Why didn’t EM banks catch COVID?

Summary: Cast your mind bank to early summer 2020. COVID-19 had hit a complacent world incredibly hard. Lockdowns were widespread and enduring much longer than expected. Economic activity slumped. The price of oil fell to $20/bbl. Furlough schemes were in full swing and central banks were pumping out QE on an unprecedented scale. Newspapers were full of stories, such as this one, that “untold millions of companies face bankruptcy amid unprecedented global lockdowns and travel bans”. And this was just in the developed world. In emerging markets, with generally fewer resources to hand and greater dependency on commodities and/or tourism – both of which had collapsed – surely things would be even worse. As this economic shock rippled through the economy and companies went bust on an unprecedented scale, went the argument, banks would face mounting debt defaults and could well collapse themselves, leading to another 2007 meltdown.

Fast-forward to the present day and it is clear that these fears for the financial system were vastly overblown. EM banks did not catch COVID. In fact, they have generally managed their way through the crisis rather well, and certainly better than firms in some other sectors. The key question is: why? And what lessons should we draw from this?

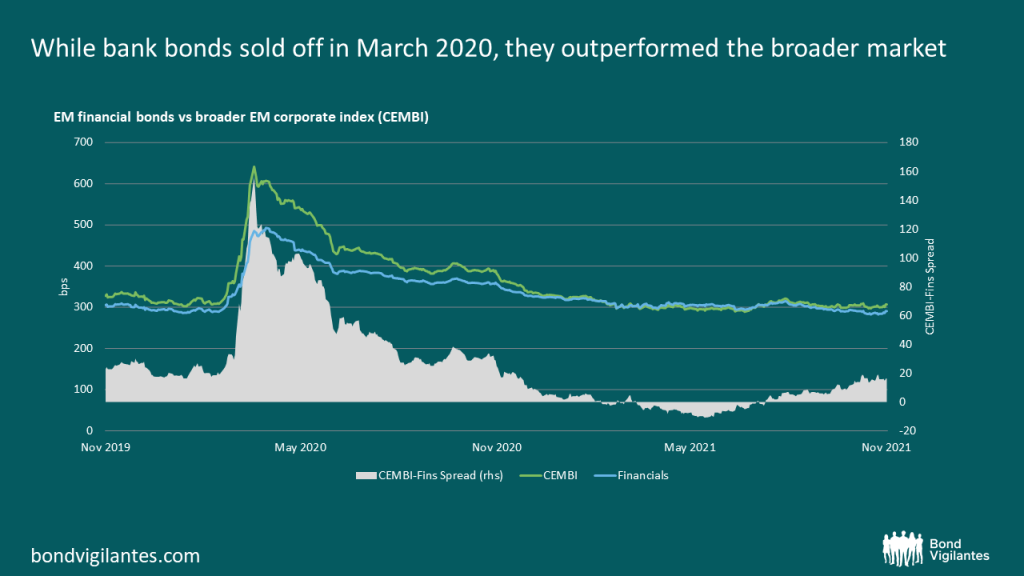

First, we should point out that the market was more sanguine about EM banks than the more hysterical elements of the Western press (and some analysts). While worries of financial collapse regularly appeared, the market overall maintained its focus. We have written previously that banks are a surprisingly defensive asset class in EM, and that remained the case throughout the pandemic. The chart below shows that, while of course bank bonds sold off aggressively in March 2020, they outperformed the broader market by a considerable margin.

Source: M&G, Bloomberg (5 November 2021).

Partly this is because experienced investors with good knowledge of local markets knew that the West broadly underestimated the capacity and willingness of emerging countries to support their economies and banks. Western countries have rightly been praised for herculean efforts made to keep the show on the road, running up huge fiscal deficits and expanding QE schemes to fund everything from furlough payments and extra hospital beds to keeping the trains running. And it doubtless surprised nobody that emerging countries like China, with its $3tn of reserves, could fund its way through the pandemic. But there has been remarkably little mention of the key fact that smaller countries were doing the same thing. Peru, for instance, introduced various government support schemes for the economy totalling around 20% of GDP. There has also been regulatory easing aimed specifically at banking sectors around the world, such as Turkey’s redefinition of NPLs as loans whose payments were 180 days in arrears (vs the previous 90 days) and the temporary reduction in minimal capital ratios in Kuwait.

Beyond this, however, I would highlight two major factors which explain banks’ resilience to the pandemic. The first is digitisation, which was already well advanced in some areas but which has been accelerated by the pandemic. Digital capabilities make banks ideal businesses for operating with minimal disruption through COVID. Employees can work from home and many customer transactions are now carried out online and/or by phone. What is truly impressive is the speed with which COVID has accelerated the digital transformation. Brazil’s Itau Unibanco, for instance, had put in place capabilities for 40,000 employees to work from home by early April 2020 (i.e. within a period of 2-3 weeks), while Access Bank in Nigeria saw its digital transaction value leap from NGN 11.7tn in 1H19 to NGN 20.8tn in 1H21. These developments allowed banks not only to keep essential systems functioning but actually to grow their businesses and set themselves up for the increasingly digital world ahead.

The second point is that EM banks have been strengthened in the aftermath of previous crises. It has been well documented that EM sovereigns have better buffers than before, with greater FX reserves typically available and in many cases more space for monetary/fiscal action, allowing governments to offer more support than before to banks in need. But banks have needed less support in the first place because of their greater strength today. Bangkok Bank makes the point well – its NPL ratio, which reached 42.9% in the 1998 crisis, fell steadily thereafter (including in the 2007-09 period) to around 1% in 2014 before picking up a little to 3.1% today. Nigerian banks cleaned up their act to some degree following the 2016 oil/Naira crisis, with First Bank of Nigeria’s NPL ratio falling from around 24% in the 2016-2018 period to under 8% today. Brazilian banks did the same after 2015-16 crisis, with Banco do Brasil increasing its CET1 ratio from just 8.2% in 2016 to 13.5% today. And many others have been strengthened by increased regulation and the global rollout of the Basel rules following the Great Financial Crisis. The result is a world where, while individual financial names can face issues – witness Huarong recently in China – and investors can fret about risks around subordinated debt, it’s hard to see a systemic financial crisis developing even in the face of a global pandemic.

So perhaps the big lesson here is that that banks across the world, not just in the West, are in much better shape than is generally recognised. While it is vital to remain focussed on keeping banks healthy, liquid and well capitalised, the trade-off should be that now we shouldn’t be quite so quick to panic about them. In fact, following their COVID-induced leap in digitisation, banks look operationally better suited to the post-pandemic world than was the case before the virus struck.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox