Which corporate bonds will the ECB buy?

Bond markets have reacted strongly to the 10th March announcement by the European Central Bank (ECB) of its new corporate sector purchase programme (CSPP). Credit spreads of euro-denominated investment grade (IG) corporate bonds have tightened by around 20 bps on average. Still, a lot of the CSPP’s particulars are anybody’s guess at this point. The publication of the account of the last monetary policy meeting yesterday hasn’t added much clarity. So far we only know that from the end of Q2 2016, the ECB will start buying IG EUR corporate bonds issued by non-bank corporations established in the euro area. The ECB has also stated that bonds eligible under the Eurosystem collateral framework would be a “starting point” for the eligible universe under the CSPP but that further rules and restrictions might apply.

There is a lot of uncertainty around the details, though. How much will they buy each month? Will the ECB be active both in the primary and the secondary market? Will there be any capital key allocation mechanism, like in the case of their sovereign bond purchase programme? What will be the maximum percentage of each eligible corporate bond issue that can be held by the ECB? Will the ECB become a forced seller if a bond held on its book is downgraded to sub-IG territory? All of these questions – and many more – are yet to be answered.

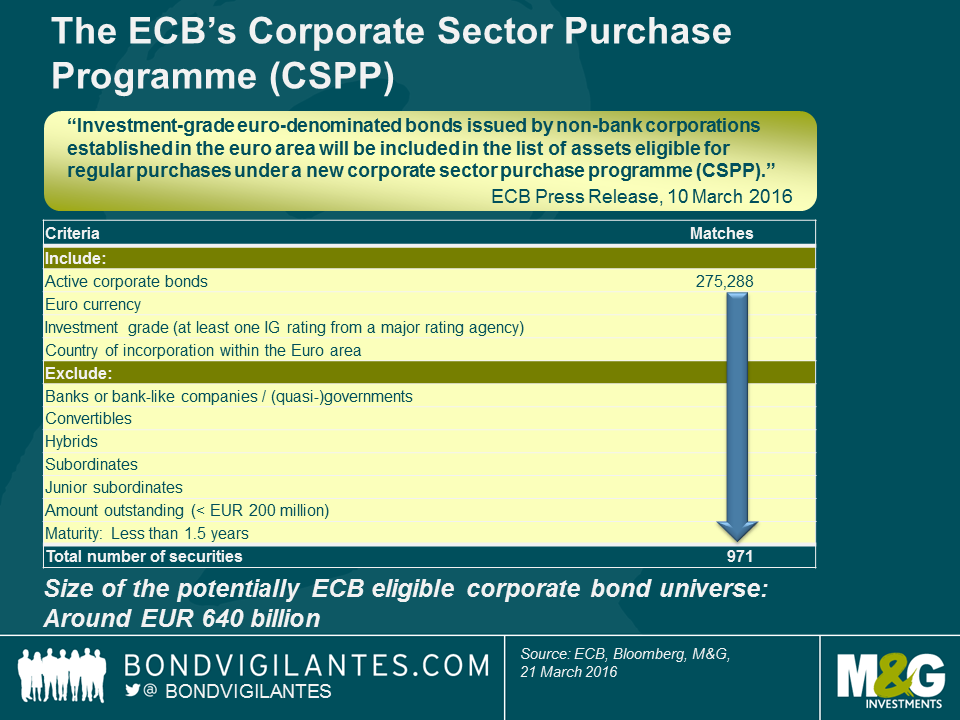

Applying a series of filter criteria, we have screened the corporate bond universe for potentially ECB eligible securities (see table below). Our analysis suggests there could be 971 bonds on the ECB’s radar, totalling around EUR 640 billion.

Some of our filter settings are pretty common-sense (e.g., euro-denomination, exclusion of banks, hybrids and (junior) subordinated instruments), others are entirely up for debate:

- Credit rating: We included all corporate bonds with an IG rating from at least one of the three main rating agencies (Moody’s, S&P and Fitch). This might be too generous as cross-over names / fallen angles with sub-IG composite ratings are included as long as their highest rating is BBB- or better. Or it might in fact be too strict since within its collateral framework the ECB also accepts credit ratings from DBRS as a fourth external agency.

- Country: The ECB announcement reads “non-bank corporations established in the euro area”. We tried to stick to the letter of the announcement and used “country of incorporation” as a filter criterion. This leads to an over-representation of the Netherlands as quite a few companies (e.g. BMW, DT) issue bonds from legal entities domiciled in the Netherlands. It also results in the inclusion of clearly non-Eurozone companies as long as the vehicle out of which bonds were issued had been incorporated within the Eurozone. It might be more useful to use “country of risk” as a filter setting (or as an additional filter). If any company, no matter where its headquarters, operations and main revenue generation are located, can simply set up a special purpose vehicle somewhere in the euro area to issue EUR denominated bonds, then in theory every IG non-bank corporation on the planet would be eligible.

- Sector: We know that banks will be excluded. But how about other financials? We have included bonds from insurance companies (but no T1s or T2s) and REITs into the eligible universe.

- Further criteria: We excluded smaller issue sizes (below EUR 200 million) and bonds maturing within one and a half years, as we wouldn’t expect the ECB to buy less liquid issues, or to want to be frequently reinvesting the proceeds from maturing bonds.

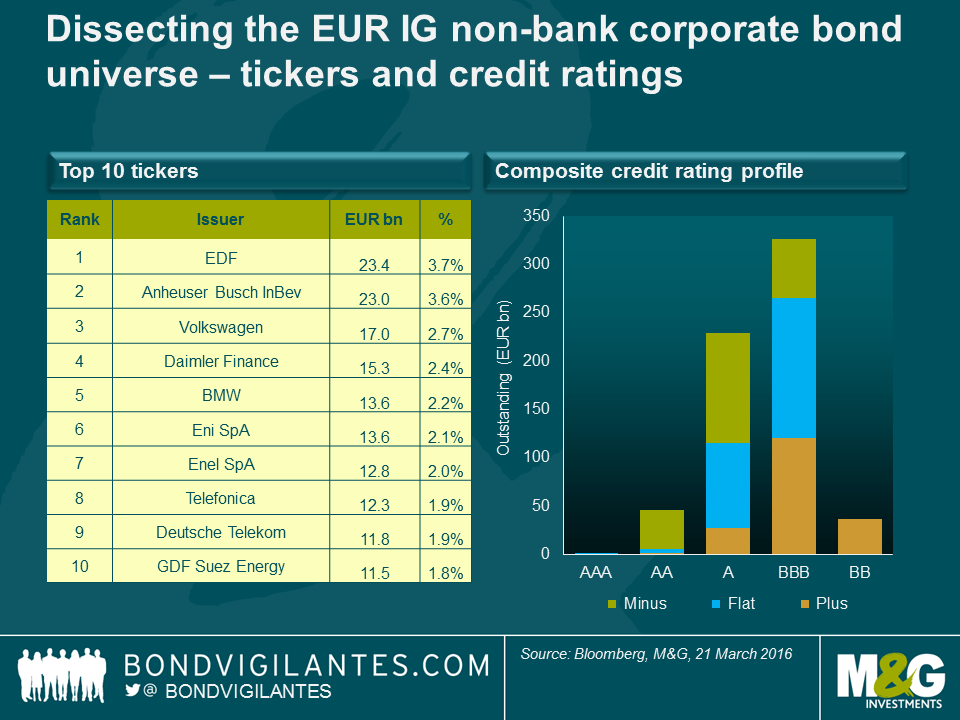

Keeping these major caveats in mind, we dissected our “best guess” ECB eligible bond universe (see chart below). The biggest beneficiaries, with particularly large amounts of potentially eligible bonds outstanding are EDF and Anheuser-Busch InBev, accounting for 3.7% and 3.6%, respectively, of the eligible universe. In terms of composite credit ratings, more than half of the universe consists of BBBs (51.1%), followed by single As (35.8%).

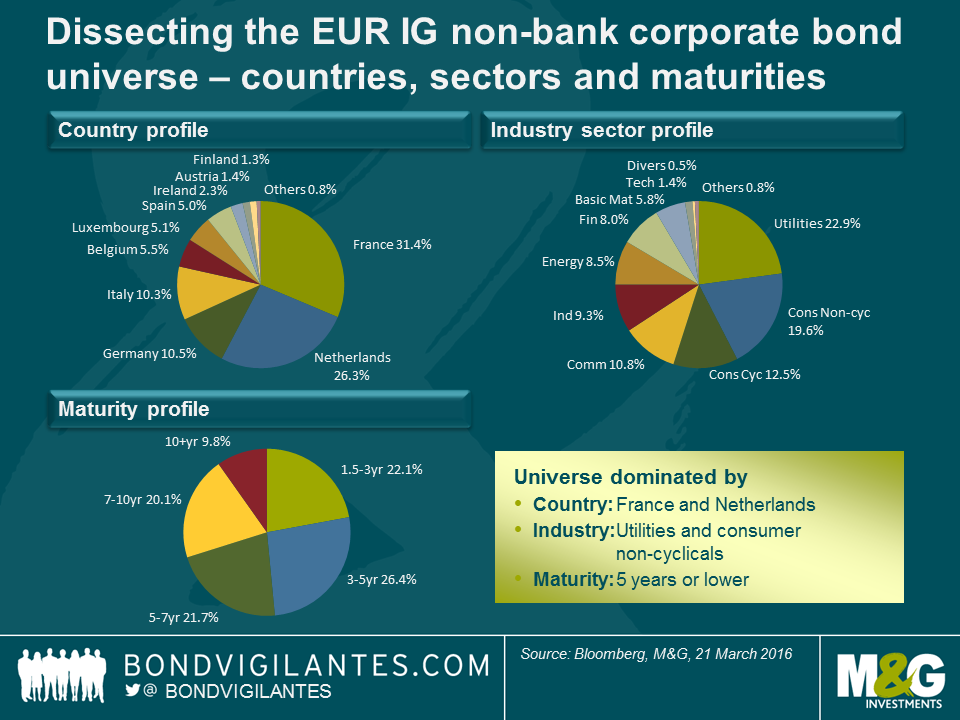

In terms of countries, French companies would be the biggest beneficiary (31.4%), as we had already predicted in 2014 (see Anjulie’s blog). The Netherlands (26.3%), benefitting from a large number of holding companies being domiciled there, and Germany (10.5%) follow in second and third place. Utilities (22.9%) are likely to be the dominant industry sector, ahead of consumer non-cyclicals (19.6%) and consumer cyclicals (12.5%). The EUR-denominated IG corporate bond space in general is relatively short in terms of duration compared to the USD IG space. Therefore, it is not surprising that c. half of our potentially eligible universe (48.5%) mature within 5 years.

So with a new buyer soon to be in the market, does this mean we should be hoovering up all the EUR credit we can get our hands on? Not necessarily. Whilst EUR credit does look good value relative to governments, spreads of EUR denominated corporate bonds, both investment and speculative grade, have been tightening since mid-February. The rally noticeably accelerated due to market euphoria around the ECB’s announcement. At this point a large portion of the expected benefits could be priced in. Valuations are arguably already stretched for certain issuers, when comparing underlying credit risk fundamentals and current spread levels.

Based on our bond screening, and assuming that the ECB can buy one third of every eligible corporate bond issue, the size of the accessible universe is “only” around EUR 210 billion. But total asset purchases will be EUR 80 billion per month, i.e., EUR 960 billion per year. When comparing these numbers, we believe that corporate bond purchases will likely be an incremental supplement to public securities purchases, perhaps to the tune of around EUR 5 billion per month. So it is entirely possible that the actual corporate bond quota, once it is communicated, could disappoint overly bullish market expectations.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox