Crossing the Climate Rubicon: Energy Credit in Transition

Energy transition pathways — the move from fossil fuel-based to zero-carbon energy — involve long time-horizons and are highly uncertain, with divergent outcomes based on assumed scenarios. The Coronavirus pandemic dented oil demand and has potentially brought forward peak global demand, if it hasn’t happened already. Against that backdrop, European International Oil Companies (IOCs) have over the past year increasingly converged on Net Zero 2050 CO2 emission targets. It appears that, in today’s world, having a Net Zero by 2050 target provides a social licence to operate.

Not all Net Zero targets are born equal

It has also become clear that not all Net Zero by 2050 targets are the same. Firstly, the most robust targets include scope 3 emissions (the widest commonly-accepted scope, which includes not only direct but also all indirect emissions in a company’s value chain) for the entire business. It is in this scope that some 85-90% of all emissions in the sector fall. Robust targets will also have absolute as well as intensity-based targets, will include elements of short, medium and long term targets to catalogue the transition journey and will be linked to executive compensation. The most stringent will also have a transparent policy on lobbying that is aligned to those targets, backed up with Task Force for Climate-related Financial Disclosures (TCFD) aligned reporting and supported by Science Based Targets (SBT).

Companies like Total fall short in that they target Net Zero by 2050 in Europe alone, rather than across their global operations. BP excludes their stake in Rosneft from their target. Shell and Equinor do not have absolute targets, relying rather on intensity-based measures. OMV’s target covers Scope 1 (direct) and 2 (indirect via purchased energy) emissions only. The US IOCs Exxon and Chevron don’t even have Net Zero by 2050 targets. Perhaps a Biden presidency will wake the US IOCs from their climate slumber. National Oil Companies (NOCs) such as Saudi Aramco, Petrobras and Pemex also lag in the quality of their climate strategies. Taking these considerations into account, as well as others including disclosure and physical climate vulnerability, it is possible to rank the companies based on their energy transition credentials.

A farewell to oil

A common theme of energy transition strategies, notably highlighted by BP’s aim to become an integrated energy company, has been a move away from oil. BP sees oil production declining by 40% to 2030, whilst ENI is working towards a production plateau by 2025 and ‘flexible’ profile from 2025, implying a managed decline thereafter. Such strategies typically lean towards gas as a transition fuel, with a focus on lower production cost, low carbon composition remaining oil reserves and rising capex allocation for building portfolios of low carbon technologies including renewables (in particular offshore wind and solar) and bioenergy. Companies are also positioning themselves in the emerging Hydrogen and Carbon Capture, Utilisation and Storage (CCUS) value chains, whilst building gas/electricity customer portfolios and increasing digitalisation and electric vehicles charging infrastructure.

Preparing balance sheets for Net Zero

New business structures that separate traditional upstream operations from energy transition ones have already been announced and are being implemented. Short term, this does not imply that a full spin-off is the end game, not least as IOCs need their upstream cashflows to fund their energy transition investments in renewables and clean energy. Longer term, a split-up of the two entities is a possibility. The most likely scenario would be the spin-off of the low-carbon business through an IPO or minority stake sale. In that context, assuming the low-carbon business has reached a critical regulated asset base, its debt capacity may be higher than the upstream petroleum part. A debt transfer would not be automatic, and investor consent may not be that easy to obtain. Regardless, both entities would need solid investment grade ratings for business and financial reasons.

Delivering on energy transition involves companies preparing their asset bases for the economic reality of Net Zero. This has meant adjustments to internal oil price assumptions, triggering impairment charges against property, plant and equipment (PPE) on the balance sheet and asset write-offs of exploration intangibles. In accounting terms, this has increased gearing through the reduction in equity (E) in the gearing ratio net debt to net debt plus equity: (ND)/(ND + E).

Impairments are writing down the size of the asset base but the stranded asset debate continues: will companies end up holding oil reserve assets which become worthless as energy transition takes place? The answer depends on the type of oil reserve. These can broadly be split into two categories: proved reserves, and probable/possible reserves. The truth is that much of the balance sheet asset value reflects proved reserves from producing fields. Since proved reserve asset lives (typically 8-12 years) typically sit inside the energy transition timeframe, much of it will be produced before 2050. Not so for the probable and possible reserves, where more of the stranded asset risk resides. With a significant value of energy infrastructure still in place, and likely acceleration of transition in years ahead, it will not be a surprise to see further asset impairments. This puts increased focus on projects awaiting final investment decision today. The barrier for such a project making the grade from a return and emission perspective has never been higher.

Pressure on oil and gas companies’ cost of capital is likely to increase

An increasingly stringent regulatory backdrop, rising ESG scrutiny, climate/environmental litigation and increasing investor/bank exclusions will put pressure on oil and gas companies’ cost of capital. It seems unlikely that the recent credit rating downgrades in the sector will be reversed in haste by the agencies given pressures on cashflows from shareholders (despite the announced dividend cuts such as Shell and Equinor by two-thirds and ENI by circa 60%) and the need to reposition portfolios toward low carbon activities (where returns may be lower). And all whilst managing an orderly decline in the core carbon business from which the majority of cashflow still comes.

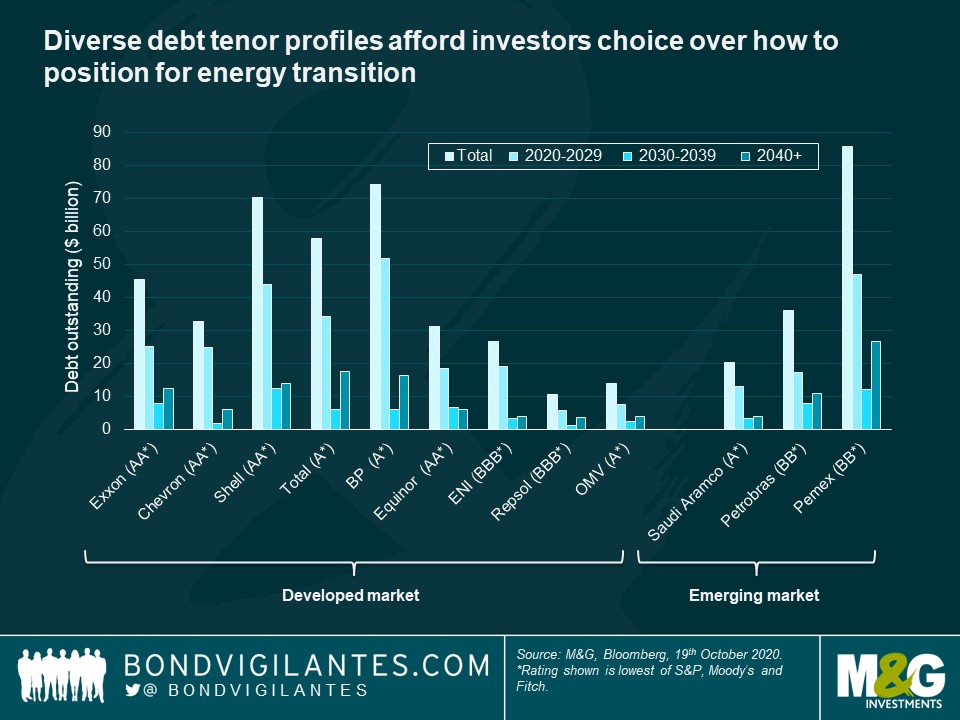

Like other corporates, IOCs issued significant debt during the Coronavirus disruption to improve liquidity, leaving large gross debt balances as a result. With gearing already elevated by the oil price collapse of 2020, and IFRS-16 impact on leverage calculation (the updated accounting regime requires firms to capitalize leases, leading to higher leverage ratios across the board), it was no major surprise this year that first BP, and soon after ENI, made their inaugural entry to the hybrid bond market to seek 100% equity accounting treatment and 50% rating agency equity treatment for hybrid debt raised. ENI claims the hybrid instrument will complement the financial framework over the longer term to allow ENI to pursue their transition strategy. Companies differ in their debt tenor profiles over the horizon of the transition, leaving bond investors with choice over how to position with respect to changing business profiles (see chart below).

Calculating a transition risk premium will be essential for investors

Whilst the equity market punished the oil and gas sector, it is difficult yet to calculate a meaningful transition risk premium, independent of term and cyclical factors, in the bond market. The chart below shows that a 10-30s curve premium (how much more investors demand to lend for 30 years compared to 10 years) exists for oil and gas bonds, but it is modest compared to the index and could in part be attributed to the cyclicality of the sector. We would expect to see higher 10-30s risk premia for credits with deficient transition strategies. Despite this, investors are apparently happy to continue funding companies with arguably weaker transition strategies such as Pemex, which issued $3.8bn 6.95% 2060 bond in January 2020.

Green bonds

Green-labelled debt remains an area the IOCs are likely observing with increasing interest. Repsol stood out in 2017 when they issued their inaugural green bond. Few followed in their footsteps at the time as the market digested the implications of an oil company issuing green bonds. The green-labelled market has, however, continued to evolve at pace since then, accelerated by the Covid crisis along with the growth of sustainability-linked bonds and the emergence of transition-financing bonds. We expect the growth to continue, especially with the ECB’s recent announcement that from 1st January 2021, bonds with coupons linked to sustainability performance targets will be eligible as collateral and for QE purchases, as long as they comply with all other eligibility criteria. In pockets, it is possible to identify instances where green bonds trade inside the conventional bond curve of the same issuer, effectively commanding a ‘Greenium’. Investors will wrangle for green-labelled bond issuers to have a separate account for proceeds to prevent them being mixed with other cash or inadvertently spent on non-eligible (non-green) projects, amongst other structural features. Meanwhile, with some transition strategies now in place and increasing investment in low and no carbon activities, green-labelled bonds may seem an increasingly attractive source of capital, perhaps even alleviating some of the pressures on the cost of capital of companies in transition.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox