UK housing market and rate cuts – are we nearly there yet?

In light of the news of recapitalisation of the UK banking sector (which Ben alluded to in his blog yesterday afternoon here) and today’s coordinated global rate cuts, I thought it would be an appropriate time to see whereabouts we are on the road to recovery.

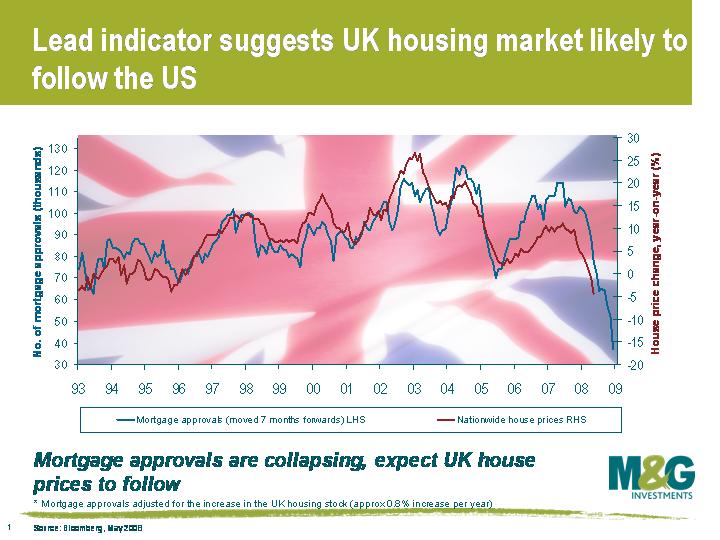

The route map we have been following has been laid out on this blog over the past 18 months, and is updated in this chart. The health of the financial system and the health of the UK citizen is intertwined by a common interest – the housing market. That common interest is based on the fact that homes generally have two owners, the consumer and the bank/building society. In order for the fortunes of these two players to turnaround, mortgage approvals must move up.

The route map we have been following has been laid out on this blog over the past 18 months, and is updated in this chart. The health of the financial system and the health of the UK citizen is intertwined by a common interest – the housing market. That common interest is based on the fact that homes generally have two owners, the consumer and the bank/building society. In order for the fortunes of these two players to turnaround, mortgage approvals must move up.

In order for mortgage approvals to rise, two problems need to be solved. First of all, the banks must have the capital and capacity to lend. The Treasury’s action today goes part of the way towards solving this. Secondly, consumers must want to buy a house, ie find housing to be cheap. The classic way to achieve this is via cutting the financing cost of purchasing a property. This is in the hands of the Bank of England.

To stop the freefalling UK housing market, the Bank of England should do its part by deploying its biggest parachute as quickly as possible. A half point cut today helps, but from my perspective rates need to be reduced a lot more than this. The lowest UK base rate in modern times was 3.5% from July to October 2003, the lowest since 1954. UK rates need to quickly go at least as low as this, and if a rate of 3.5% fails to stimulate the mortgage market, then it needs to be driven much lower.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox