European credit: divergence between the bond and credit derivatives markets

There is a general belief in markets that the economic cycle follows the US – and therefore that you can’t have a recession in a developed market without a US recession first. Yes, the US economy is the biggest out there, and with general market sentiment being that we are late cycle it is understandable that everyone’s focus is on the US data and its flattening yield curve.

But what has really been grabbing headlines in recent months has been the Eurozone economy, where data continues to disappoint: real growth is at its lowest since the sovereign debt crisis, Italy is now officially in recession after posting two consecutive quarters of negative growth, while Germany is on the borderline having just posted Q4 growth of zero after a negative Q3 print.

Only time will tell whether the Eurozone goes into recession but if we do have a recession in Europe, while European credit will likely underperform, the magnitude of this underperformance probably won’t be as extreme as that which we saw in the sovereign debt crisis of 2011-12. This is not only because the ECB remains a significant investor in the market (through its QE investments), but also because the composition of the market has changed drastically over time, making the European corporate bond index more diversified.

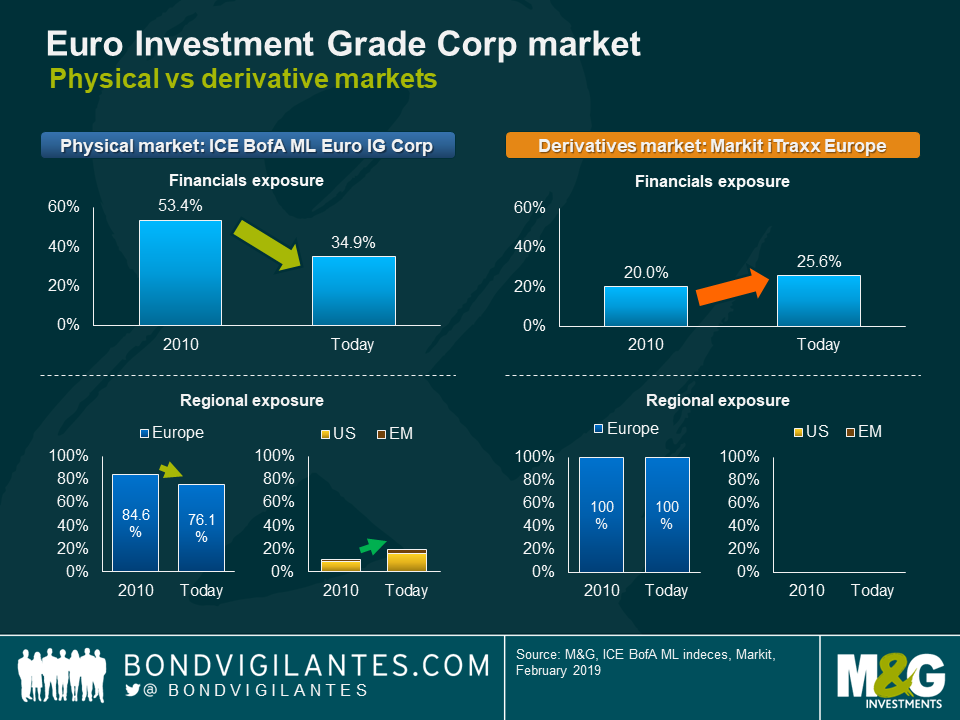

Take a look at the charts below: on the left-hand side you can see two ways in which the European investment grade index has changed since 2010. Firstly, the financials exposure of the index has decreased considerably, from 53 per cent in 2010 to 35 per cent today. The financial sector is generally one of the most impacted sectors during a downturn, as we saw in the 2011-12 European sovereign debt crisis. Secondly, the regional concentration of the index has decreased, from 85 per cent Europe in 2010 to 76 per cent today. This exposure has been taken up mainly by the US and emerging markets, making the index more geographically diversified.

It is also interesting to compare this to the Euro credit derivative market (on the right-hand side). The composition of the Credit Default Swap index (iTraxx) has also changed, but in the opposite direction: financials exposure has grown by around 6 per cent, while regional exposure to Europe remains at 100 per cent. While it might seem strange that the composition of these two indices moved in opposite directions, there are good reasons why this happened: the physical index is a market capitalisation weighted index which includes companies issuing in Euros. The derivative index is an equally weighted index which only includes European entities. This means that over time the physical one has been able to better capture some of the key developments that have been taking place in the European credit market, making this index more diversified. The banking sector has borrowed less compared to traditional corporates (both as the former tried to deliver post the GFC and Eurozone debt crisis, and because their bonds were ineligible for the ECB QE buying programme, reducing the yield compression benefits that corporate debt received).

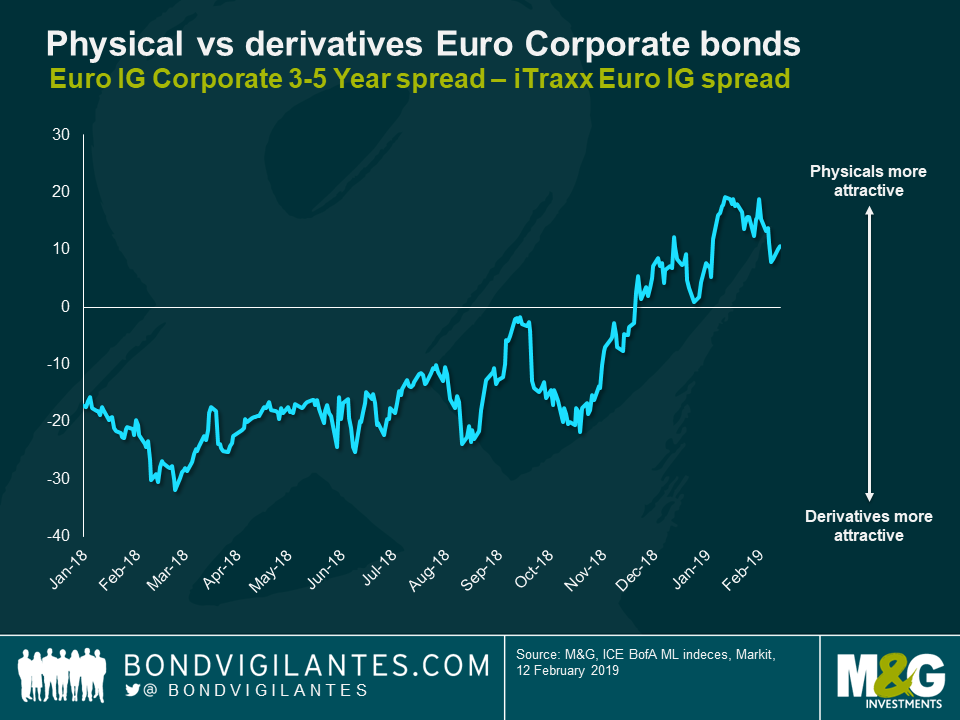

What does this all mean for investors? Firstly, if we see another Eurozone recession, it will be important to bear in mind that the derivative index could be more impacted than in the past, while the physical bond index, despite its rising BBB exposure (up by from 48% in 2012 to 59% now) could prove relatively more resilient thanks to its better diversification. Also, the iTraxx Euro IG index has recently outperformed the physical market (see chart below) and is now looking relatively expensive. These together give investors an opportunity to de-risk/hedge their portfolios by shorting (i.e. buying protection) this index.

On the other hand, if you want to add some Euro credit risk but have a Eurozone recession at the back of your mind, one good way of doing so would be through Reverse Yankees. These are bonds issued by US companies in Euros, a market which has been growing significantly over the past few years and which should be less impacted by a Eurozone recession.

Only time will tell whether the Eurozone will enter recession imminently. Either way, the changing composition of European credit over the last ten years shows that investors should always remain aware of the makeup of the indices and markets in which they invest.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox