Negative Evergrande news flow is struggling to provoke CNY – why?

Recent headlines have centred around China’s Evergrande, the world’s most indebted real estate developer. New rules aimed at controlling the debt owed by large real estate developers have led Evergrande to offer its properties at major discounts to keep the business afloat. With the company now struggling to meet interest payments on its debt, however, its share price has fallen by around 80% while its bonds have been downgraded by credit rating agencies. This has unnerved investors globally, since the risk of default or of massive debt piles leading to a huge restructuring could have spillover effects into the broader financial system: some are calling this the potential ‘Lehman moment’ for China.

Thus far, however, the damage remains reasonably contained and limited mostly to the Chinese high yield property sector, with policymakers and regulators stepping in to try to limit the impact on homeowners. We have seen some assets selling off in response to the heightened uncertainty, especially Asian equities and FX but also broader emerging market assets, as investors seem to be once again flying to the safe haven currency of choice, the US dollar. In contrast, the currency that one might expect more obviously to suffer from this macro backdrop, the CNY, is holding up remarkably well. This raises a number of questions. Do investors see this as an idiosyncratic/sectoral risk rather than systemic? Are broader inflows and technical factors keeping Chinese assets cushioned from the negative headlines? Has the PBOC succeeded in stabilising and supporting the Renminbi, transitioning it into being seen as a reserve currency?

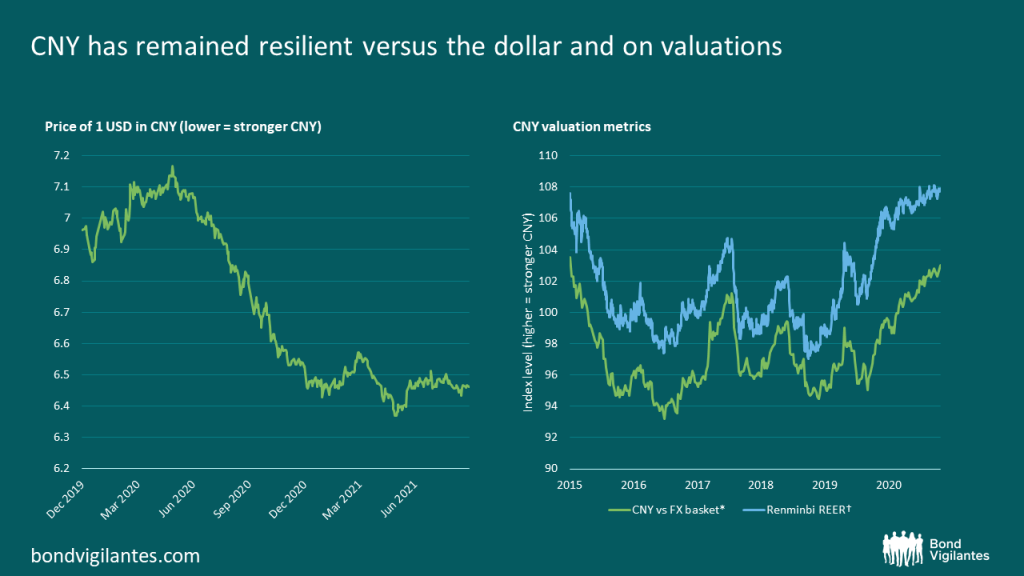

For almost all of Q3 2021, the USDCNY currency pair has been stable and trading between 6.4 and 6.5, its strongest level since 2018. When compared to a basket of other currencies, CNY is also sitting at around a five-year high. While Chinese equities and real estate credits have been on the back foot, the currency has been stable or even strengthening. This has been the case since mid-2020, with the currency outperforming in light of China’s handling of the Covid-19 pandemic. This trend has persisted despite the pandemic being China-centric at the beginning of the outbreak and with local Delta-variant outbreaks now leading to a tightening of restrictions on mobility across a number of provinces and cities. On a real effective exchange rate basis, valuations are also at a five-year high, and increasing. So why do investors seem unfazed, and remain long the currency despite its seeming overvaluation?

Source: M&G, Bloomberg (24 September 2021). *Index based on BIS currency basket †Real Effective Exchange Rate.

The most direct channel of spillover from an Evergrande crisis to the FX market would be through a dent to risk sentiment. Thus, equity flows are arguably the most vulnerable asset class against this backdrop. The predominant difference between China and other emerging markets, however, is that domestic investors are the majority shareholders of local assets, whereas foreign investors’ exposure to property names in the onshore equity market accounts for only 1% of total foreign holdings. Additionally, only 5% of MSCI China equities are CNY-denominated (most are HKD or USD). This means that, if foreign investors wish to de-risk, especially in equities, this should have a limited impact on currency flows. A robust bond market could also help counter depreciation pressures from equity outflows: bond inflows have remained pretty stable with the upcoming inclusion of China’s bonds in the WGBI index from October. This has also helped CGBs to be seen as more of a safe-haven asset amid financial stress, rather than as an EM credit product – month to date, 10 year CGB yields have risen only +0.77% and have fallen -8.67% year to date(as a percentage of starting yield).

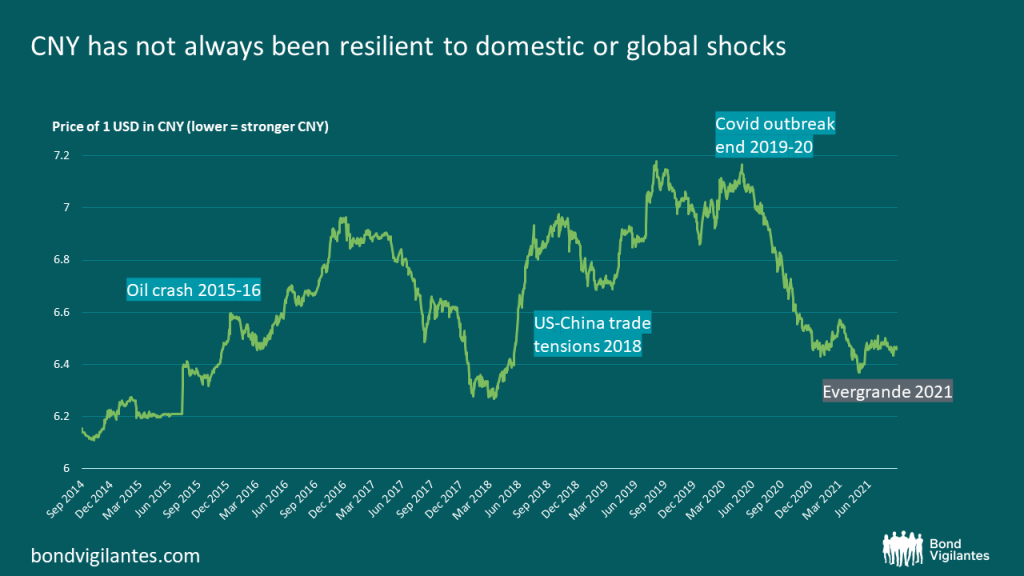

With resurgences in Covid cases globally due to the Delta variant, coupled with the new risks posed by the property sector, the CNY seems resilient both to domestic and global shocks. But was this always the case? Definitely not. Back in August 2015, the CNY dropped about 5% against the dollar, and the PBOC had to intervene via one of the biggest support operations in history – cumulative interventions added up to around $1,000 billion, with over $100 billion in August alone. We also saw significant underperformance of CNY vs USD during the escalation of China’s 2018/2019 trade conflict with the US. Since then, however, there seems to have been a decoupling in the relationship between FX valuations and trade – it could be argued that the pandemic and the associated supply-side distortions have likely changed the sensitivity of global trade to price changes. This is supported by a continued rise in the share of Chinese exports as a percentage of global exports last year, despite a stronger domestic currency.

Source: M&G, Bloomberg (24 September 2021).

So what has changed? Key are structural changes in the CNY, largely due to the PBOC’s approach to the currency. In recent years, China has been working to close holes in the balance of payments, with the PBOC taking multiple steps to open up more outflow channels to balance the one-sided inflows into the country. This relaxation of outflow restrictions has meant that a strong balance of payments position has dampened the depreciation pressures one might expect from policy tightening, slowing economic growth and lack of outbound tourism. China also has ample onshore liquidity in USD – due to strong trade and capital account inflows, the onshore private sector has been stepping up dollar accumulation. Given the lack of outbound tourism, this hoard of unsold USD has helped to absorb CNY depreciation pressures. It is also clear that the PBOC has been heavily intervening in FX markets in order to stabilise volatility and rebrand the CNY as a reserve currency. The PBOC has continued to build a reputation of being quick to inject liquidity into the markets after credit events, in order to improve market confidence and curb spillover risks. Thus, even if broader contagion from an Evergrande fallout were to emerge, leading to sharper macro headwinds, the PBOC is now well-known for stepping in and supporting the currency to avoid capital flight dynamics. This is also supported by the bank’s external balance sheet: it has little external debt (especially in foreign currency) and has accumulated $3 trillion in reserves, a level which has been steadily increasing since the end of 2016.

Given the intentions of policy makers and the structure of the external balance sheet, the Chinese currency is trading very resiliently in the face of a domestically-orientated shock (even outperforming other Asian currencies). Tail risks undoubtedly still remain, but it is clear that policy makers will work very hard to avoid damaging their currency’s reputation and, at the very least, ensure that the Evergrande episode is, at worst, a short-term sentiment hit for CNY FX, rather than an indicator of durable currency weakness.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox