Happy new year

The start of another year is always a time to take stock, reflect on the last year and plan for the next. Last year was dramatic from an investment point of view, with equity markets having their biggest bear market since the great depression (and credit markets doing even worse) while government bond yields collapsed to post war lows.

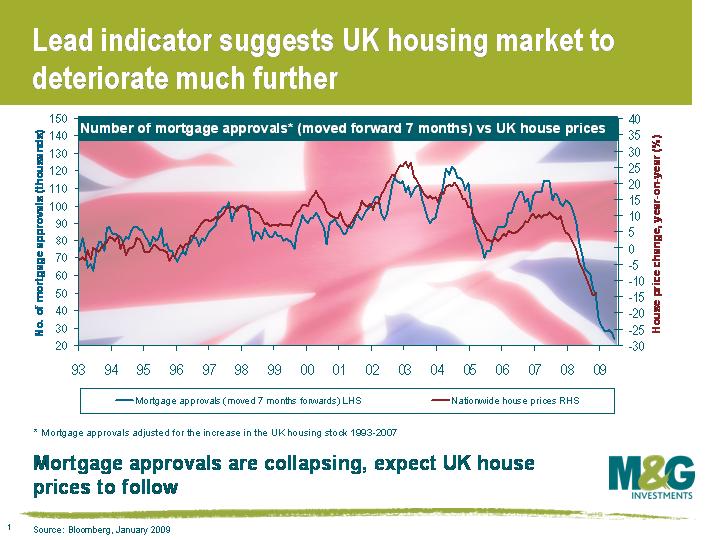

All the way through this crisis we have focused on the strength of the housing market as a lead indicator of what is to come for financial markets and the broader economy. We have been joined in our observations by the policy makers, with the US Federal Reserve giving further detail last week over its plans to buy $500 billion of mortgage related debt by mid 2009. This is designed to drive the cost of mortgage debt down, so helping the US housing market. A similar response is being sought in the UK, where base rates have never been lower since the Bank of England was founded in 1694 (and rates are set to go lower still).

In the UK the lead indicator we have focused on has been the level of new mortgage approvals (see previous comment here), which indicates the upcoming buying power entering the UK property market. The latest numbers were released on the 2nd January, and the record low number continues to point to further weakness, as illustrated in the chart.

So the crisis has unfolded, a policy response is in place, but when will the economic animal spirits come back to the fore, watch this space…

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox