The changing nature of market liquidity – understanding banks’ corporate bond inventory

When looking at the risk premium embedded in the extra return you receive in owning corporate debt versus “risk free” governments, one of the factors that we have to take into account is the less liquid nature of corporate bonds. This adds to the potential risk premium from a liquidity and transaction cost perspective. A constant theme since the financial crisis has been the belief that the crash removed the abundant liquidity of the corporate bond market, and therefore corporate spreads should now be intrinsically wider.

The first chart below shows the annual moving average of dealer inventory from 2006 to date, this peaked near $200 billion and has collapsed towards $20 billion, a 90 percent drawdown in committed capital. By definition, this does not sound good for liquidity and corporate bond risk premiums.

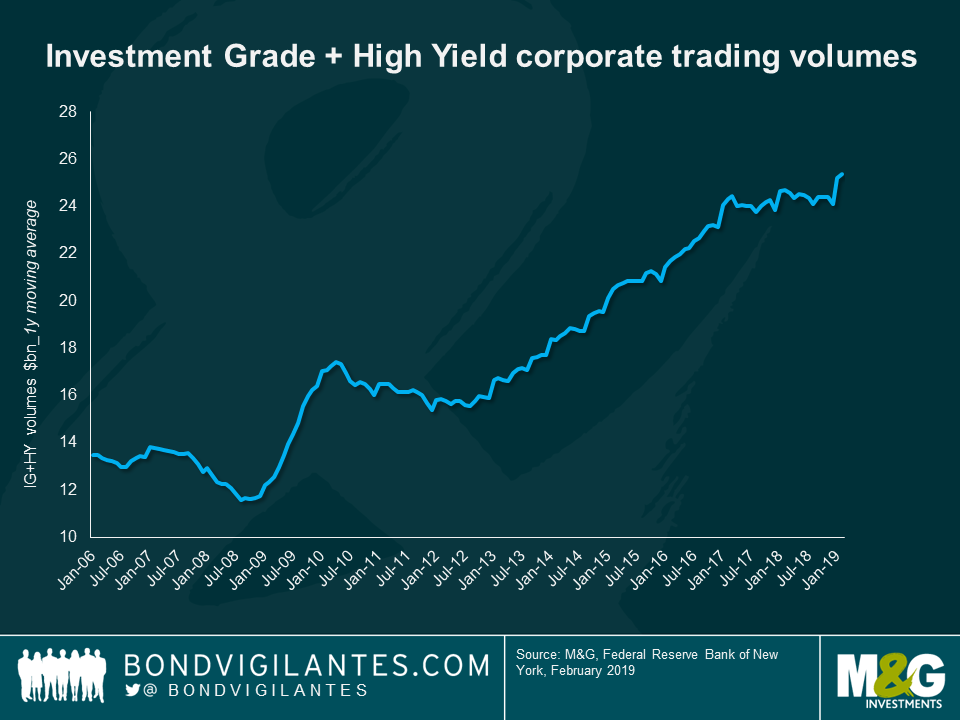

The second chart shows actual dealer volume over the same period. This has roughly doubled from peak to trough from circa $12.5 billion to $25 billion.

The obvious conclusion is that whilst capital committed has collapsed, real turnover has increased. This is depicted in the final chart below.

Inventory management has significantly improved from 5 percent turnover in the summer of 2008 to 80 percent as of now; that’s a considerable change. This change is highly understandable though, given the increase in banks cost of capital from a market and a regulatory perspective post the financial crisis. It is fairly clear that the bloated inventory of the past was not designed to facilitate trading, but more indicative of the traditional bank lending nature of these institutions (trading books then were often given an “available for sale” break not available in traditional lending). These days it appears that inventory is primarily there for trading, not investing. This is a healthy outcome for the market, the weakness in corporate bonds in the financial crisis was exaggerated by banks removing their investment inventory from their bloated balance sheets in the midst of a funding crisis. This technical environment is no longer present, which is good news for the corporate bond asset class.

Commentators constantly point to the collapse in investment bank balance sheets as a Cassandra with regard to corporate bond spreads. These concerns are understandable, but analysis of the numbers show that the bloated balance sheets of the past were not a good guide to probable liquidity, and one could argue these positions actually increased the volatility and the pain of the financial crisis.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox