Doom for UK retailers in 2010? VAT hike implies collapse in retail sales.

In under a month’s time, the UK’s emergency VAT reduction from 17.5% to 15% will be reversed. This will not only cause a blip upwards in inflation rates (most of the CPI basket apart from food attracts the tax) but might also derail the recovery of the UK economy. Because this VAT hike is pre-announced, is it possible that we will see lots of frontloading of consumption in December, and a big fall back in 2010? After an understandably weak 2008 and first half of 2009, it looks like retail sales have started to pick up. The British Retail Consortium reported yesterday that November hadn’t been as strong as expected, partly due to a big fall in food inflation, but like-for like sales in non-food items were up 3.3% from last year.

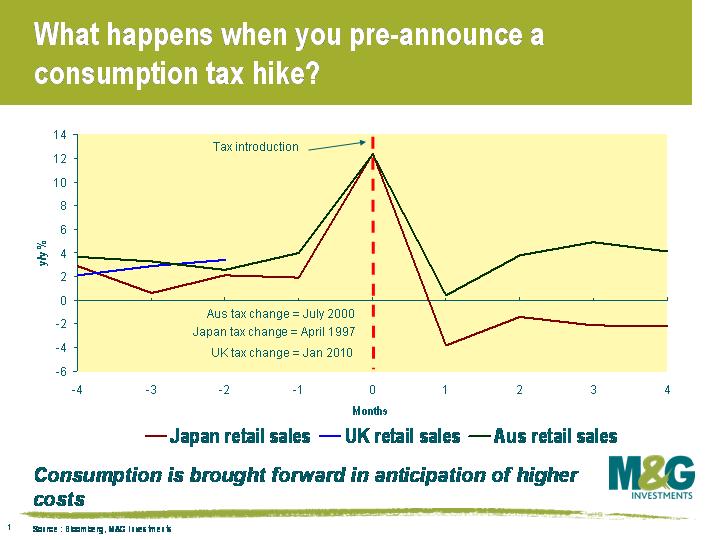

This chart shows what happened in other countries around the time of a pre-announced increase in consumption taxes. Perhaps the most famous example came in Japan in 1997. Although it had formally come out of recession, annual growth had not convincingly risen above 2% for 3 years, compared with an average of nearly 5% in the boom years of the 1980s. Yet because, like the UK, the fiscal position was poor, consumption taxes were hiked from 3% to 5%. As you can see, in the month before the tax hike came into effect, retail sales were up by around 12% year on year.

This chart shows what happened in other countries around the time of a pre-announced increase in consumption taxes. Perhaps the most famous example came in Japan in 1997. Although it had formally come out of recession, annual growth had not convincingly risen above 2% for 3 years, compared with an average of nearly 5% in the boom years of the 1980s. Yet because, like the UK, the fiscal position was poor, consumption taxes were hiked from 3% to 5%. As you can see, in the month before the tax hike came into effect, retail sales were up by around 12% year on year.

The following month, post the consumption tax increase, retail sales plummeted, and in Japan’s case retail sales remained extremely weak for months afterwards. It looks therefore that the impact of the tax hike was to bring forward consumers’ purchasing decisions in order to mitigate the impact of that tax, an entirely rational thing to do. I would guess therefore that in the run-up to Christmas the UK will see bumper sales – especially of big ticket, non-food items. But the impact of the VAT hike in 2010 will be to slow things down dramatically – with the caveat that the first half of 2009 was so weak, that the year-on-year numbers might look respectable without it necessarily being a cause for celebration from the retailers.

But there might be worse to come. If the Conservatives are elected to government in May or June, they would call an emergency Budget. They haven’t announced any plans to do so, but many expect a further rise in the VAT rate to 20% (Vince Cable of the LibDems said that the Tories would hike to 25%!).

We’ve also shown the Australian example on the chart above. In contrast to the UK and Japanese examples, Australian economic growth was strong in the run up to the consumption tax hike in July 2000. As a result, whilst retail sales did spike up ahead of the tax introduction, they didn’t fall back so aggressively the following month, and indeed by the next month they were back to normal levels. It’s much less messy to tighten fiscal policy when the economy is in good health, than when it’s not – obviously. But it does make you worry that the UK’s VAT hike might provoke a double-dip in a nation where consumption remains nearly 2/3rds of the economy. Post the April 1997 Japanese tax rise, the economy slipped back into recession with average quarterly negative growth of around 0.3% for the next 2 1/2 years!

And from a purely selfish viewpoint, I’m sure I’ve told you about my mental block about buying a new television. My current one is over ten years old, is deeper than it is wide, and the on/off button broke in 2004, so since then it has to be turned on or off from the plug socket. I still maintain that it has a better picture than the flashy, but poor quality, 50" flatscreen sets that the youngsters on the desk got jobbed into in Dixons a couple of years ago – but technology has moved on, and it’s probably time to buy a new one. Do I buy now, and achieve a guaranteed 2.5% discount relative to January’s higher VAT prices, or do I wait until the New Year, when VAT is higher, but where the retailers are much, much more desperate to sell me one?

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox