additionally, US President Trump said he might regret appointing Jay Powell to head the Federal Reserve (Fed), which he blames for raising rates too quickly. The Fed minutes of its September meeting were indeed upbeat, leading to a spike in US 10-year Treasury yields to 3.2%, although they dropped down back to 3.1% as the week progressed. The death of Washington Post columnist and Saudi critic Jamal Khashoggi and Japan’s September export drop, the biggest since January 2016, also contributed to an uncertain outlook.

Against this backdrop, equities dropped and oil plunged to $66 dollars per barrel, down from $76 only earlier this month. Some investors are increasingly worried that this year’s collapse of Emerging Market (EM) currencies including the Argentinean peso and the Turkish lira, may reduce demand for oil as crude becomes more expensive – for more on oil prices and economic growth, read M&G fund manager Jim Leaviss’ “Just like 2008? Oil up, ECB tightening – all we’re missing is a credit accident.” Only traditionally stable assets such as German bunds and Swiss government bonds delivered positive returns over the past five trading days, and so did UK gilts, whose yields dropped but for other reasons: September inflation disappointed and the country faces daily media speculation about a disorderly departure from the EU and over the future of Prime Minister Theresa May (more below). The US dollar rose against most major currencies, except the Brazilian real, which mostly continued to rally ahead of Sunday’s final election round – the two candidates are seen as fiscally responsible.

Heading up:

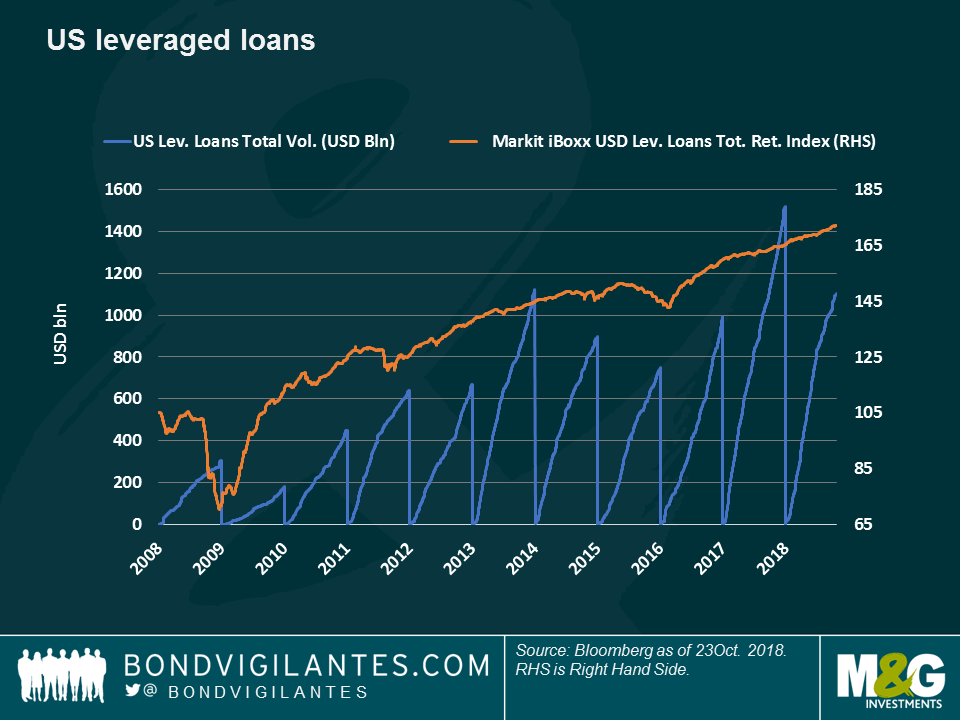

Leveraged loans – Fed alert: Buried in the 7th page (of 10) of the latest Fed minutes, the de facto world’s central bank warned about the growth of leveraged loans, about the loosening terms and standards of the sector, and especially referred to the increased loan activity from non-bank lenders – this could all pose risks to financial stability. As seen on the chart, the volume of outstanding US leveraged loans has reached $1.12 trillion, up from barely $306 billion ten years ago. Leveraged loans have now overtaken the US High Yield (HY) bond market, which is suffering from a dearth of supply, partially because in a rate-rising environment, investors tend to favour loans, which normally bear a floating rate. As seen on the chart, higher demand has helped the asset class deliver hefty returns: it is up 4.5% so far this year, and 18% over the past three. The loan Vigilantes, however, include more parties than the Fed: in its latest quarterly report, the Bank of International Settlements (known as the bank of central banks), said that leveraged loans have behaved pro-cyclically, growing rapidly before a market downturn.

Gilts – top 100: UK government debt was the best-performing fixed income asset class over the past 5 trading days, among the 100 tracked by Panoramic Weekly: fears that the Bank of England will have to delay future rate hikes to avert a post-Brexit recession pushed 10-year gilt yields down to 1.4%, the lowest since early September. With annualised inflation at 2.4%, UK rates are still offering negative real yields, at the same time that the country is growing at a pace of 1.2%. This happens as Brexit uncertainty weighs over nominal yields, which have not been anywhere near the 2% level they had before the Brexit referendum in 2016. The uncertainty may only intensify as the March 2019 deadline to leave the trading bloc approaches.

Heading down:

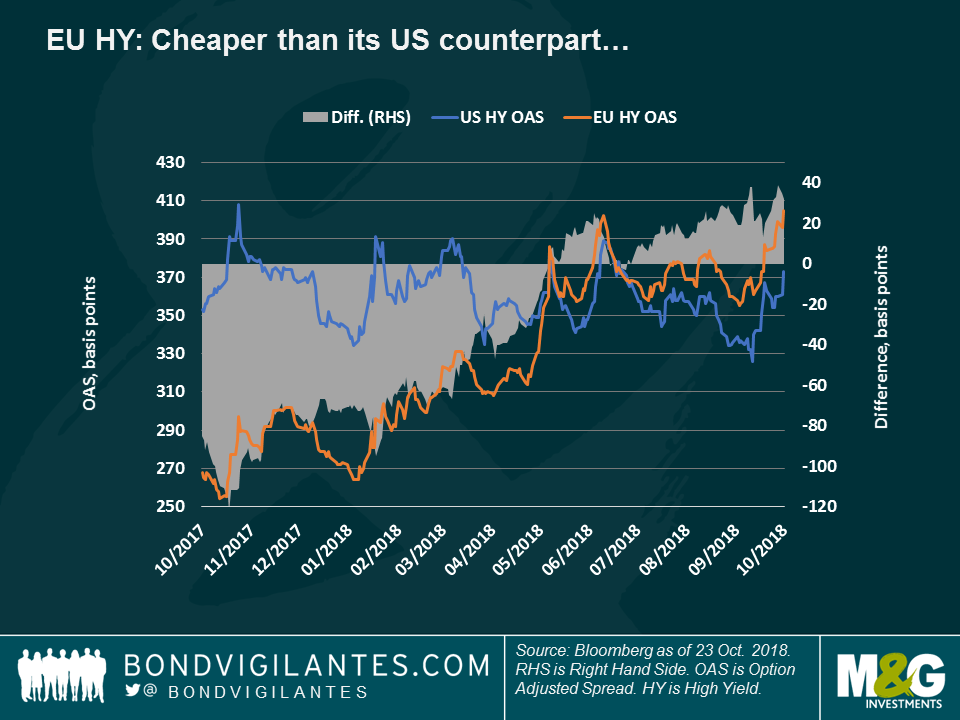

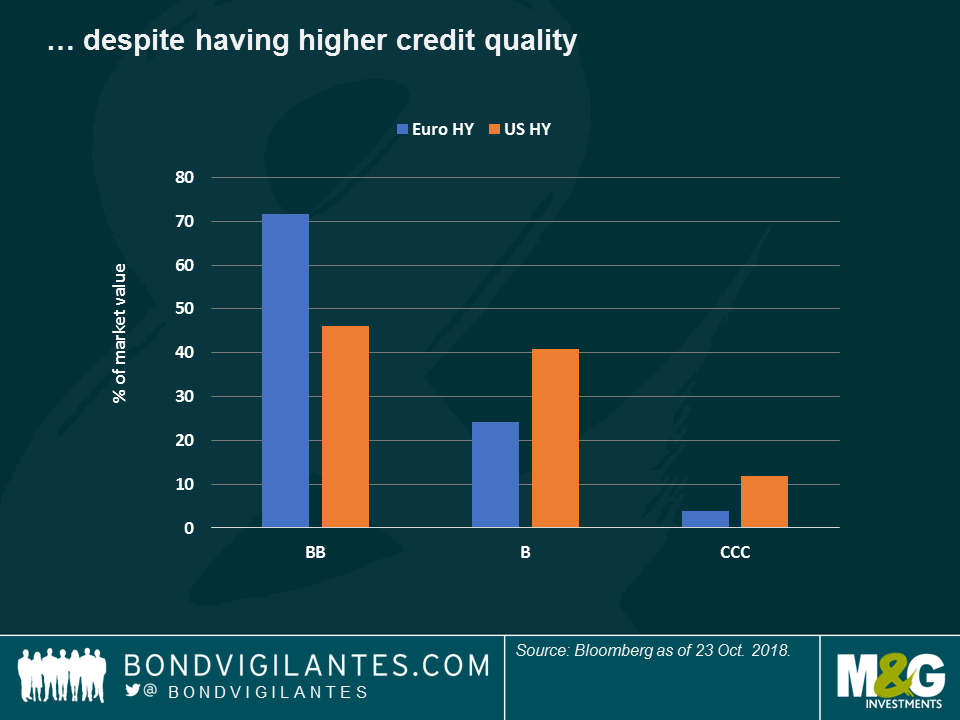

European High Yield – under (Italian) construction: European HY debt continued to disappoint over the past five trading days, especially as renewed tensions between Italy and the EU over the country’s budget hit Italian corporate names. Italy was also downgraded by Moody’s, although the rating agency maintained the country’s Investment Grade rating. Italian construction companies are especially feeling the pressure of a tight government budget, and in some instances have also been unfortunate to seek alternative markets in recently-troubled countries such as Argentina and Turkey. It is no surprise then that four of the ten worst-performing European HY names so far this year are Italian, including 2 construction companies (for more detail read James Tomlins’ Watch Your Step: Cliff Edge risk in European High Yield). Their sharp declines (69% and 53%) are dragging down the index, lifting its risk premium over US HY, as seen on the chart; the difference between two reached 27 basis points on Oct. 19, the widest since 2012. This is happening despite European HY having a better credit quality than its US counterpart – as seen on the last chart, 71% of European HY companies have the highest Non-Investment Grade rating (BB), substantially more than in the US (46%). For further insight on Italy’s woes, watch M&G’s Carlo Putti and Saul Casadio recent discussion: Italian construction, a sector in crisis.

Mexico – not lindo: The return of Mexican sovereign debt plunged by 4.5% over the past 5 trading days, while the peso lost 3.8% against the US dollar, the worst-performing major currency. After a long transition period, the country is now welcoming new president Andrés Manuel López Obrador, known as AMLO, who won the election in July. The new government has said it wants national oil champion Pemex to prioritise domestic supplies rather than international shipments – a move which might weaken the company’s capital structure, according to Fitch Ratings. The agency downgraded the firm’s outlook from stable to negative last week.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox