Panoramic Weekly: Emerging Markets win US mid-terms

Emerging Market (EM) bonds and currencies were one of the main beneficiaries of Tuesday’s US mid-term elections, which resulted in a split Congress, with the Democrats controlling the House of Representatives and the Republicans, the Senate. This may refrain President Trump from implementing further fiscal incentives, which usually fuel the economy, lifting Treasury yields and the US dollar. This is good news for EMs, which have dollar-denominated debt and use Treasuries as their base risk-free rate (more below). The world benchmark US Treasury 10-year yield eased to 3.19%, after rising above 3.2% on Friday, following the publication of the strongest wage-increase data in almost one decade.

The risk-on mode lifted US High Yield (more below), while long-dated bonds fared worst, including UK inflation-linked debt and gilts, down 2.3% and 1.3% respectively over the past five trading days. Long-maturity Treasuries lost 1.2% over the same period. Global stock markets reacted positively to the US election results on hopes that moderately-rising Treasury yields and a potential toning down of the US-China trade war may better support the world economy.

Heading up:

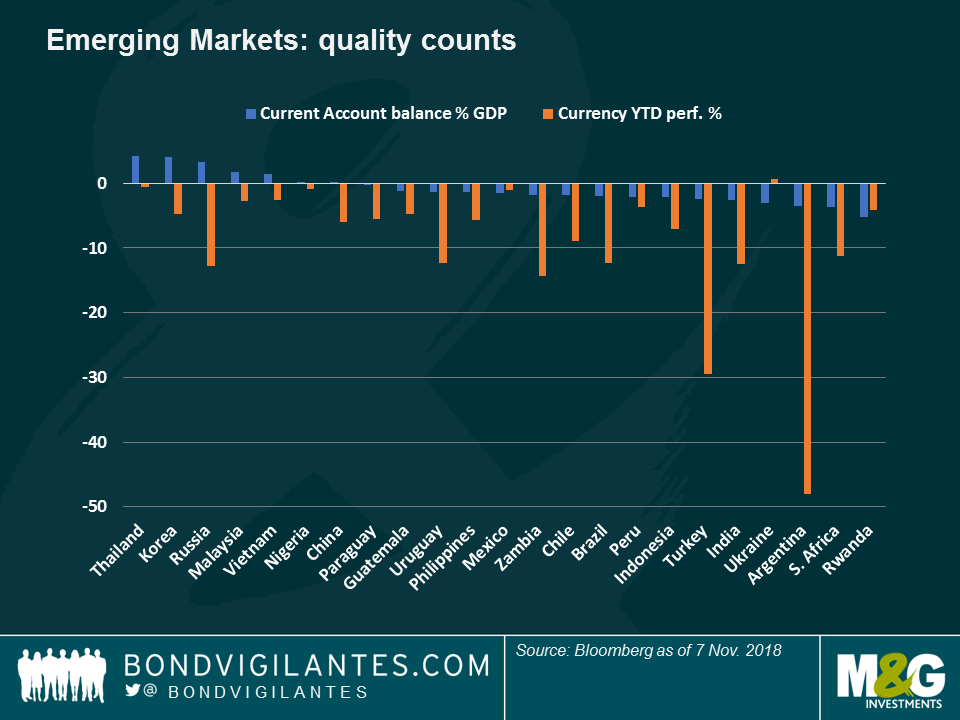

Emerging Markets – dollar relief: EM currencies surged in the aftermath of the US mid-terms, especially those countries that are more exposed to a higher dollar. As seen on the chart, countries with the biggest Current Account deficits have seen their currencies drop by the most so far this year, but some took a slight relief after the election: the South African rand gained 1.3% on Wednesday, while the Brazilian real strengthened by 0.5%, also driven by unexpected soft inflation data. The Indonesian rupiah performed best, up 1.5% in one day, as the country also posted third-quarter GDP growth of 5.17%, above expectations, and said that its foreign reserves rose in October for the first time this year. Despite the EM optimism, some observers warned that the election outcome may not have much effect on the ongoing trade tensions between the US and China, as these are largely dependent on presidential views. Still, this week’s gains have softened the year-to-date EM’s negative returns, as they have been partially driven by a strong dollar: the JP Morgan GBI index of local government bonds is up 1% in local currency terms in 2018, but down almost 8% when translated into dollars. A softer greenback may make life a bit easier for the asset class.

US High Yield – loving low rates: The risk premium that investors pay to hold US HY over Treasuries dropped to 350 basis points (bps), down from 380 bps only last week, on expectations that a moderate rate environment will help contain defaults. This week’s gains lifted US HY’s year-to-date return to 1.3%, widening the gap with its US Investment Grade peers, which have lost investors 3.7% over the same period, dragged down by ample supply and a deterioration in credit quality. US HY is also outperforming European Investment Grade and HY, underpinned by positive fundamentals such as lower net leverage and higher interest coverage.

Heading down:

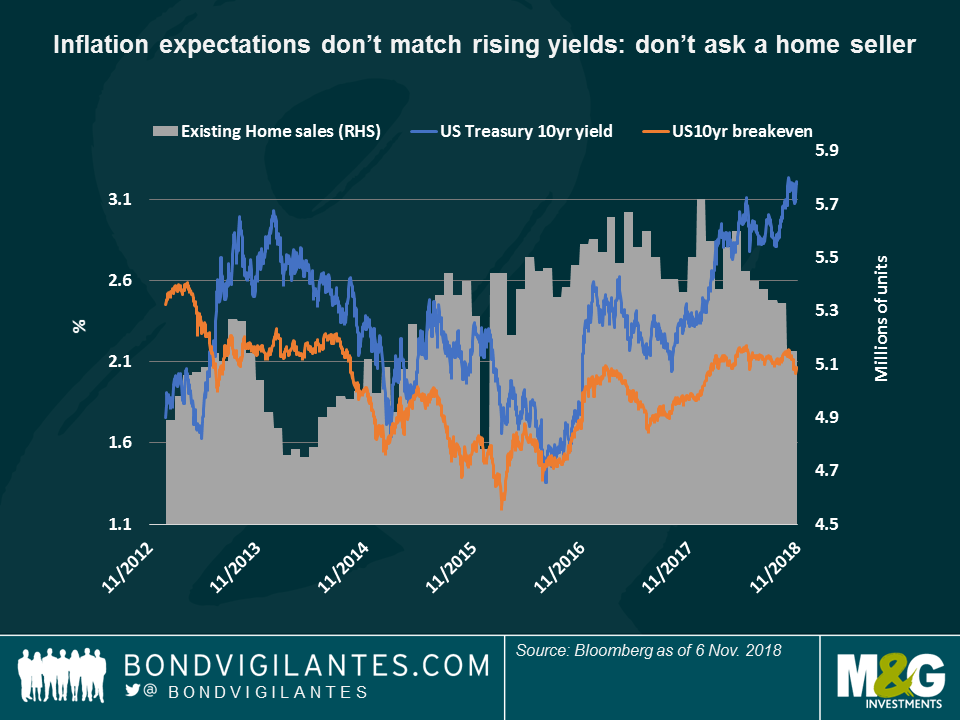

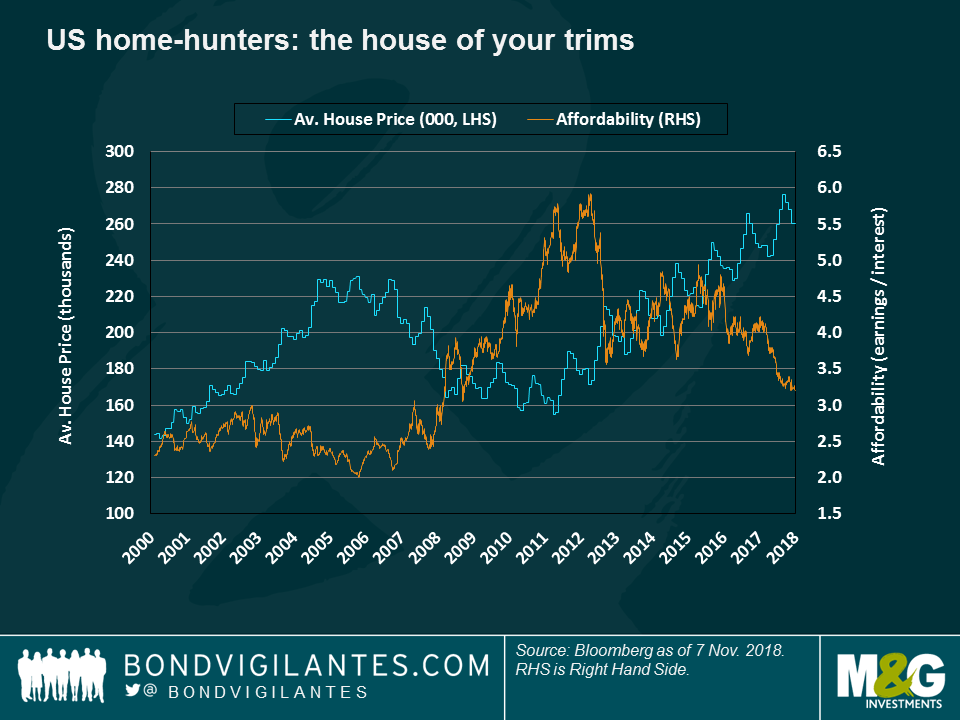

US homeward bound – I wish I was!: If Simon & Garfunkel were writing lyrics now and not in 1966 they might have come up with a different line as US homes ain’t what they used to be – something with dire economic consequences: inflation expectations have risen since Friday’s strong jobs report, but they are down by almost 2% over the past 30 days, limited by lukewarm data: as seen in the first chart below, inflation expectations have remained relatively flat this year, while Treasury yields have spiked up. The decoupling happened as existing home sales started dropping at the same time, given the multiplying effect that house sales have in the economy (new homes usually mean new appliances and goods). The second chart sheds some light on why Americans are buying fewer homes: while house prices have risen almost non-stop since 2012, affordability levels (earnings divided by interest payments) have been dropping for more than two years. Just looking at an ad offering a New York flat for $68m may help explain why the supply of new unsold homes has reached 7 months, up for 4.9 months last year, a level historically consistent with GPD growth of zero. This was flagged by M&G fund manager Richard Woolnough in his prescient blog “The knock-on effect of falling house prices – crystal ball breaking” – in 2007…

Spain: you say yes, I say no: Spain’s banking sector has been on a roller-coaster this week: first, and after months of intense discussion, the country’s Supreme Court ruled that banks would not have to pay any stamp duty on real estate sales. The decision, which sent banks’ stock prices soaring, was soon rebuffed by Prime Minister Pedro Sánchez, who said that the mortgage law would be changed so banks would have to foot the bill. Some observers said the move might have little effect as banks may quickly lift other fees or raise mortgage interest rates to offset any higher costs.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox