Will Blue bonds make investors see red? A Belize case study

Summary: Following our blog on Sustainable bonds and the case of Benin, this time we focus on Blue bonds and Belize. Belize recently announced a tender offer for its existing $553 million Eurobond due in 2034, which will be financed by the concurrent placement of a Blue bond as part of the Nature Conservancy Blue Bond Ocean Conservation Programme.

The Blue bond concept aims to use debt proceeds to finance water-related and/or ocean-based projects with an evident and monitored positive impact towards the achievement of the UN Sustainable Development Goals. It has already been used by a few emerging market issuers, but not as widely as have Green bonds.

One relevant case study was the $15 million 10 year bond placement in 2018 by Seychelles. That bond was issued as part of a broader debt relief that included the Paris Club and was the first Blue bond issued by a sovereign entity. At the time, Seychelles was rated BB- by Fitch and had a non-disbursing agreement with the IMF, underpinning its commitment towards improving economic policies. The principal is partially guaranteed by the World Bank and carries a 6.5% coupon. Seychelles was subsequently upgraded to BB, but has since been downgraded to B on the back of the impact of the pandemic on tourism and the broader economy.

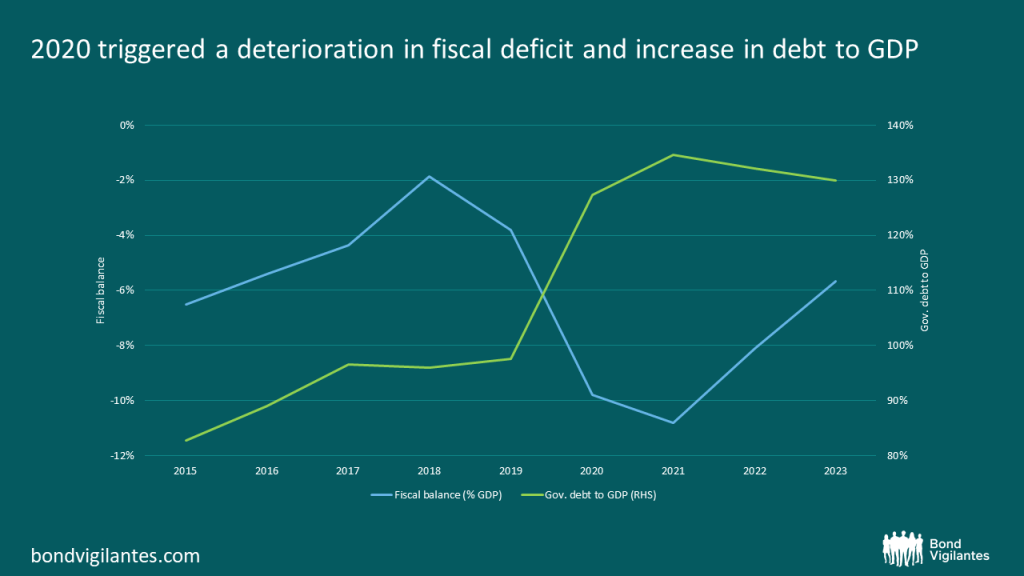

The Belizean economy was also heavily impacted by the decline in tourism revenues seen in 2020, which triggered a large contraction and fiscal deficit.

Source: IMF April 2021, M&G calculations – data do not reflect any debt reductions as a result of the bond tender. Future years are forecast.

Source: IMF April 2021, M&G calculations – data do not reflect any debt reductions as a result of the bond tender. Future years are forecast.

Belize’s tender envisions a 45% haircut on the currently outstanding principal, which would reduce the country’s debt by approximately 9% of GDP. Belize has also pledged to pre-fund a $23.4 million account to support marine conservation projects. The authorities are proposing fiscal consolidation on its upcoming budget, but absent a steadfast implementation and a cyclical recovery, debt levels will stay high as the remaining debt (multilateral, bilateral and domestic) is not expected to be restructured. Since its inaugural debut bond in 2000, when the country was in the BB range, Belize has restructured its Eurobond four times – on average once every five years. Despite these frequent Eurobond restructurings, Belize has not managed to reduce its debt burden as growth has been low and expenditures elevated, leading to persistent primary deficits.

The details of the Blue bond have not yet been announced, so we do not know if there will be additional principal or coupon guarantees provided besides political risk insurance provided by the US International Development Finance Corporation.

We welcome this innovative approach and are hopeful that bondholders and issuers continue to increase collaboration towards the sustainability of our ocean resources and improving ESG credentials more broadly. At the same time, good ESG intentions cannot replace prudent economic management and willingness to pay. If history repeats itself – and we hope it will not here – the upcoming Blue bond may well see itself restructured once or twice over its tenor. If that occurs, though from a blue start, investors will be seeing red again.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox