Panoramic Weekly: Fed extends Goldilocks contract

If investors enjoyed a dream Goldilocks scenario in 2017 in which growth was hot enough to lift earnings but not too much to warrant sharp rate hikes, many expected 2018 to be more like the year of the bear, marked by a significant rate hiking cycle – until last week. US Fed chair Jerome Powell said the current policy rate is just below the non-accelerating rate of inflation – a sign that the central bank might slow down the rate-hiking path it outlined in October. Stocks soared and bond yields dropped, with the 10-year Treasury yield slightly dipping under 3% for the first time since September. Risk asset spreads, such as those of High Yield, tightened.

Powell’s dovish comments came as oil has shed $20 per barrel over the past two months to trade at just above $50, the lowest level in more than one year. US economic data has also disappointed (Housing, Industrial Production, Durable Goods Sales and Consumer Confidence) Recent mid-term election reverse for US president Trump makes further tax cuts more unlikely, which could weigh on growth. Last week, European PMIs also came in below expectations. The IMF warned about weakening global data and darker clouds looming, only one month after cutting its global growth forecast. At least, geopolitical tensions seemed to abate after the weekend’s G20 summit in Buenos Aires, in which Trump and China’s president Xi signed a trade war truce, which helped soften the US dollar, boosting Emerging Markets assets.

Heading up:

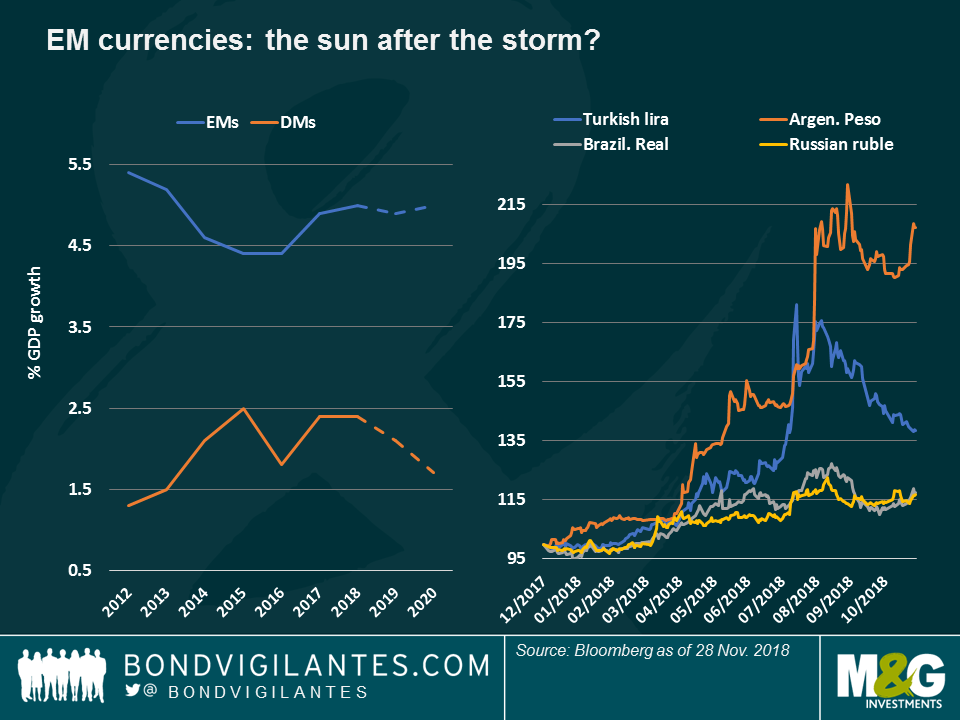

EM currencies – winter sun: Emerging Market (EM) currencies had a good November. Despite the recent global credit sell-off, locally-denominated EM sovereign bonds delivered a 1.6% return to investors in November, which increases to 2.2% when translated in to US dollars, given the currency appreciation. As seen in the chart, the Turkish lira (blue line) has performed strongly up 6.7% against the greenback so far this month, helping it recover about half of what it lost over the summer. Investors now seem less concerned about Turkey’s fundamentals especially given the plunging oil prices which are a relief for the country’s Current Account. India, another major oil importer, saw its currency soar 5% over the past month, especially as the US waived some sanctions on Iran so that the oil-producing nation could continue exporting. The South African rand, recently unfavoured by investors due to the country’s high Budget and Current Account deficits, also rallied after the central bank recently hiked rates to 6.75%, from 6.50%, and cut its inflation projections. After the summer storm in which Turkish and Argentinian uncertainty spread to other EMs investors seem to be looking back at fundamentals. As seen in the chart the growth outlook is far rosier for EMs than for Developed Markets.

Italy – last will be first: Still deep in the red so far this year, Italian government bonds occupy a surprising No. 1 position in the weekly return table of 100 Fixed Income asset classes. The gains, which reduce the year-to-date loss to 4.7%, come as the country’s government and the EU seem to be nearing an accord over Italy’s budget deficit. Since it was elected in May, the government has challenged Brussels’ fiscal discipline creating tensions that not only widened Italian government and corporate spreads but also had a negative impact on European assets overall. More optimism about an agreement has lifted this week’s returns of Europe’s High Yield indices where Italy has a 15% weight, more than any other nation.

Heading down:

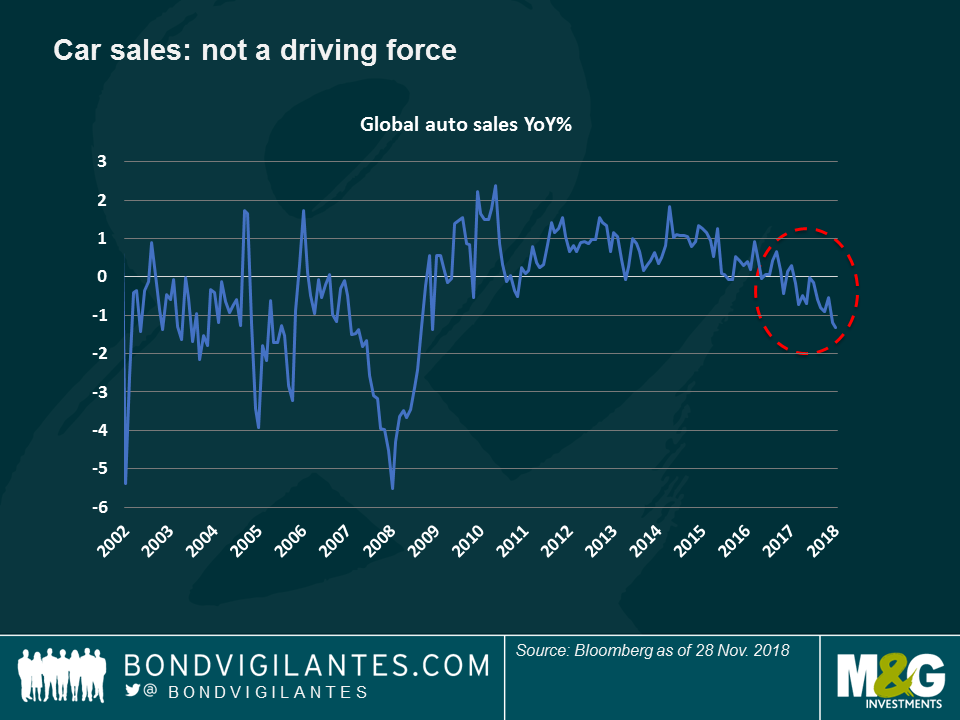

Cars – canary in the coal mine? Car sales have stopped being an economic driver – they feel more like a puncture to the wheels of global growth: maybe this is because of global trade wars; maybe because developed market average populations are getting old and youngsters use on-demand services, or perhaps because the EU has introduced a new pollution-testing regime. As seen in the chart, annualised growth of global auto sales is falling deeper into negative levels, something which has made the industry the worst-performing US High Yield sector so far this year, down by 7.3%. Earlier this week auto giant GM said it planned to close as many as five North American plants and cut staff. To make matters worse the IMF doesn’t see a rosier picture ahead – the fund expects growth to moderate, especially in developed economies because of aging demographics, slow productivity and rising rates. In the US, the end of the recent fiscal stimulus may also hinder growth. High Yield investors seem to have priced in the tough times ahead: the more resilient Supermarkets and Pharmaceuticals are the best-performing HY sectors this year, up 7.8% and 6.7%, respectively.

TIPS – tipping over: US Treasury Inflation-Protected Securities have lost investors 0.6% over the past five trading days, taking their year-to-date loss to 2.7%. The drop has been mostly driven by plummeting oil prices and unconvincing data. Still, some investors argue that with US 10-year nominal yields at 3.0% and breakeven rates (or inflation expectations) at 1.93%, a real rate of more than 1% is attractive relative to the negative real rates that are still prevalent in most developed countries where the inflation rate is above the base policy rate.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox