High Yield in the Covid Crash: Risky, but potentially very rewarding

1. What’ s happened to the high yield market in the last month?

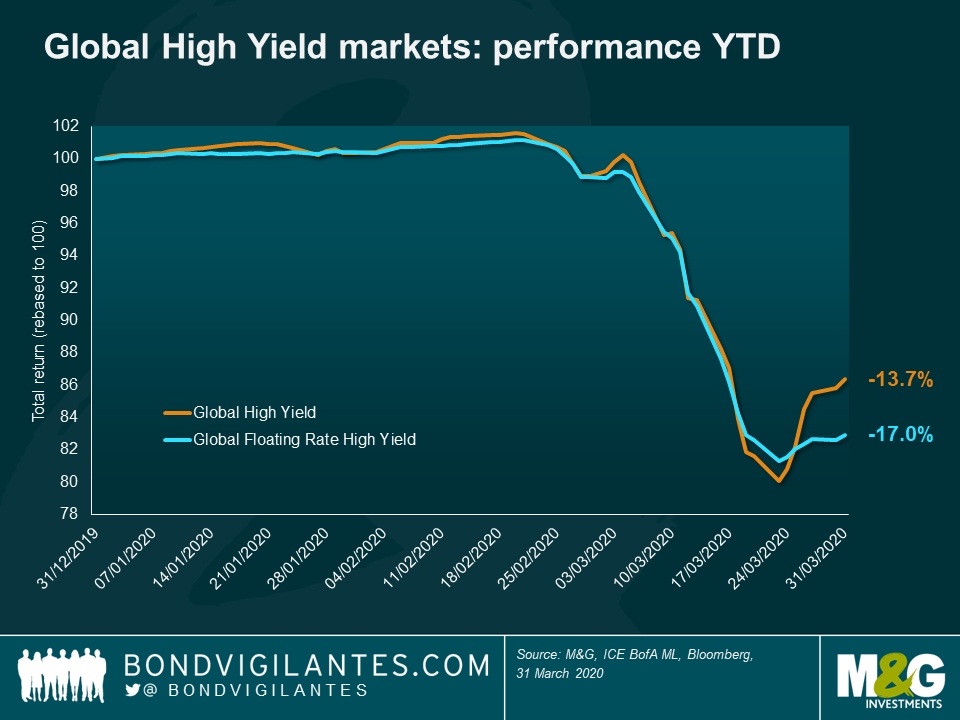

We’ve seen negative returns of -12.7% for the global high yield market. Following a weak February this brought the Q1 return to -13.7%. To put this in context, this was the second worst month and second worst quarter since 1998. Only October 2008 and Q4 2008 saw a more negative drawdown for the market.

2. Can it get worse?

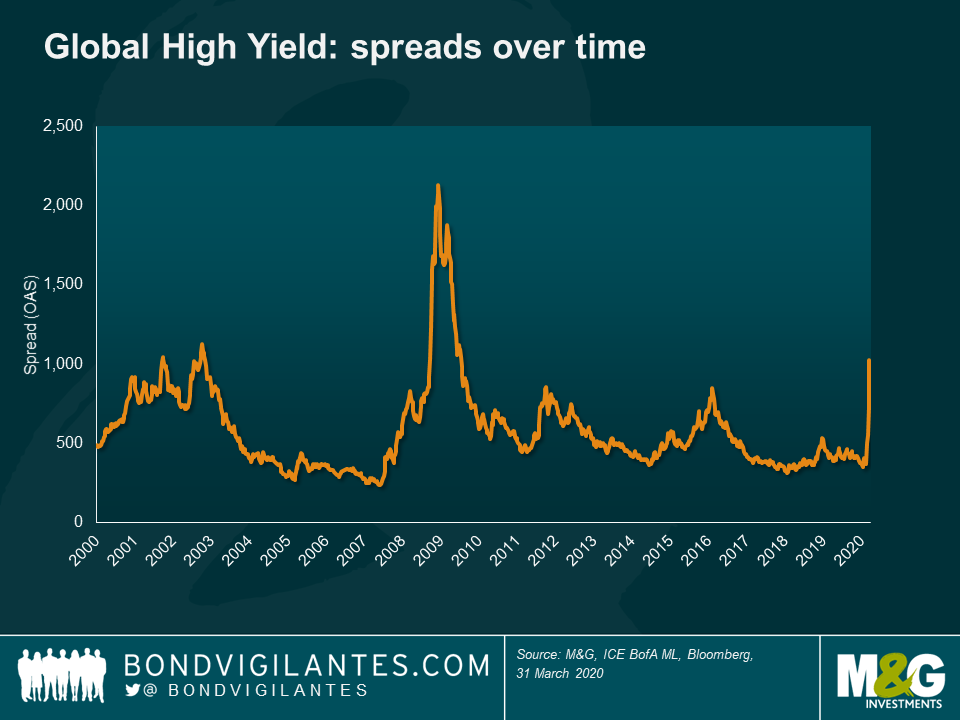

Yes, but I think probably not that much worse. Over the long term, spreads have been wider (topping out at over 2,000 basis points following the Lehman Brothers bankruptcy – see the chart below), and they are currently hovering at just under 1,000 basis points. It is hard to pinpoint the bottom of this particular market cycle. It may have been a few days ago, it could be in a few months’ time, but what gives me some hope and comfort that it might not get much worse is that:

- The policy response we’ve seen has been swift and hard-hitting both in terms of supporting markets and in terms of direct fiscal support for companies and individuals. Remember, the last time spreads got to 2000+ was before the US passed the Troubled Asset Relief Program legislation.

- This coronavirus crisis has a definitive cause and thus should have a definitive end: once infection rates subside considerably and life returns to a semblance of normality, the world will move on. Of course, there will be long-lasting economic impacts, but this will not be forever and, given the action by policymakers, I do not think we are looking at an existential crisis for the high yield markets.

3. Will there be more defaults?

Definitely. Global default rates were in the low single digits for high yield coming into this. There is no doubt that we will see more companies restructuring their debts and in some cases failing altogether and going into liquidation. I would make two points here:

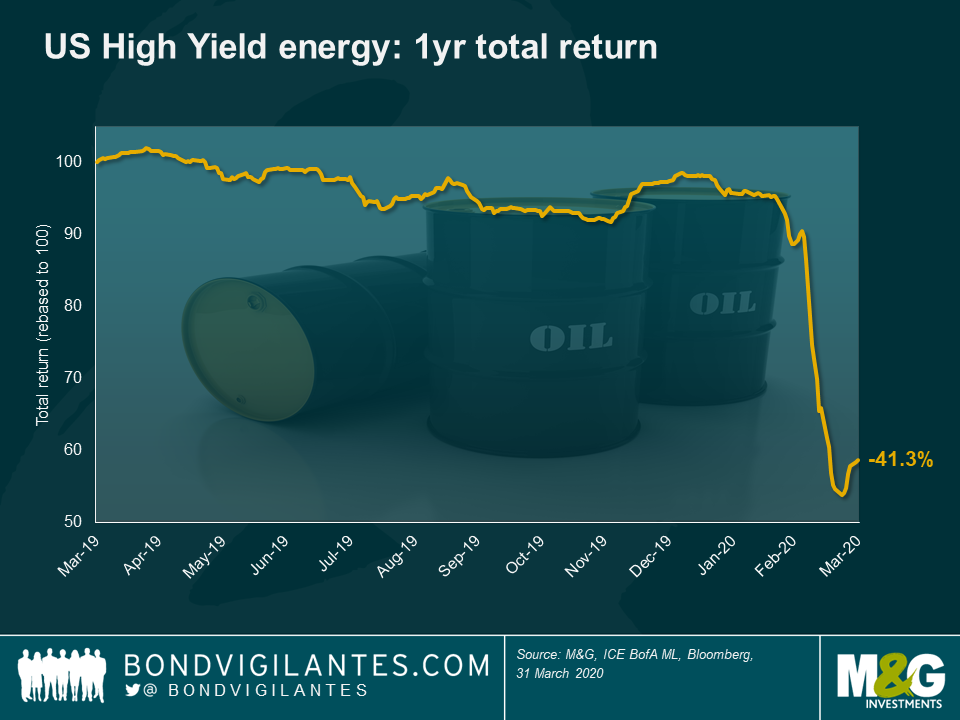

- There will be a huge dispersion in defaults between sectors. There is little doubt we will see a very large and substantial uptick in energy defaults given the recent OPEC actions and the subsequent oil price crash. Indeed, a few days ago a high yield issuer, Whiting Petroleum, filed for Chapter 11 bankruptcy protection. The company’s bonds are trading at 5% of face value, implying a loss to bondholders of around 95%. There will be more, and indeed the market has already started to price this in (see chart below for the US High Yield Energy bonds – a loss of almost 50% from peak to trough). Other sectors that look particularly vulnerable are transportation, non-food retail, automotive, basic industries and consumer cyclicals.

On the other hand, food retailers, packaging businesses, Technology, Media and Telecom companies, pharmaceuticals and healthcare operators (which are all big parts of the High Yield market) will either see relatively limited impact to their businesses or in fact an upturn.

- Defaults do not always mean permanent destruction of capital. A business may default on its debt in the short term, but if bondholders receive equity as a result and the business is otherwise viable in the long term, then riding out a restructuring in this situation can often be the optimal strategy for recouping losses. This is the time when distressed debt expertise will really count.

4. So defaults are going to rise but what’s priced in in terms of default rates?

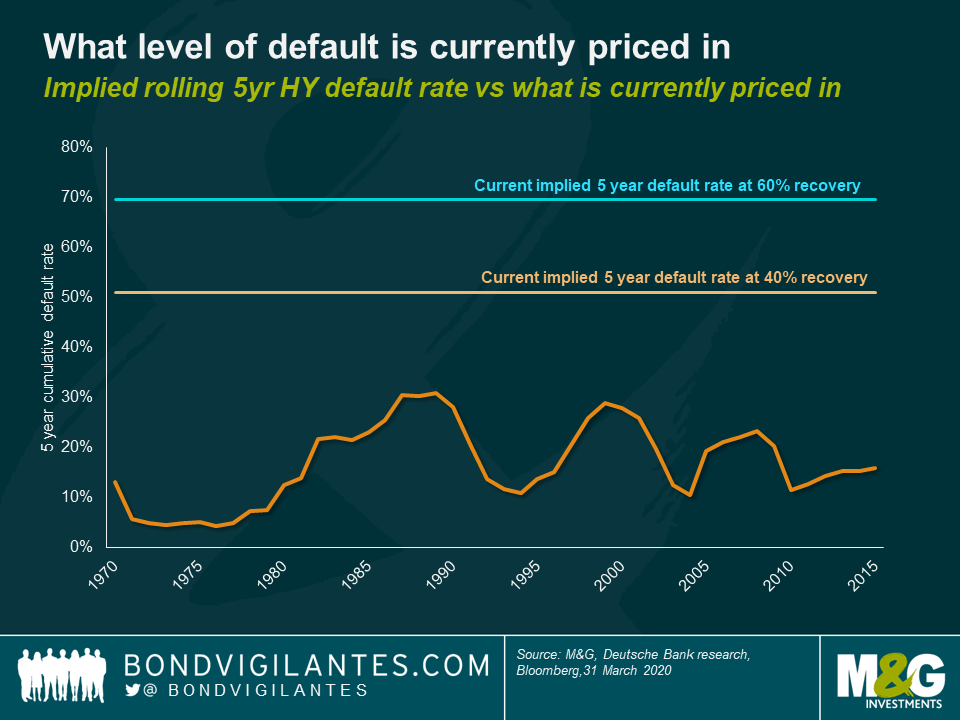

Quite a lot of the bad news is priced into spreads, and then some. If we look at the chart below, five year cumulative default rates of a little over 50% are now priced into the market (assuming a 40% recovery). For investors focused on senior secured debt (e.g. senior loans and FRNS), the implied default rate in spreads is even more pessimistic at just under 70% over five years (assuming a 60% recovery). As we can see below, historically, the peak for five year default rates has been 31%. I would argue that the market is already pricing in a very extreme and painful scenario for defaults. Of course there will be losses for bondholders, but I struggle to see losses of this magnitude. Consequently, I think high yield valuations currently look cheap.

5. What’s the potential upside for investors?

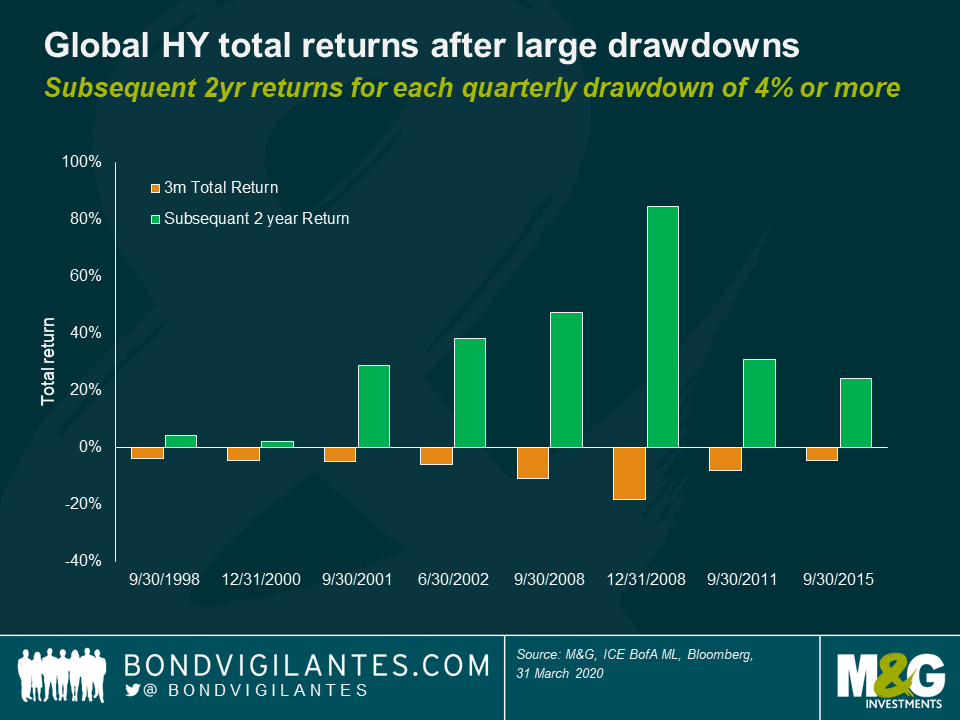

In the short term, no idea. The market is still very volatile and fairly illiquid. We could well see more short term losses rather than gains. However, in the medium to long term (e.g. a time horizon of say two years), the potential returns could be meaningful. Again, if history is any guide, the chart below shows the subsequent two year returns from the global high yield market following a quarterly drop of 4% or more. Over the past 20 years, this has always generated a positive return, and indeed over the last six such dips the returns have been in excess of 20% over the following two years. This is not inconceivable either at this point in time. If for example the market has a spread of 1000 basis points, and in two years’ time this normalises to circa 400 basis points (a level consistent with more recent history), with four years of spread duration that would mean a potential capital gain of 24%. So all in all, certainly not without risk, volatility and defaults, but also potentially quite rewarding.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox