The Case for People’s Quantitative Easing by Frances Coppola. An interview and a competition

A decade on from the Global Financial Crisis after multiple rounds of QE across the developed economies, we are stuck with mediocre growth rates, the anticipation of renewed policy easing and the prospect of yet more bond buying from the ECB.

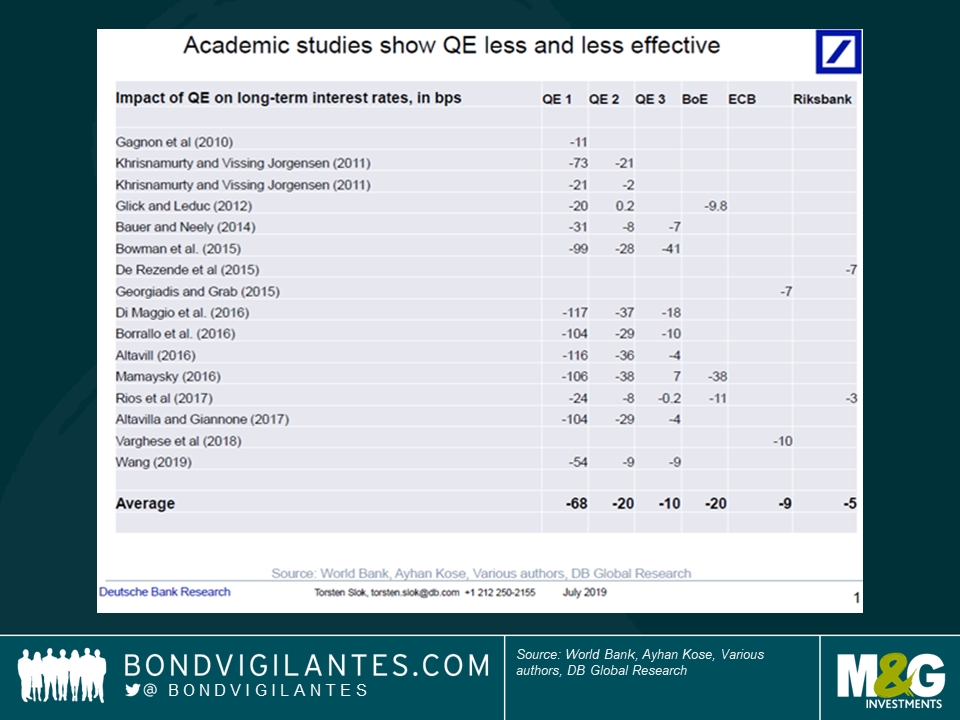

Yet much of the academic research into the impact of QE suggests there are diminishing returns from successive bouts of bond purchasing. It also seems likely that by boosting all asset prices in distorting the value of the risk free asset (gilts, treasuries, bunds etc) the unintended consequences – like a rise in inequality – might be doing more harm than good.

In this short video I interview the famous financial author, Frances Copolla, about her new book – ‘The Case for People’s Quantitative Easing’ – the cover of which shows a helicopter dropping bank notes on the town below. That should give you a clue as to some of her suggested alternative ways to stimulate economic activity! Whether policy makers are willing to go that far is debatable, but policies like student debt relief, or money printing to fund a Green New Deal could certainly find real world support.

We are also running a competition to win a copy of Frances’s book. To win a copy, answer this question: how much QE has the Bank of England done in the U.K.?

[This competition has ended]

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox