EM Debt: 2019 review and 2020 outlook

2019 proved to be a spectacular year for returns in most asset classes and emerging market debt was no exception. Returns were driven by a combination of cheaper valuations to begin with and also helped by the market-wide U-turn in going from pricing in Fed hikes to cuts and by the subsequent US rate rally. Some key risks were also priced out as the year moved on, including the US-China trade war after the Phase 1 deal was announced.

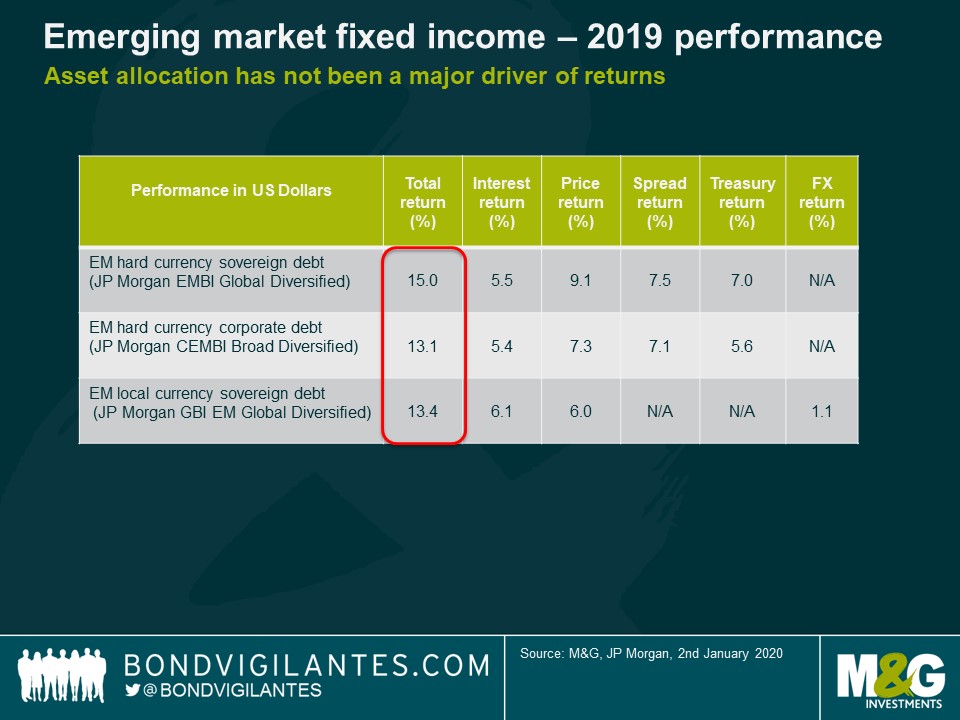

Asset allocation between hard, local and corporate debt was not a major call in 2019

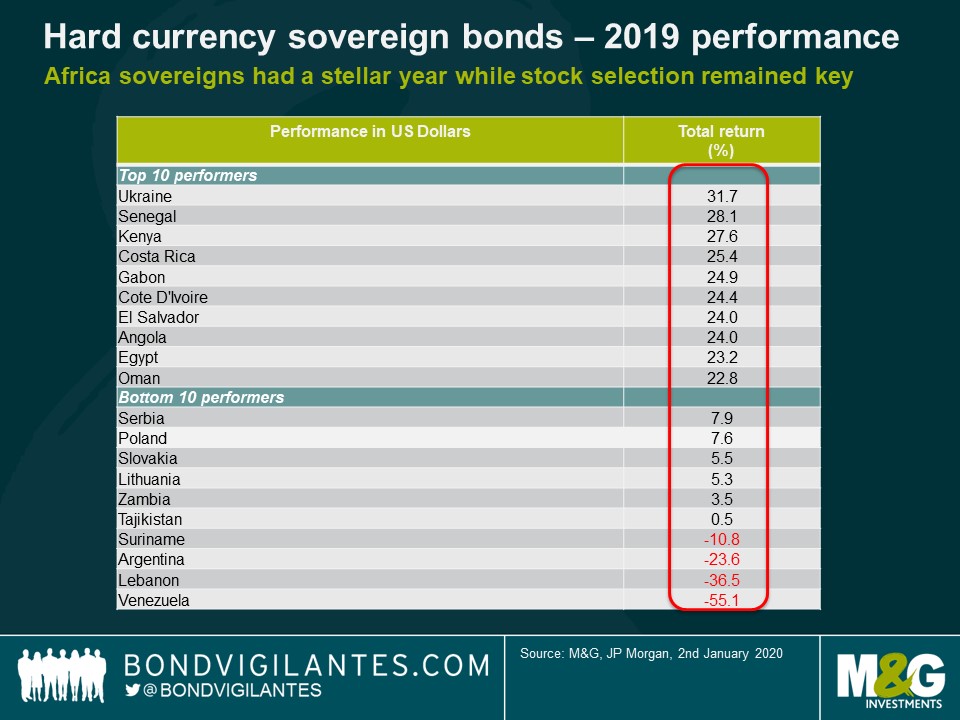

The key call in 2019 was to be long most assets and avoid the large tails, particularly Argentina and Lebanon which had a combined index weight of over 5%. This makes 2019 one of the years with the largest percentage of assets heading into a restructuring since 2001, when Argentina entered its last restructuring.

Differentiation of performance between countries and also within countries

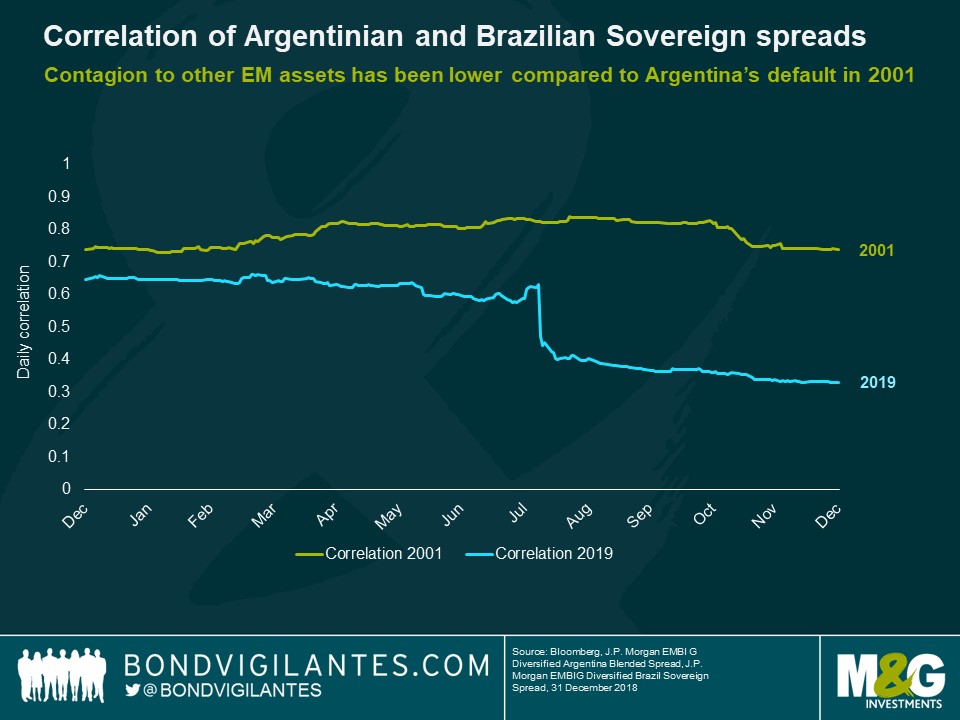

Despite the high level of debt becoming distressed in 2019, it is encouraging that markets (correctly) treated both sell-offs as being idiosyncratic, not systemic. The correlation between Argentina and Brazil spreads, for example, was much lower this time around than in the early 2000s. The asset class is much more diversified than it was in the early 2000s: there are almost 80 countries represented now, while there were fewer than 20 then. Many countries, Brazil included, also managed to improve their debt profiles by funding more in their local currency instead of via external debt. This increased resilience and has helped to lower contagion risk.

It was also reassuring to note that, even within single countries, there were large differences between individual credits. For example, while Argentinean corporates underperformed somewhat, they still returned a not-too-shabby 8.4% in 2019 despite the unfavourable macro environment. Investors have been able to differentiate credits, including the ones that have lower leverage and foreign exchange earnings.

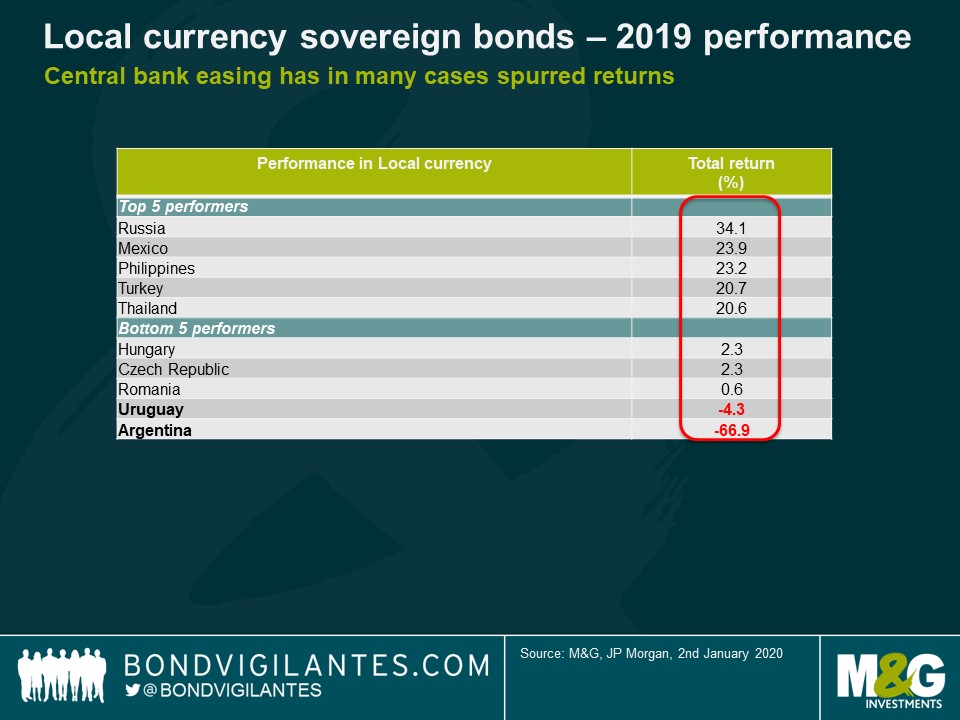

Similar divergences in outcome were also seen in local currency bonds where, for example, contagion from the depreciation of the Argentinean Peso only mildly impacted Uruguay, an economy which has strong trade and economic links with its neighbour.

Outlook for 2020

The stellar returns produced in 2019 are unlikely to be replicated in 2020. This is mainly since starting valuations, particularly in spreads but also in local rates, are less favourable than those which we had a year ago.

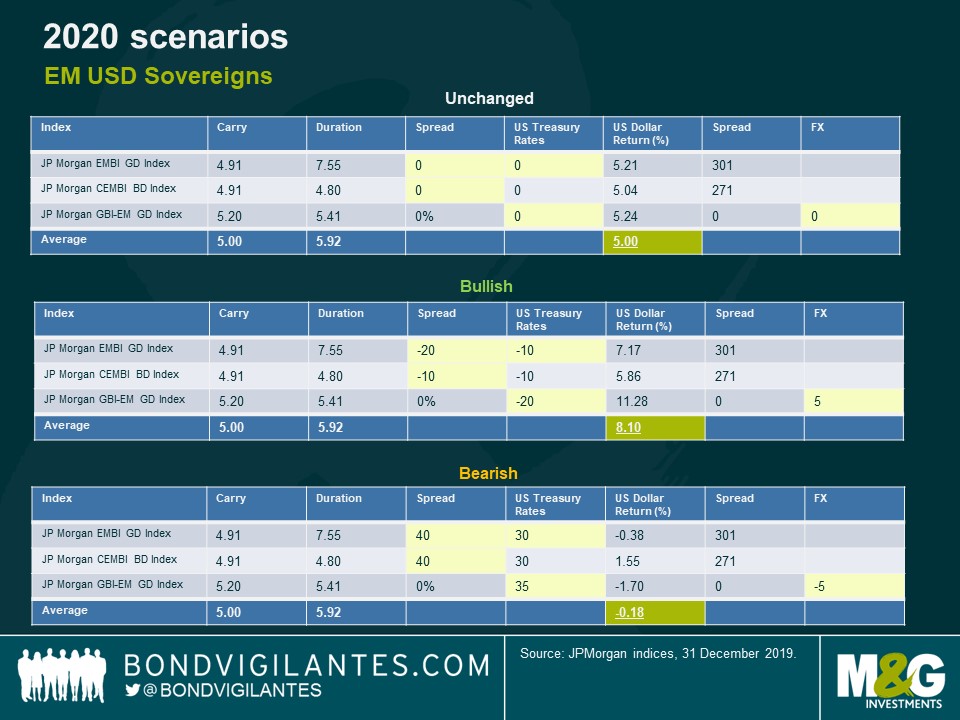

Below are three scenarios of potential returns. Of course, there are several assumptions that need to be made here. The below scenarios assume parallel spread or yield shifts and include the initial carry but not the difference in yield movements through the year.

Scenario A: Unchanged

The unchanged scenario (which almost never happens in EM) outlines potential returns should everything be constant: essentially returns based only on carry and with no currency movements versus the US dollar.

Scenario B: Bullish

A bullish scenario would reflect a supportive macro environment with growth improving in many EM economies, the US slowing only mildly, continued easy monetary conditions by developed market central banks and no worsening of global geopolitical risks – of which there are plenty. Read Charles’ recent blog for a sample of some potential geopolitical risks for EMD investors to watch in 2020.

Scenario C: Bearish

A bearish scenario would reflect a more challenging macro environment, with global and EM growth slowing further, or a scenario of less accommodative policy by global central banks and rising inflation, a worsening of geopolitical risks or policy mistakes in various economies.

Given that few EM central banks are likely to continue cutting rates this year, currencies rather than rates will likely be the key driver of returns in all scenarios. Most EM and DM central banks are also now done with or close to ending the monetary easing cycle, so there is much less scope for a rally on local rates.

Despite favourable valuations of EM currencies (in absolute terms but also relative to external debt), I remain neutral overall in terms of asset allocation given the uncertainty of the various geopolitical risks and potential impact on the US dollar. Similarly to my view in 2019, I do not expect asset allocation to be a major driver of outperformance but rather a directional call on the markets and, to a lesser extent, specific countries and managing tail-risks appropriately.

Key country calls will be centred around the higher yielders such as Argentina, in which we moved last month from neutral to small overweight after the sell-off, expecting a higher recovery value than current prices (low to mid 40s) and a restructuring being completed in 2020. Other likely candidates include Ecuador and select frontier countries such as Sri Lanka, Ghana or Ivory Coast.

As a consolation, while EM debt may not look cheap when compared to prevailing valuations a year ago, most other asset classes (equities, US high yield) have also rallied materially. So on a relative basis, maintaining exposure to the asset class may still look like an attractive proposition for its income in an environment of still low yielding assets elsewhere.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox