Is market pricing of African eurobonds unfair?

When Ken Ofori-Att – the Ghanaian finance minister – presented mid-year budget revisions, he highlighted the huge challenges of the pandemic. The Ghanaian response to COVID-19 has been quick, well organised and aimed at stopping economic weakness becoming a depression. But the rescue is coming at a large financial cost to the country. The fiscal deficit is forecast to be around 11% of GDP in 2020, while economic growth is expected to slump to 0.9% from a stellar average of 6.8% over the past three years.

While advanced economies and emerging markets with deep domestic debt markets have raised cheap money, many frontier economies have struggled. Like Ghana, they tend to rely more on external borrowing to finance their deficits. Some of this money comes at concessional interest rates from the IMF and multilateral development banks. But for larger volumes, frontier markets have tapped global debt markets. This does not come cheap, even as global investors have searched for yield.

The high cost of borrowing led Ghana’s finance minister, who had a successful career on Wall Street before entering politics, to argue that global capital markets are unfair to African issuers. He argued that “there is no basis for us borrowing at 6%, 7%, or 8% while other countries borrow at cheaper rates”.

Is there an ‘Africa premium’ on global debt markets?

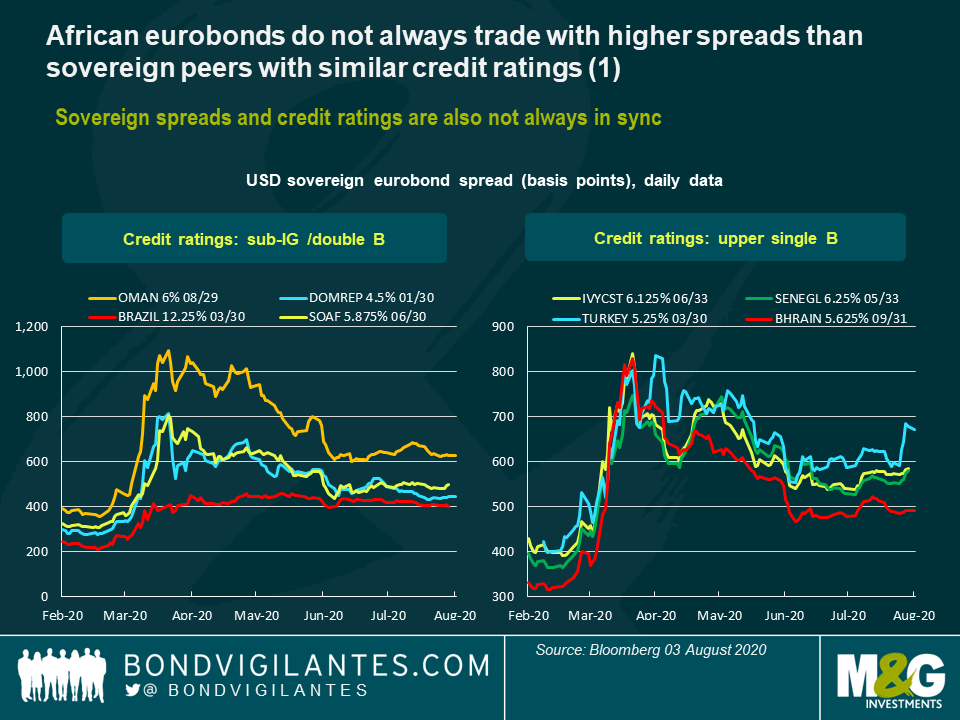

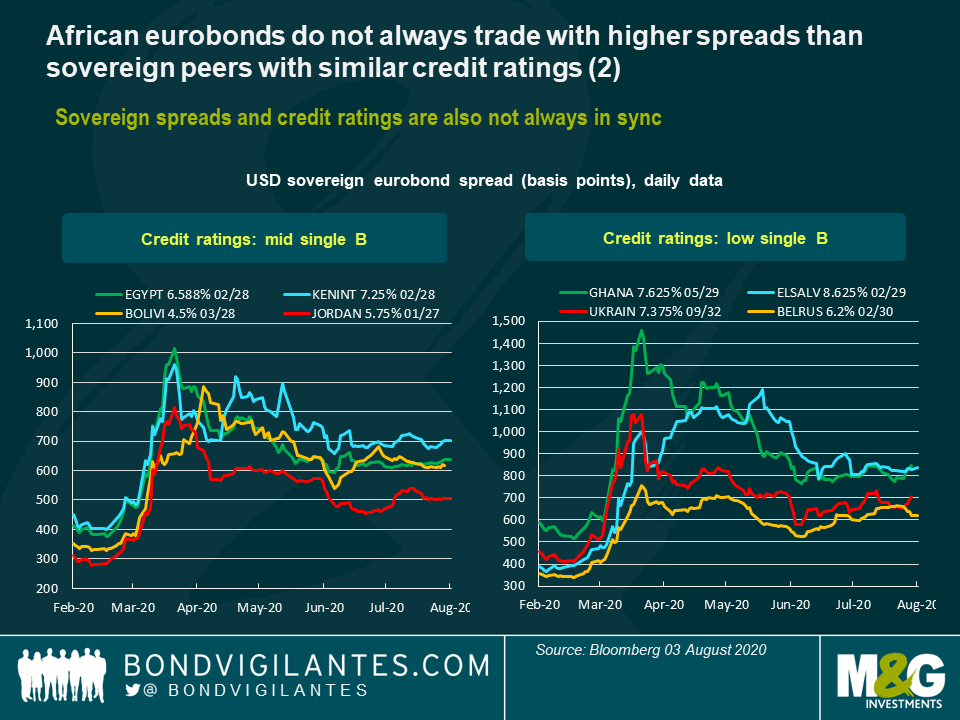

Three methods are used to evaluate any unfairness. First, specific African bonds can be compared to those of similar maturities from emerging market peers with similar credit ratings.

- Compare specific African bonds to EM peers with similar maturity

Here the results are varied and depend on which comparison is made. For example, you can compare a 10-year USD South African eurobond with one from Brazil. Despite similar credit ratings, Brazil-30s have a spread (over US Treasuries) of around 305 basis points, while the spread on South Africa-30s is around 486 basis points. However, South Africa-30s trade better than Oman-30 – also with a similar credit rating – which have a spread of over 600 basis points. Similarly, in a higher single-B credit rating category, Senegal and Ivory Coast trade better than Turkey but worse than Bahrain. And in a lower single-B credit rating bucket, Ghana trades with a higher spread than El Salvador, Ukraine and Belarus. In these cases market pricing might be out of sync with the credit ratings, or the credit rating might be out of synch with the sovereigns. But neither is ever a perfect guide to debt sustainability. These comparisons justify why Ghana’s finance minister raised this issue, but fall short of confirming any systematic unfairness across African sovereigns.

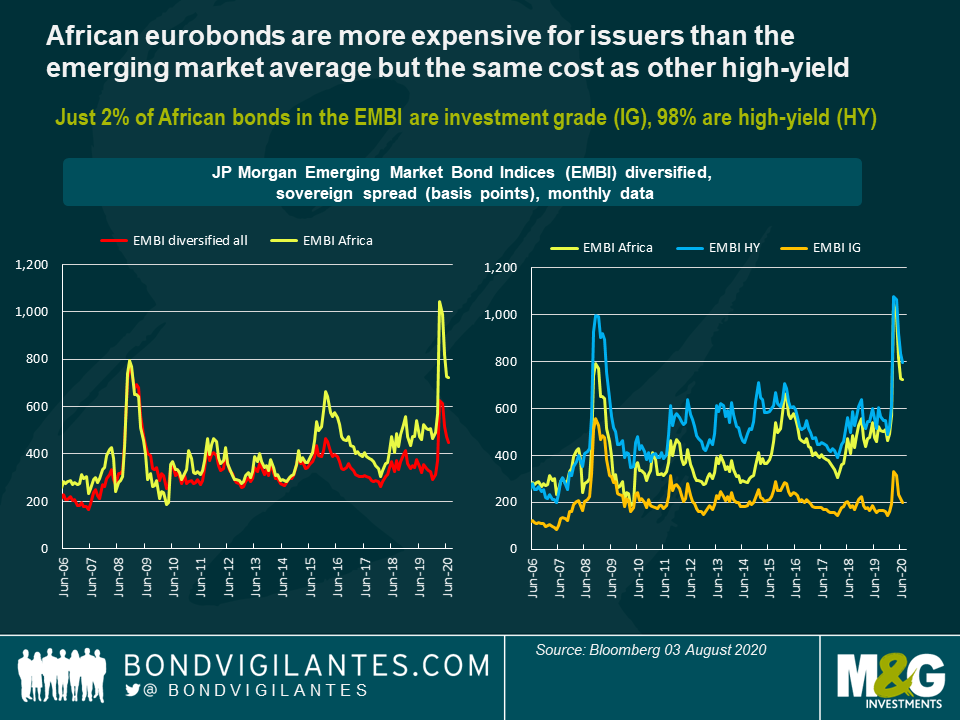

2. Compare spreads of a larger sample of eurobonds

The second method is to compare the spreads of eurobonds across a larger sample. Between 2006 and 2015, African eurobonds in JP Morgan’s emerging market diversified bond index (EMBI diversified), had similar spreads to the index average, including during the global financial crisis. However, since late 2016, African eurobonds have traded with a premium. And during this crisis, this spread premium for African issuers has increased dramatically relative to the full index average. The shift since 2016 is to do with increased sub-investment grade issuance by African sovereigns over the past 7 years, which has helped grow the stock of African eurobonds to $121 billion from 20 issuers.

Only 2% of African eurobonds in the EMBI diversified have investment grade credit ratings (just Morocco’s), compared to an index average of 54%, providing some justification for higher African spreads. So a more meaningful comparison is between African eurobonds and other high yield emerging market eurobonds (also with sub-investment grade credit ratings). Once the credit ratings of the issuing sovereigns are accounted for, a premium is less easily identified.

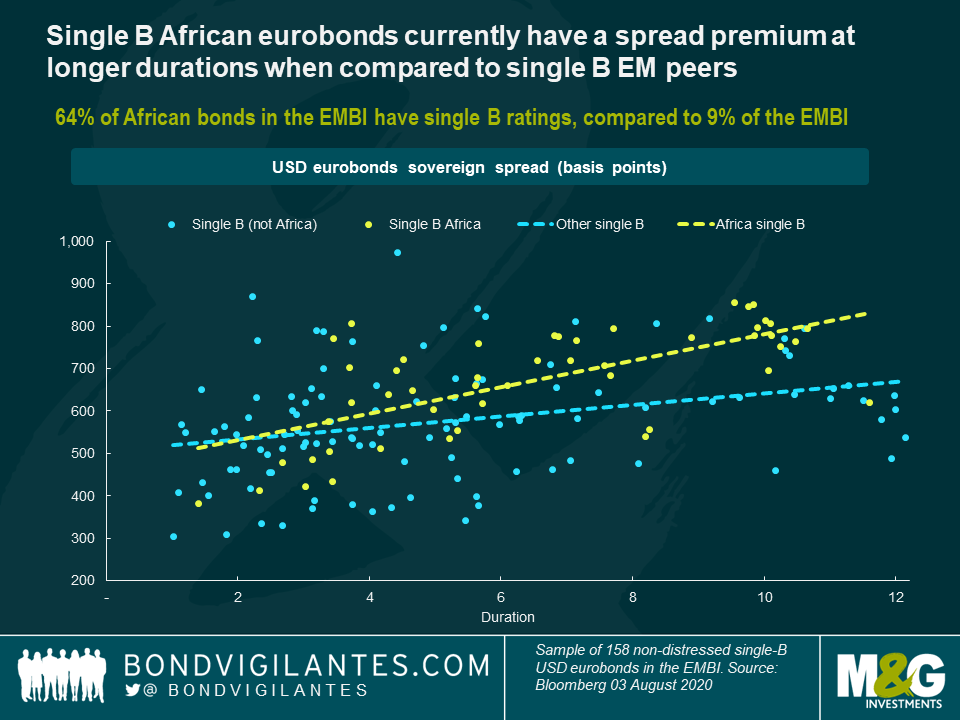

3. Focus on non-distressed eurobonds

The third method is to focus on a sample of non-distressed eurobonds with the same credit rating to allow for the varying durations of emerging market bonds. A sample of 158 single-B USD eurobonds is plotted, including 49 from African issuers. Here the analysis suggests a higher spread for longer-duration African eurobonds. While debt risks have increased during the 2020 crisis, this does not explain why African duration is doing less well than other single-B duration. One factor weighing more on African sovereigns might be the frequent G20 calls for debt service suspension.

Are the calls for debt suspension keeping African eurobond spreads higher?

Of the 17 countries in the EMBI that are eligible to apply for the G20 debt service suspension initiative, ten are African¹. In many cases the calls for a debt service suspension, or deeper debt relief, are justified by the huge pressure that lower-income countries are facing in 2020. But they also have undermined confidence that debts will be repaid in full, even for countries with market access and no clear debt problems.

There are 64 non-distressed USD sovereign eurobonds that have been issued by countries eligible for the G20 debt suspension initiative. When the spreads of these bonds are compared to a benchmark of bonds not eligible for the initiative, in this case Egypt’s eurobond curve, there is currently a spread premium of around 100 basis points. This spread premium could reflect the uncertainty of whether eligible sovereigns will suspend coupon payments on eurobonds, in line with the G20’s advice. This concern exists despite half of the eligible and EMBI included sovereigns refusing the initiative and, of those requesting it, most stressing that they seek only bilateral debt service suspension. Interestingly though, further analysis of the spread premium shows that it persists whether or not an eligible country has accepted or rejected the initiative.

Conclusion

The Ghanaian finance minister should be frustrated that they pay more to borrow than similar-rated sovereigns from other regions. But once credit ratings are accounted for, there does not appear to be a persistent higher cost of borrowing for African issuers. This suggests reforms, economic growth and reduced debt risks will be needed to improve credit ratings and reduce relative borrowing costs—or improved credit ratings metrics if it is evidenced that they over-state African risks.

Nonetheless, there is currently a higher spread for long duration African eurobonds. This may be linked to uncertainty about the debt suspension initiatives. Greater certainty on the extent of the suspensions might close this gap in 2020. But there are also other uncertainties in play, including whether specific countries are facing liquidity or solvency problems as a result of the 2020 crisis.

An in-depth understanding of the varying risks being faced across African and frontier sovereigns is going to be essential for investor strategy in the remainder of 2020 and in 2021. As data for the second and third quarter of 2020 is released, differentiated market judgments will result as the debt scars of the crisis become easier to measure.

¹ DSSI eligible countries in the EMBI include: Angola, Cameroon, Ethiopia, Ghana, Ivory Coast, Kenya, Mozambique, Nigeria, Senegal, and Zambia from Africa. Plus Honduras, Mongolia, Pakistan, Papua New Guinea, Sri Lanka, Tajikistan, Uzbekistan from elsewhere.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox