“High” Yield yields hit a low

The dramatic rally in US high yield bonds since the end of September saw yields reach lows of 4.6% earlier this month, the US high yield index’s lowest level since 2000. Yields have risen modestly since then but remain very tight: 4.9% at the time of this writing. The US high yield bond spread over risk-free government bonds has narrowed close to its pre-Covid level (see chart below), a trend which has accelerated over the last few weeks following the US election result and news of positive vaccine trials. Both pieces of news had a dramatic effect across high yield markets.

The biggest reaction was concentrated in Covid-sensitive issuers such as airlines, cruise lines and casinos, but the news was also felt more broadly across the asset class: 29 out of 32 US high yield sectors were trading with spreads higher than their pre-Covid levels at 30 September; now that figure is just 15. Issuers within the energy and healthcare sectors were notable beneficiaries of the election outcome as the threat of a “blue wave” subsided. President-elect Biden’s legislative programme, which included healthcare reform, clean/renewable energy proposals and potential restrictions on drilling on federal land, will have a hard time getting through a divided Congress.

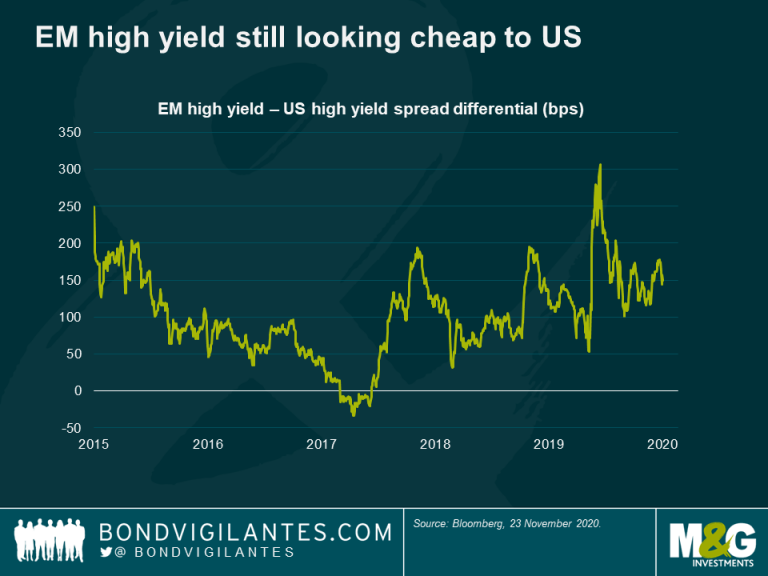

In credit spread terms, the US high yield market is now looking expensive relative to its peers in Europe and emerging markets. Emerging market high yield in particular still offers some value in my opinion. Here, high yield spreads remain elevated versus the US due in part to the weaker central bank firepower available in emerging markets. The chart below highlights the current spread pickup for investing in EM high yield versus US high yield.

Looking at the overall picture of global high yield credit, most investors would agree that valuations now look expensive compared to historical levels, especially given the backdrop of dramatically rising infections in the US and the threat of stricter lockdowns and rising unemployment everywhere else.

Even after the rally, there remain several powerful supportive technical factors which high yield investors ignore at their peril. Demand for higher-yielding debt remains robust and the asset class is experiencing strong fund flows (albeit lower than in investment grade). A further tailwind is the supply of new issuance, which now looks relatively constrained following a record-setting summer of issuance as companies built up liquidity buffers and refinanced debts, leaving a more limited forward issuance calendar. The loan market has also seen a resurgence, which is taking borrowers away from the bond markets and further constraining supply. We must also remember that $171bn of investment grade bonds fell into the US high yield market after being downgraded by the rating agencies. These so-called fallen angels expanded the index by 21% and are (by-and-large) higher quality than average, which supports tighter spreads.

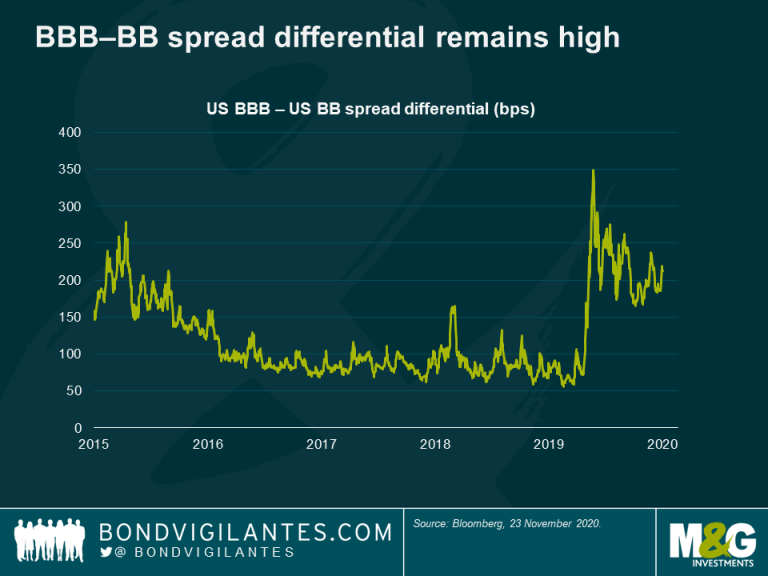

Also, while valuations might be difficult for high yield fund managers to stomach at the moment, the asset class still offers a degree of relative value. For example, while the spread differential between BBBs and BBs has compressed somewhat since the peak of the crisis, it is still materially wide versus historical levels (see chart below). In a world of $17 trillion of negative-yielding bonds, the 4-5% yield offered by high yield can look attractive to investors outside the traditional investor base, potentially drawing more participants to the market and leading to further spread tightening.

Lastly, the U.S. government (however divided) and the Federal Reserve proved over the spring and summer that they are prepared to do “whatever it takes” to support the economy and markets. From massive fiscal stimulus to bond purchases (including high yield), they provided enormous support which has helped businesses survive and markets recover. There is some concern about whether there will be another round of stimulus given a still-divided Congress. However, I am of the mindset that further support and stimulus will be delivered if it proves necessary on the back of accelerating lockdowns. The size and scope of the stimulus will be debated, but I believe that none of the current president, the president-elect, the Senate or the House will want to “own” the stimulus not being done and have a side-lining of the recovery on their shoulders.

The current environment poses a dilemma for high yield investors given tight valuations with the backdrop of the ongoing pandemic and resulting economic turmoil, with the prospect of more damage to come. Do they de-risk in light of these pending threats and ignore the strong technical forces noted above, potentially missing out on the continued rally? Do they de-risk anyway on expectations that, despite strong technicals, the market has come too far too fast and is due a correction after which they can reinvest? Or do they rotate into Covid-exposed names such as airlines and leisure companies where bonds have rallied but are still meaningfully cheaper than before the crisis, banking on the success of the vaccines and a near-term return to normality?

My belief is that technical factors will probably dominate the less attractive valuations from here. Yes, there are obvious risks to the downside but, as we learned over the summer, the technical forces mentioned above (federal stimulus in particular) are too strong to ignore. The greater risk in my view is not to be invested in a high-yielding, income-producing asset class with a stimulus-lined path out of the Covid crisis that is now clearer than before. In the meantime, as always, there are single names and sectors that have run too far in my view (e.g. gaming) and sectors too that are now much more investible (e.g. airlines) but, for the high yield market in general, there could well be further upside form here.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox