This recession, banks are the good guys

The Covid-19 crisis has been a very different recession in a number of ways. One that I think is particularly interesting is the role of banks. While it is a vast oversimplification, ask ten people what caused the great financial crisis, and nine will answer “the banks!”.

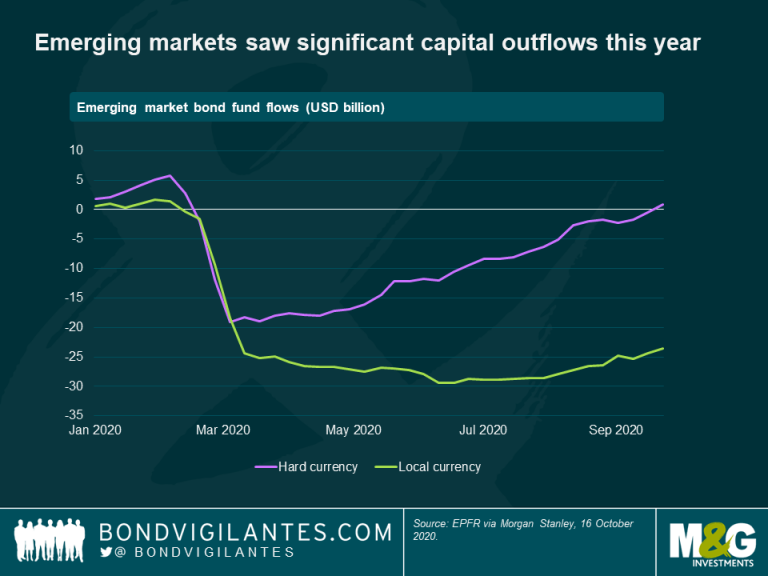

This time round, it has been the commercial banks that have helped many economies to remain functioning. Nowhere is that truer than in emerging markets. In the worst of the liquidity crisis at the start of the year when emerging market (EM) governments needed to issue new debt, many foreign investors—usually one of the large sources of financing for EM economies—exited the market as the virus started spreading globally and major risk aversion took hold. This resulted in significant outflows of capital, especially from the local currency bond markets where flows remain deeply negative to this day (still down by around $23 billion – see chart below).

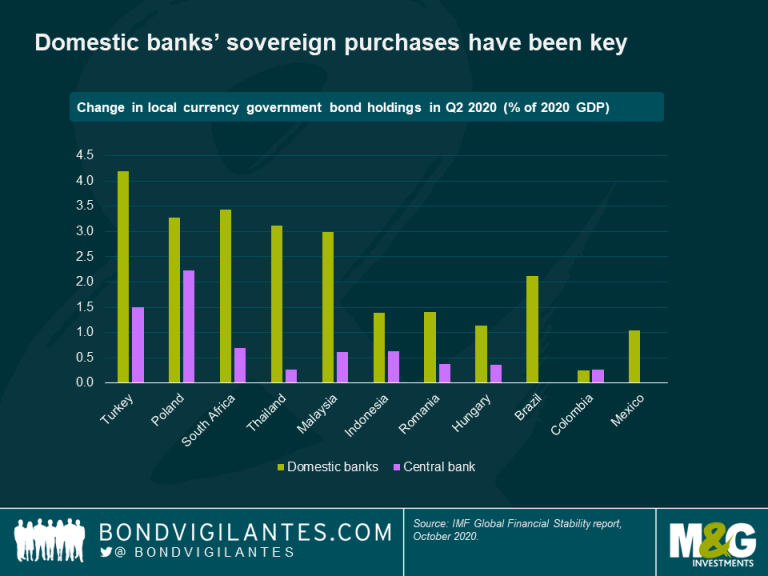

In a blog earlier this year, I described how many emerging market central banks followed in the footsteps of developed market banks and initiated some form of quantitative easing (QE) in response to the challenges of increased budget deficits and a lack of foreign investment. I also touched on the risks that these programmes posed on the future credibility of EM central banks and their local markets. Several months later, it is interesting to note that most central banks have in practice remained very conservative in their approach to direct sovereign bond purchases.

There have been a few exceptions, such as the Philippine central bank, which bought more than 80% of the country’s net sovereign bond issuance year to date. Likewise, the Polish, Indonesian and Israeli central banks all purchased around 50% of their sovereign net issuance. For other economies however, central banks have been far more restrained and bought on average less than 10% of the net issuance this year. This has been in large part thanks to local commercial banks which stepped up and purchased significant amounts of sovereign debt, absorbing as much as two-thirds of net local currency bond issuance year to date according to Deutsche Bank.

Local commercial banks’ involvement in local sovereign debt markets has been driven by several factors. While governments have in many cases increased incentives for banks to purchase sovereign debt, it has been largely driven by economic rationale.

First, the gap between deposit and loan growth increased sharply this year. Deposits increased as a result of precautionary savings, less spending and fiscal transfers, while demand for new loans collapsed as economies entered into recession. This created space on bank balance sheets to buy more sovereign bonds. Banks also likely became less willing to extend credit to private borrowers as the risk of default increased, making sovereign bonds’ higher credit quality an appealing feature.

Relatively steep government bond curves provided a further economic incentive for bank to buy sovereign bonds. As bank funding costs generally tracked policy rates, steep curves provided an attractive carry pick up. The potential for duration gains from falling yields as central banks were cutting rates provided additional upside.

Government policy was also an important factor, and several measures were designed specifically to increase local bank demand for sovereign bonds, reducing the need for central banks to intervene. Indeed, many central banks remain reluctant to engage in significant QE operations, particularly in regions and countries where previous monetary crises serve as a reminder of the importance of central bank independence – the Mexican and Brazilian central banks notably did not engage in QE at all.

Cuts to reserve requirements have been widely used too in order to encourage commercial banks to purchase sovereign bonds. They were explicitly linked to increasing bond holdings in some cases, such as in Malaysia and Indonesia, where in the latter a private placement of IDR 105 trillion of sovereign bonds was organised to coincide with the time of the reserve requirement change. Generous liquidity provisions for the purchase of sovereign bonds were also implemented in many countries, encouraging the carry trade.

Finally changes in accounting rules, allowing for more favourable treatment of sovereign bonds by easing mark-to-market rules, also played a role. For example, Russia allowed banks to mark purchases at their market price on the 1st of March, even if they had bought them after that date. In the third quarter, Russia also decided to issue floating rate bonds, which are typically held by local banks and not by foreign investors.

Local commercial banks provided an essential backstop for local sovereign debt markets in 2020. Their significant involvement allowed governments to issue debt at reasonable costs, and to finance their deficits at a critical time when foreign investors were on the side-lines. Importantly, it allowed central banks to limit their interventions in most EM countries, safeguarding their hard-earned credibility while ultimately having a similar effect to central bank QE.

While I think this has been a positive trend, this situation also raises potential risks down the line. It is increasing the interdependence between the banks (which are financing governments) and those governments (which are expected to recapitalise banks in case of a crisis). Potential concerns over government debt sustainability in the future could lead to worries over banks’ balance sheet in a vicious circle, reminiscent of the eurozone crisis in 2010. Furthermore, the main difference between commercial banks’ purchases and central banks’ QE is the economic rationale – commercial banks are profit-driven. Their appetite for sovereign bonds this year has been a function of the low funding costs available and the carry opportunities offered by sovereign bonds. If inflation were to return in a meaningful way, forcing central banks to hike front-end rates, the rationale for these investments would disappear and local banks would likely reduce or stop their investments in sovereign bonds, leading to potential volatility for emerging market bonds.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox