Africa’s Covid-19 response: official financing and calls for debt relief

To date, there have been several packages announced by multilateral financiers that will support African countries with their Covid-19 responses. These packages are urgently needed: first, to finance the health response and, second, to cushion the economic impact.

The IMF has announced $1 trillion of firepower to help the global response to the health, humanitarian and economic impacts of the Covid-19. $50 billion of this is earmarked for low-income and emerging countries. Ten-year interest-free loans have already been announced for lower-income countries, including Rwanda, Senegal and Madagascar. The World Bank has also announced that $160 billion will be available over the next 15 months, and has begun approving emergency financial packages. The African Development Bank is also providing substantial capital, including via a $3 billion social bond it issued last week.

Debt pressures

Even with the rescue financing, some African countries’ capacity to repay debts could be overwhelmed. This is because many African countries had debt pressures even before the outbreak of the virus. At the end of last year, 19 lower-income African countries were in debt distress or at high risk of debt distress according to the IMF and World Bank.

This led the IMF and World Bank on 25th March to make the call for “all official bilateral creditors to suspend debt payments from IDA countries [lower income countries that qualify for highly concessional borrowing from the multilateral lenders] that request forbearance”. Meanwhile, a group of African finance ministers urged for $100 billion of financing, and reemphasised the need for debt relief via a statement from the United Nations Economic Commission for Africa.

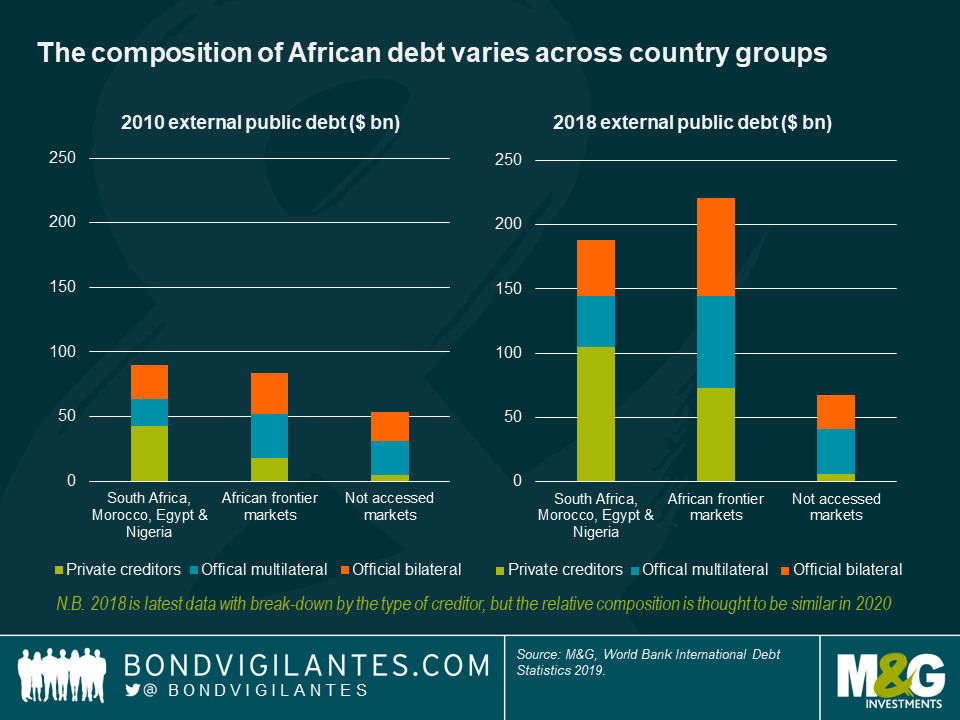

Historically, securing debt relief has been a long process taking many years. To be useful in 2020, debt relief would need to be provided at unprecedented speed, at a time when African debt stocks have become more complex following the growing diversity of creditors. When the G8 countries, the main members of the Paris Club—a group of creditors who try to find sustainable and coordinated solutions to countries’ debt payment problems—announced sizeable debt relief in 2005, Africa’s debt stock was mainly owed to them directly, or to the multilaterals (whose boards the Paris Club members dominate). Since 2010 however, the composition of Africa’s debt has changed, with 20 African countries accessing the markets and the emergence of China and other non-Paris Club lenders. Whatever plan emerges, it must take this new reality into account.

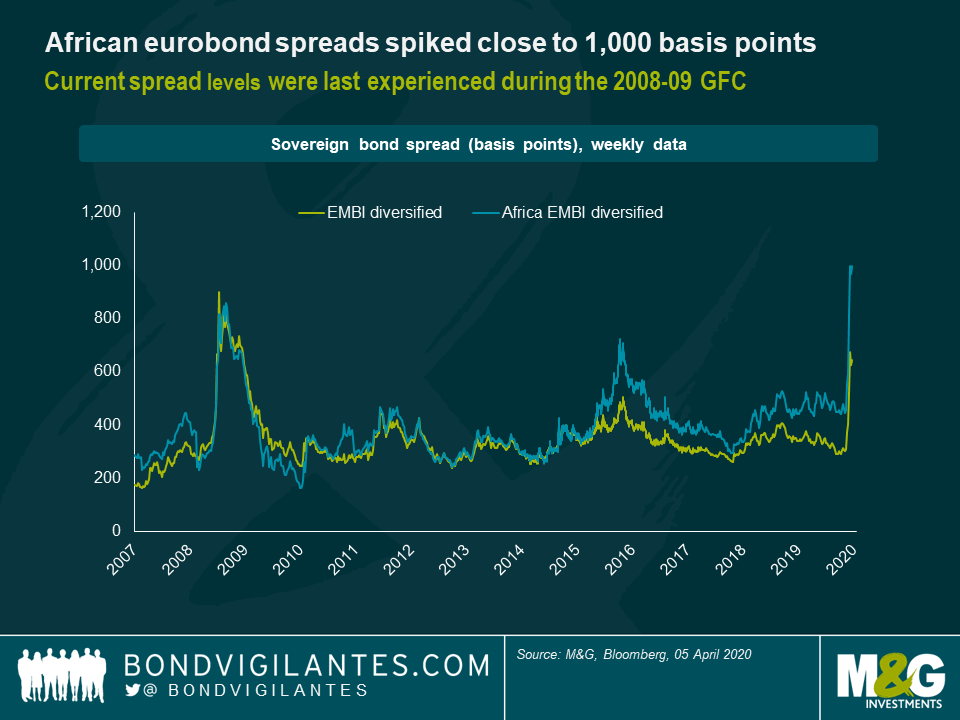

While there are debt pressures from coupon payments, there are very few African eurobonds requiring repayment in 2020 or 2021. The only large maturities due this year are from South Africa (paid in March), Egypt (at the end of April), and Morocco (in October). These could be met without any new borrowing. Thankfully, no bonds come due from smaller sovereigns: African bond spreads spiked close to 1,000 basis points, signalling that any refinancing would be problematic at present.

The new composition of Africa’s debt

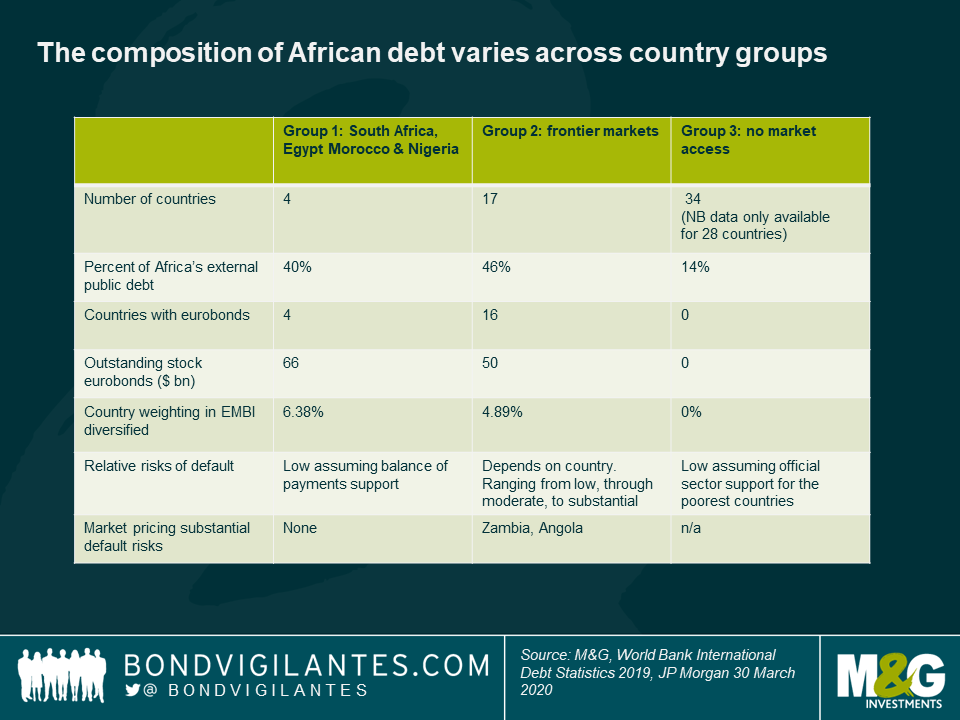

There are 54 African countries with a wide variety of debt stocks, but a broad three tier typology of countries is helpful to understand the debt challenges.

- Group 1: The larger economies, with more developed financial markets, including South Africa, Morocco, Egypt and Nigeria. These four countries have had regular market access and are responsible for about 40 percent of Africa’s external public debt. More than half their lending is commercial, but there has still been some official sector borrowing. China does not dominate the lending.

- Group 2: These are the 17 frontier economies that have borrowed more and more from all sources since 2010. They include Angola, Ghana, Ivory Coast, Kenya and Zambia. Their commercial debt stocks tend to account for a third of their debt, including eurobonds, syndicated loans and oil-backed loans. Here, the groups’ external debt stock is split very evenly between bilateral, multilateral and commercial creditors. China is a very important creditor in this group.

- Group 3: This large and varied group of countries has not accessed the markets. The group is responsible for just 14 percent of Africa’s external debt. The countries have small debts in US dollar terms for two main reasons. Either they are low-income countries so carry much less debt (for example Mali, Burundi and Uganda), or they have not needed to borrow much externally (for example Botswana or Mauritius).

Support to the ‘Group 1’ larger economies

This group’s needs vary by country but each needs the markets to stabilise and outflows to halt for better financial health. South Africa and Egypt both need to secure IMF programmes for balance of payments support. South Africa’s economy was under pressure even before markets seized up, and a lockdown of its economy has been required in response to a growing number of Covid-19 cases. Egypt is also trying to contain an outbreak, while foreign exchange inflows have decreased from tourism, the Suez canal receipts, remittances, and as more risk averse foreign investors have pulled-back from their domestic debt.

Nigeria is the only country in this group that could access more concessional support, and could even be included in an effort to suspend payments on official bilateral debt. Nigeria is completely oil-dependent and has been under intense pressure from lower oil prices. Meanwhile, Morocco appears relatively more stable than the others, with a credit rating agency affirming its investment grade rating. Morocco also has a precautionary IMF program that could be increased in size.

Support to the ‘Group 2’ frontier economies

This is where the biggest debt challenges are. There is a risk that, for some of these frontier countries, the health and economic crisis also becomes a debt one. This could include a request for the suspension of bilateral official debt repayment by some countries, and in others an extension of debt repayment difficulties to bilateral, multilateral and commercial obligations.

Zambia and Angola are most at risk in this group, having been vulnerable before Covid-19. Markets are now pricing their default. Neither must repay any eurobonds in 2020 and 2021, but there are large amortisations due to China and on other commercial debts this and next year. Angola has an already large IMF programme in place, while Zambia urgently needs one. But unless China—a large creditor to both—also provides some sort of relief, there will not be any meaningful change to the 2020 debt burden. The G20 virtual meetings are essential here, as it is one forum where China and the United States are on the same conference call.

Meanwhile, a second tier of risk comes with Ethiopia, Ghana and Gabon who, while being more resilient, are also subject to the impacts of the global recession and may yet tragically face their own large domestic virus outbreaks. For each of these countries, scaled-up concessional financial support from the official sector will be essential in 2020.

Benin, Cameron, Ivory Coast, Ethiopia, Ghana, Kenya, Mozambique, Senegal and Zambia are all ‘IDA countries’ in global debt markets, meaning that they have the potential to be candidates for some form of debt payment suspension by bilateral creditors in line with the IMF and World Bank announcement.

Support to the ‘Group 3’ no market access countries

Countries in this group have either low debts, or have less complex debt stocks from fewer creditors, dominated by a more patient official sector. The risk of an additional debt crisis is lower for them. Despite this, Covid-19’s health and economic impacts could be catastrophic in some low-income countries with large numbers of people living below the extreme poverty line. The urgent need is for official financing for health, humanitarian needs and to counter the economic impacts. Any available grant financing is likely to be applied to the poorer countries in this group, along with interest-free loans.

Uncertainty ahead

While the impacts on African countries of the global recession are now playing out, it is hard now to predict how severe individual country’s Covid-19 outbreaks will be. While advanced economies can currently borrow at exceptionally low interest rates for their stimulus, African countries do not have this luxury. It is at times like this we need to be thankful for the international organisations, as a global pandemic requires a coordinated global response.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox